Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Bold Market Moves

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Analyzing the Bold Market Moves

The cryptocurrency market is buzzing with excitement as investment in Bitcoin exchange-traded funds (ETFs) surpasses the $5 billion mark. This monumental surge signals a significant shift in investor sentiment and a growing acceptance of Bitcoin as a mainstream asset class. But what's driving this unprecedented influx of capital, and what does it mean for the future of Bitcoin and the broader financial landscape? Let's delve into the details.

The Rise of Bitcoin ETFs: A Game Changer?

The approval of the first Bitcoin futures ETF in the US in October 2021 marked a watershed moment. While not directly investing in Bitcoin itself, these ETFs offered a regulated and accessible entry point for institutional and retail investors wary of the complexities and volatility of the cryptocurrency market. This initial step paved the way for the current boom in investment. The recent surge past the $5 billion mark represents a significant leap forward, demonstrating increased confidence in Bitcoin's long-term potential.

Factors Fueling the Investment Boom:

Several key factors contribute to this massive investment in Bitcoin ETFs:

- Increased Regulatory Clarity: While regulations surrounding cryptocurrencies remain complex and vary across jurisdictions, the gradual increase in regulatory clarity in key markets, such as the US, has boosted investor confidence. The SEC's recent approvals, while still cautious, are viewed as a positive step towards greater legitimacy.

- Inflation Hedge: With persistent inflation concerns worldwide, investors are increasingly seeking alternative assets to protect their portfolios. Bitcoin, with its limited supply and decentralized nature, is seen by some as a potential hedge against inflation. This perception has driven significant demand.

- Institutional Adoption: The growing adoption of Bitcoin by institutional investors, including hedge funds and asset management firms, is another key driver. These large-scale investors bring significant capital to the market, further accelerating the growth of Bitcoin ETFs.

- Technological Advancements: The ongoing development of the Bitcoin network, including layer-2 scaling solutions, is improving transaction speeds and reducing costs. These advancements enhance the practicality and usability of Bitcoin, attracting more investors.

Potential Risks and Considerations:

While the surge in investment is impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin and its ETFs:

- Volatility: Bitcoin's price remains highly volatile, susceptible to significant price swings driven by market sentiment, regulatory changes, and technological developments.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and sudden changes could negatively impact the value of Bitcoin ETFs.

- Security Risks: Although Bitcoin is a decentralized system, exchanges and custodial services holding Bitcoin for ETFs are still vulnerable to security breaches and hacking.

Looking Ahead: What's Next for Bitcoin ETFs?

The $5 billion milestone represents a significant achievement but is likely just the beginning. We can anticipate further growth in the Bitcoin ETF market as more products are launched and regulatory clarity improves. The potential approval of spot Bitcoin ETFs in the US could further propel investment, unlocking even greater liquidity and potentially driving Bitcoin's price higher. However, investors should remain cautious and carefully consider the inherent risks before investing in Bitcoin ETFs. Diversification and thorough research are crucial elements of any successful investment strategy.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by following reputable news sources and conducting your own thorough research before making any investment decisions. Remember to consult with a financial advisor to determine the suitability of Bitcoin ETFs for your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Bold Market Moves. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brett Favres Fall A J Perez Discusses Intimidation Tactics And The Untold Series

May 20, 2025

Brett Favres Fall A J Perez Discusses Intimidation Tactics And The Untold Series

May 20, 2025 -

Climate Changes Impact On Fertility And Pregnancy Outcomes

May 20, 2025

Climate Changes Impact On Fertility And Pregnancy Outcomes

May 20, 2025 -

Homeland Security And Reality Tv Exploring The Citizenship Application Process

May 20, 2025

Homeland Security And Reality Tv Exploring The Citizenship Application Process

May 20, 2025 -

International Support Urged For Balis Tourist Safety And Conduct

May 20, 2025

International Support Urged For Balis Tourist Safety And Conduct

May 20, 2025 -

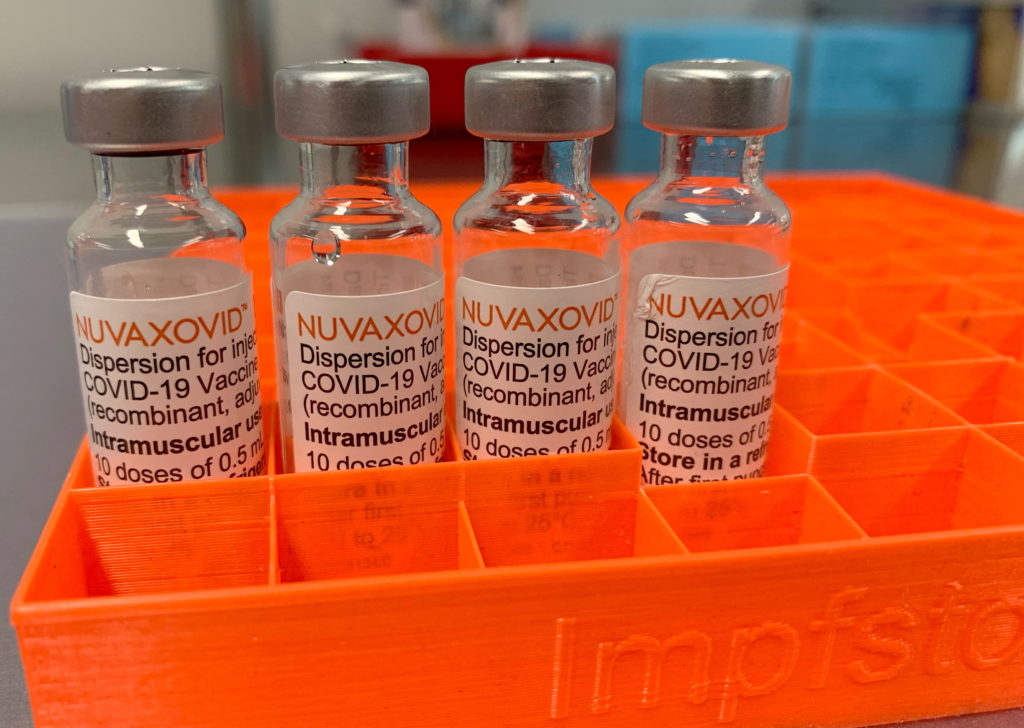

Novavax Covid 19 Vaccine Fda Approval Comes With Significant Restrictions

May 20, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Significant Restrictions

May 20, 2025