Australia's Interest Rate Cut: A Response To Cooling Inflation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia's Interest Rate Cut: A Response to Cooling Inflation

Australia's central bank, the Reserve Bank of Australia (RBA), has surprised markets with an unexpected interest rate cut, lowering the cash rate by 25 basis points to 3.85%. This move, announced on [Insert Date of Announcement], marks a significant shift in monetary policy and comes as inflation shows signs of cooling. The decision has sparked considerable debate amongst economists and analysts, with opinions divided on its long-term impact.

Cooling Inflation, But Still Elevated

The RBA's decision is primarily attributed to the recent slowdown in inflation. While inflation remains significantly above the bank's target range of 2-3%, recent data suggests a moderation in price growth. [Cite source for inflation data, e.g., Australian Bureau of Statistics]. This cooling, however, is not uniform across all sectors, with some prices continuing to rise sharply. The RBA cited concerns about the potential for further interest rate hikes to negatively impact employment and economic growth.

The RBA's Justification: A Balancing Act

The RBA's statement accompanying the rate cut emphasized the need to balance inflation control with the risks to the broader economy. Governor Philip Lowe [or whoever made the announcement] highlighted the weakening global economic outlook and the potential for further downward pressure on inflation. He also acknowledged the lagged impact of previous rate hikes on consumer spending and investment. The bank is clearly adopting a more cautious approach, preferring to monitor the effects of past tightening before enacting further increases.

Market Reaction and Expert Opinions:

The rate cut has been met with mixed reactions. While some analysts applaud the RBA's proactive response to softening inflation and potential economic slowdown, others express concern that it could reignite inflationary pressures. [Quote an economist with a positive view and link to their source]. Conversely, [Quote an economist with a negative view and link to their source] argues that the move is premature and risks undermining the hard-won progress in bringing inflation under control.

What this means for Australian consumers and businesses:

The rate cut is expected to provide some relief to borrowers, reducing monthly mortgage repayments and potentially stimulating consumer spending. However, the extent of this benefit will depend on individual circumstances and the response of lenders. Businesses may also see improved borrowing conditions, potentially boosting investment. However, the continued uncertainty surrounding inflation and global economic growth means that the overall impact remains uncertain.

Looking Ahead: Uncertainty Remains

The RBA's decision underscores the complexity of managing inflation in the current global environment. The future path of interest rates remains highly uncertain, with the RBA indicating that it will closely monitor incoming economic data and adjust its policy accordingly. Further rate cuts or hikes remain possible depending on the evolution of inflation and the broader economic landscape. This situation requires ongoing vigilance and careful analysis of both domestic and international factors.

Key Takeaways:

- The RBA has cut interest rates by 25 basis points to 3.85%.

- This decision reflects a cooling, though still elevated, inflation rate.

- The RBA is balancing inflation control with economic growth concerns.

- Market reaction has been mixed, with some analysts expressing caution.

- The future path of interest rates remains uncertain.

For further updates on Australian economic policy, please visit the Reserve Bank of Australia website: [link to RBA website]. Stay informed and make informed financial decisions based on the latest developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia's Interest Rate Cut: A Response To Cooling Inflation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Immigrant Competition For U S Citizenship A Proposed Reality Tv Show

May 20, 2025

Immigrant Competition For U S Citizenship A Proposed Reality Tv Show

May 20, 2025 -

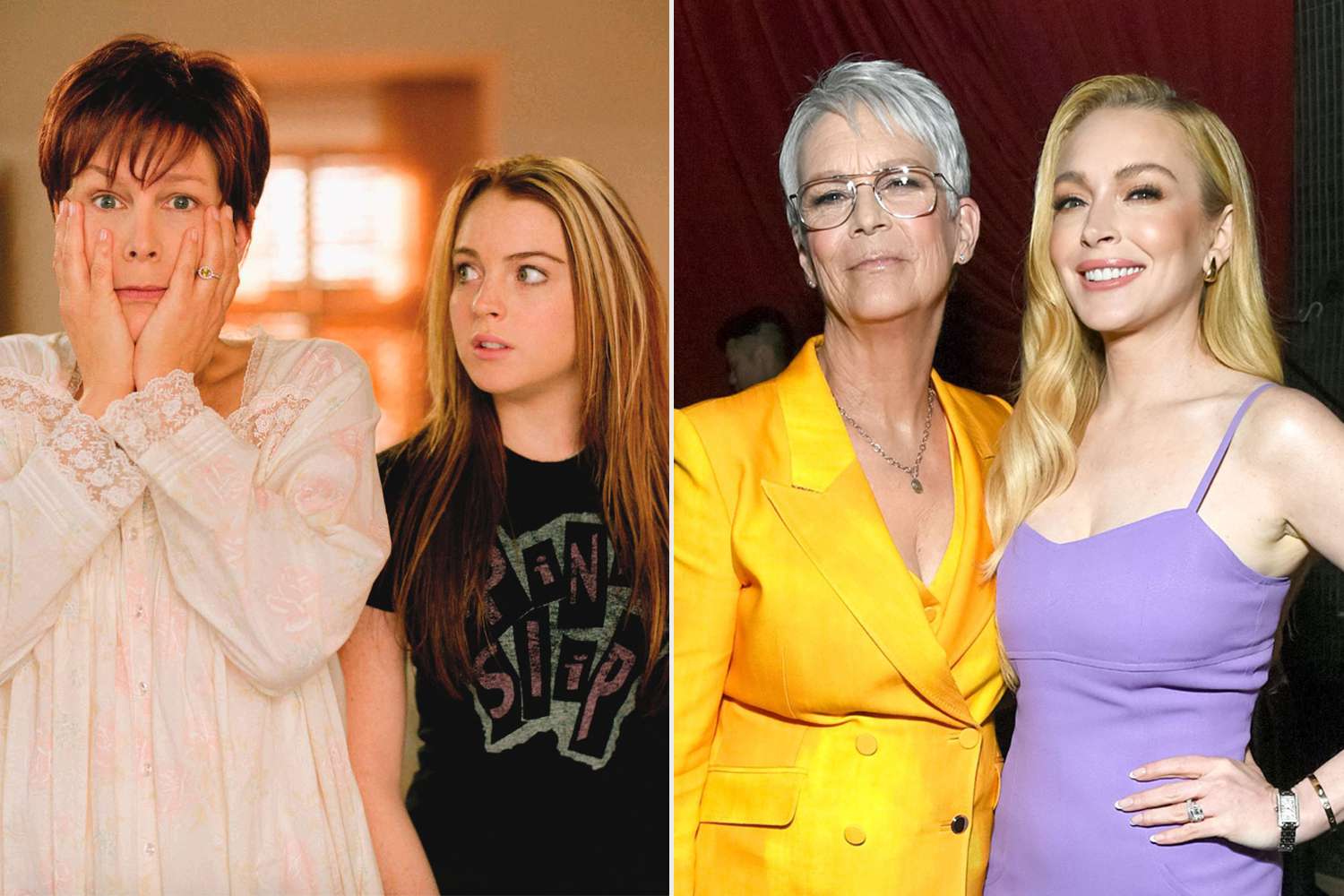

Jamie Lee Curtis And Lindsay Lohans Post Freaky Friday Friendship An Exclusive Update

May 20, 2025

Jamie Lee Curtis And Lindsay Lohans Post Freaky Friday Friendship An Exclusive Update

May 20, 2025 -

Is A Citizenship Reality Show In The Works At Homeland Security

May 20, 2025

Is A Citizenship Reality Show In The Works At Homeland Security

May 20, 2025 -

Improving Tourist Conduct In Bali A Call For Global Collaboration

May 20, 2025

Improving Tourist Conduct In Bali A Call For Global Collaboration

May 20, 2025 -

Putins Actions Highlight Trumps Reduced Global Relevance

May 20, 2025

Putins Actions Highlight Trumps Reduced Global Relevance

May 20, 2025