Stock Market Today: Analyzing The S&P 500's 6-Day Rally And Moody's Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Today: Decoding the S&P 500's Six-Day Surge and Moody's Downgrade Ripple Effect

The S&P 500 has just enjoyed a remarkable six-day rally, defying expectations and leaving many investors wondering what fueled this unexpected surge. While positive economic indicators played a role, the impact of Moody's recent downgrade of several US banks adds a layer of complexity to the situation. Let's delve into the factors driving this market movement and what it might mean for the future.

The Six-Day Rally: A Closer Look

The S&P 500's impressive six-day climb represents a significant shift in market sentiment. This rally, which saw the index gain [Insert Percentage Here]%, followed a period of uncertainty and volatility. Several factors contributed to this positive turn:

- Stronger-than-expected economic data: Recent economic reports, including [mention specific reports and data points, e.g., better-than-forecast consumer confidence figures and robust retail sales], painted a more optimistic picture than initially anticipated. This boosted investor confidence, leading to increased buying activity.

- Easing inflation concerns: While inflation remains a concern, recent data suggests a potential slowing of price increases. This eased fears of aggressive interest rate hikes by the Federal Reserve, a key driver of market volatility.

- Corporate earnings season: The ongoing corporate earnings season has delivered some positive surprises. Strong performances from major companies in various sectors have helped fuel the rally, showing resilience amidst economic headwinds. [Mention specific examples of companies exceeding expectations].

- Bargain hunting: After a period of decline, many investors saw the recent dip as an opportunity to buy stocks at discounted prices, further fueling the upward momentum.

Moody's Downgrade: A Counterintuitive Influence?

Ironically, the rally occurred despite Moody's decision to downgrade the credit ratings of several regional US banks. This action typically triggers market anxiety, yet the impact appears muted so far. Several theories explain this:

- Targeted downgrades: The downgrades were specific to certain regional banks, leaving the broader financial system relatively unaffected. The impact was therefore contained.

- Market anticipation: The market may have already priced in some of the negative news surrounding the banking sector, mitigating the impact of the formal downgrade.

- Focus shift: Investors' attention may have shifted to other more positive economic indicators, overshadowing the concerns surrounding the banking sector’s credit ratings.

What Does This Mean for the Future?

While the six-day rally is undeniably positive, it's crucial to avoid over-optimism. The market remains susceptible to various factors, including:

- Further interest rate hikes: The Federal Reserve's next move on interest rates remains a major wildcard. Any further hikes could dampen market enthusiasm.

- Geopolitical uncertainties: Ongoing geopolitical tensions can easily trigger market volatility.

- Inflationary pressures: Persistently high inflation could undermine the current positive trend.

Conclusion:

The S&P 500's six-day rally presents a complex picture. While positive economic data and bargain hunting contributed significantly, the muted response to Moody's bank downgrades adds an intriguing twist. Investors should remain vigilant, monitoring key economic indicators and geopolitical developments for potential shifts in market sentiment. It is advisable to consult with a financial advisor before making any investment decisions.

Keywords: S&P 500, Stock Market, Stock Market Rally, Moody's, Bank Downgrades, Economic Data, Inflation, Interest Rates, Investment, Financial Markets, Market Analysis, Stock Market Today

(Disclaimer: This article is for informational purposes only and should not be considered financial advice.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Today: Analyzing The S&P 500's 6-Day Rally And Moody's Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Santa Rosa Church Faces Major Vandalism Two Teenagers Charged

May 21, 2025

Santa Rosa Church Faces Major Vandalism Two Teenagers Charged

May 21, 2025 -

Over 5 Billion Invested In Bitcoin Etfs Understanding The Surge

May 21, 2025

Over 5 Billion Invested In Bitcoin Etfs Understanding The Surge

May 21, 2025 -

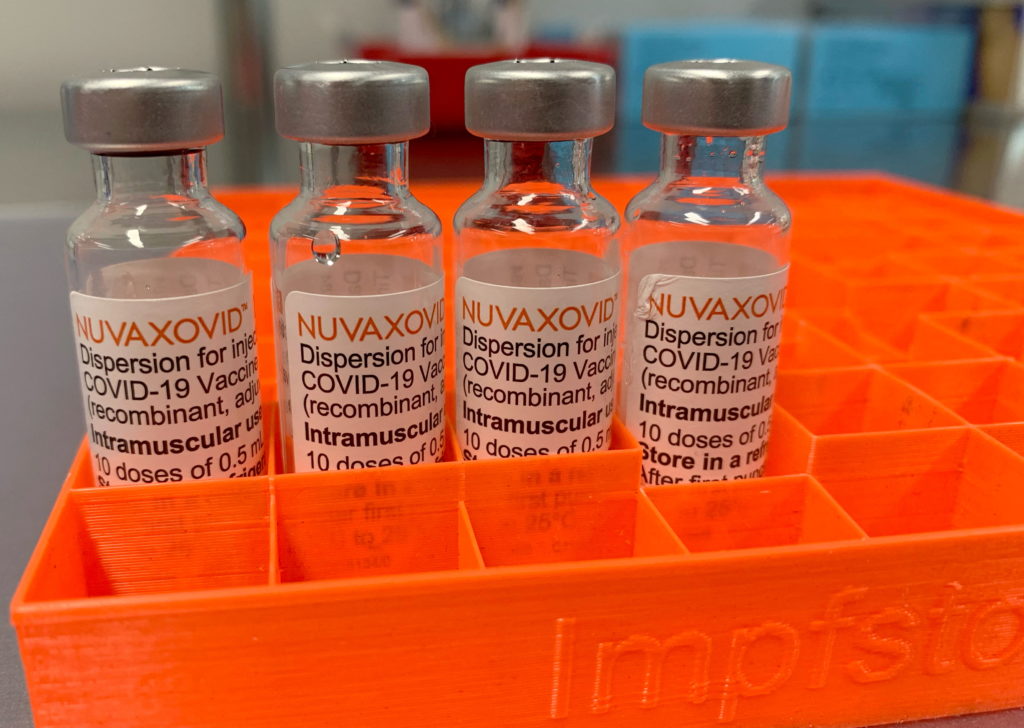

Novavax Covid 19 Vaccine Fda Approval And The Specific Use Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval And The Specific Use Restrictions

May 21, 2025 -

Medical And Scientific Research A Pillar Of American Global Leadership

May 21, 2025

Medical And Scientific Research A Pillar Of American Global Leadership

May 21, 2025 -

5 B Poured Into Bitcoin Etfs Directional Bets And Market Outlook

May 21, 2025

5 B Poured Into Bitcoin Etfs Directional Bets And Market Outlook

May 21, 2025