S&P 500 Extends Winning Streak: Market Rally Continues Despite Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Extends Winning Streak: Market Rally Continues Despite Moody's Downgrade

The S&P 500 index defied expectations, extending its winning streak despite a surprise downgrade from Moody's, a leading credit rating agency. This unexpected market resilience has left analysts scrambling to understand the driving forces behind this continued rally. The move highlights the complex interplay of factors influencing the current market climate and raises questions about the future direction of the US economy.

Moody's Downgrade: A Catalyst for Resilience?

On August 1, 2024, Moody's downgraded the credit rating of several major US banking institutions, citing concerns about the increasing federal debt and potential risks to the financial system. This action was widely expected to trigger a market correction, but the opposite occurred. The S&P 500 shrugged off the negative news, continuing its upward trajectory. This unexpected reaction underscores the resilience of the market and the potential decoupling of credit ratings from investor sentiment.

What's Fueling the Rally? Several Key Factors at Play:

Several factors are likely contributing to the ongoing S&P 500 rally, even in the face of adverse economic news:

-

Strong Corporate Earnings: Despite economic uncertainty, many major corporations have reported surprisingly strong second-quarter earnings, exceeding analysts' expectations. This positive performance is boosting investor confidence and driving stock prices higher. Learn more about the latest corporate earnings reports by visiting [link to a reputable financial news source].

-

Resilient Consumer Spending: Consumer spending remains surprisingly robust, indicating a level of economic strength that defies some pessimistic predictions. This ongoing consumption is supporting corporate revenues and bolstering the overall market sentiment. Further analysis on consumer spending can be found at [link to a reputable economic data source].

-

Federal Reserve's Monetary Policy: While the Federal Reserve continues to navigate a complex economic landscape, the current pause in interest rate hikes may be contributing to market stability. The anticipation of a potential pivot in monetary policy, depending on future inflation data, is also positively influencing investor psychology. For updates on the Federal Reserve's decisions, visit the [link to the Federal Reserve website].

-

Technological Innovation: Continued advancements and breakthroughs in artificial intelligence (AI) and other technological sectors are fueling investment in innovative companies, adding further momentum to the market's upward trend. This ongoing innovation is shaping the future of various industries and attracting significant capital.

Looking Ahead: Uncertainty Remains

While the current market rally is impressive, it's crucial to acknowledge the inherent uncertainties. The Moody's downgrade highlights the ongoing risks to the US economy, and factors like inflation, geopolitical instability, and potential future interest rate hikes remain significant concerns.

H3: Navigating Market Volatility

Investors should remain cautious and diversify their portfolios to mitigate risk. Seeking professional financial advice is crucial for navigating the complexities of the current market environment. Remember that past performance is not indicative of future results.

Conclusion:

The S&P 500's continued winning streak despite the Moody's downgrade presents a fascinating case study in market dynamics. While the rally is fueled by several positive factors, investors must remain aware of the inherent risks and uncertainties that lie ahead. The coming months will be crucial in determining the sustainability of this upward trend. Stay informed and make well-informed decisions based on a thorough understanding of market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Extends Winning Streak: Market Rally Continues Despite Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

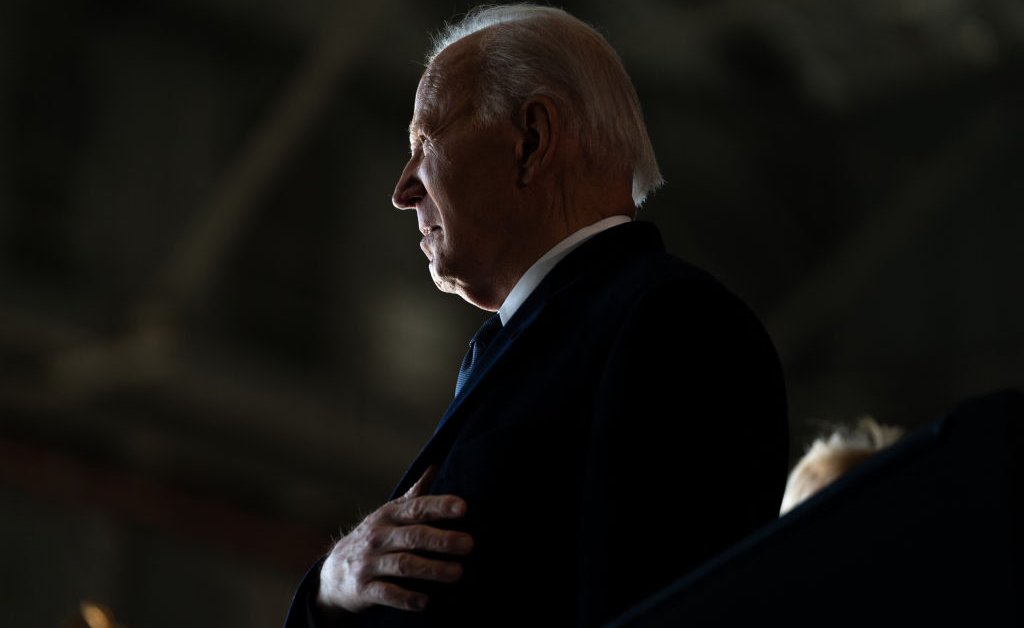

President Bidens Cancer Diagnosis A Wave Of Political Solidarity

May 20, 2025

President Bidens Cancer Diagnosis A Wave Of Political Solidarity

May 20, 2025 -

Tom Aspinall Negotiations And Jon Jones I M Done Tweet Whats Next For The Ufc

May 20, 2025

Tom Aspinall Negotiations And Jon Jones I M Done Tweet Whats Next For The Ufc

May 20, 2025 -

Get Masters Of Ceremony Skins In Helldivers 2s May 15th Warbond Event

May 20, 2025

Get Masters Of Ceremony Skins In Helldivers 2s May 15th Warbond Event

May 20, 2025 -

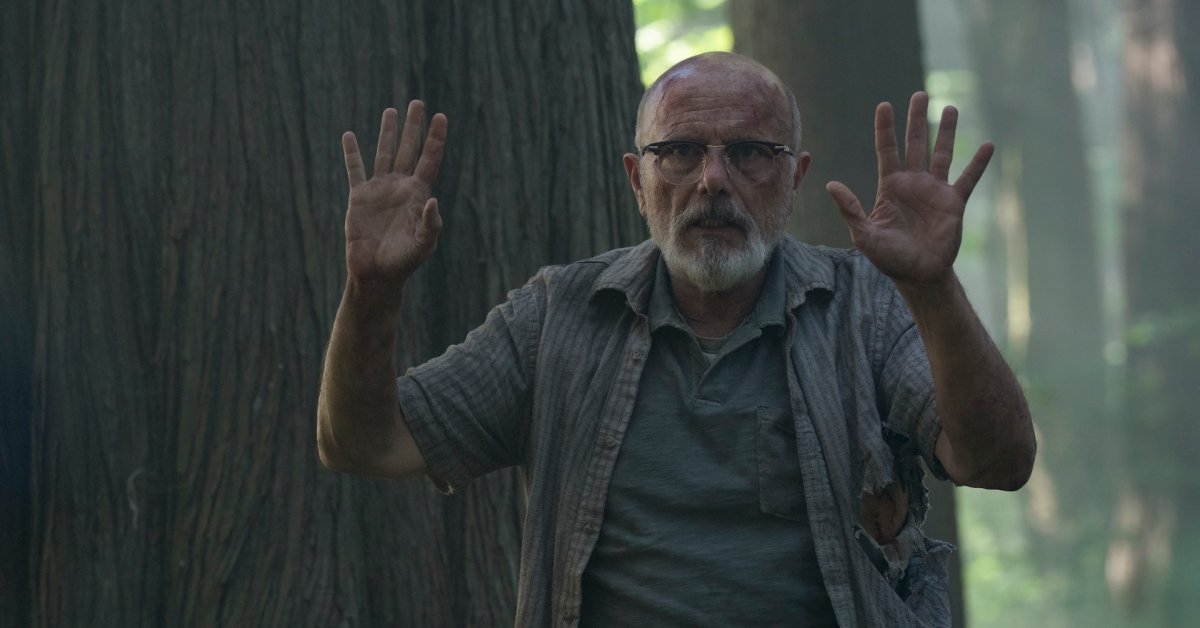

The Last Of Us Season 2 Examining The Impact Of Narrative Changes On Joel And Ellies Connection

May 20, 2025

The Last Of Us Season 2 Examining The Impact Of Narrative Changes On Joel And Ellies Connection

May 20, 2025 -

Deconstructing Success The Taylor Jenkins Reid Publishing Model

May 20, 2025

Deconstructing Success The Taylor Jenkins Reid Publishing Model

May 20, 2025