$5B+ Poured Into Bitcoin ETFs: Directional Bets And Market Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Floods into Bitcoin ETFs: A Bullish Signal or Fleeting Fad?

The cryptocurrency market is buzzing after over $5 billion poured into Bitcoin exchange-traded funds (ETFs) in a remarkably short period. This massive influx of capital has ignited intense debate amongst analysts: is this a strong bullish signal for Bitcoin's future, or simply a temporary trend driven by speculative fervor? This article delves into the recent investment surge, exploring the directional bets fueling this momentum and analyzing the broader market outlook.

The ETF Gold Rush: Unpacking the Numbers

The recent surge in Bitcoin ETF investments represents a significant shift in institutional and retail investor sentiment. While precise figures fluctuate daily, the overall trend is undeniable. This influx signifies a growing acceptance of Bitcoin as a legitimate asset class, attracting investors seeking diversification and exposure to the digital asset market. Several factors contribute to this surge:

- Increased Regulatory Clarity: The approval of several Bitcoin ETFs in key markets like the United States has significantly boosted investor confidence. This regulatory clarity reduces uncertainty and encourages broader participation.

- Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin through ETFs, signaling a maturing market.

- Retail Investor Interest: The ease of access offered by ETFs has attracted retail investors who previously found direct Bitcoin investment complex or risky.

Directional Bets and Market Sentiment:

The massive investment in Bitcoin ETFs reveals a predominantly bullish market sentiment. Investors are betting on Bitcoin's continued price appreciation, driven by factors like:

- Limited Supply: Bitcoin's fixed supply of 21 million coins acts as a deflationary pressure, potentially driving up its value over time.

- Technological Advancements: Developments in the Bitcoin network, such as the Lightning Network, continue to improve scalability and efficiency.

- Global Adoption: Growing adoption of Bitcoin as a payment method and store of value in various countries contributes to its long-term potential.

Market Outlook: Navigating Uncertainty

However, it's crucial to acknowledge the inherent volatility of the cryptocurrency market. While the influx into Bitcoin ETFs is positive, several factors could impact the future outlook:

- Macroeconomic Conditions: Global economic uncertainty, inflation, and interest rate hikes could significantly influence investor sentiment and Bitcoin's price.

- Regulatory Scrutiny: Future regulatory changes could impact the accessibility and performance of Bitcoin ETFs.

- Competition: The emergence of alternative cryptocurrencies and blockchain technologies poses a competitive challenge to Bitcoin's dominance.

Conclusion: A Cautious Optimism

The massive investment in Bitcoin ETFs indicates a growing acceptance of Bitcoin as a valuable asset. While the future remains uncertain, the current trend suggests a cautiously optimistic outlook. However, investors should always conduct thorough research and understand the inherent risks involved before investing in any cryptocurrency. The recent surge highlights the importance of staying informed about market developments and considering diverse investment strategies.

Further Reading:

- (Replace with actual relevant link)

- (Replace with actual relevant link)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risks, and you could lose some or all of your investment. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Directional Bets And Market Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

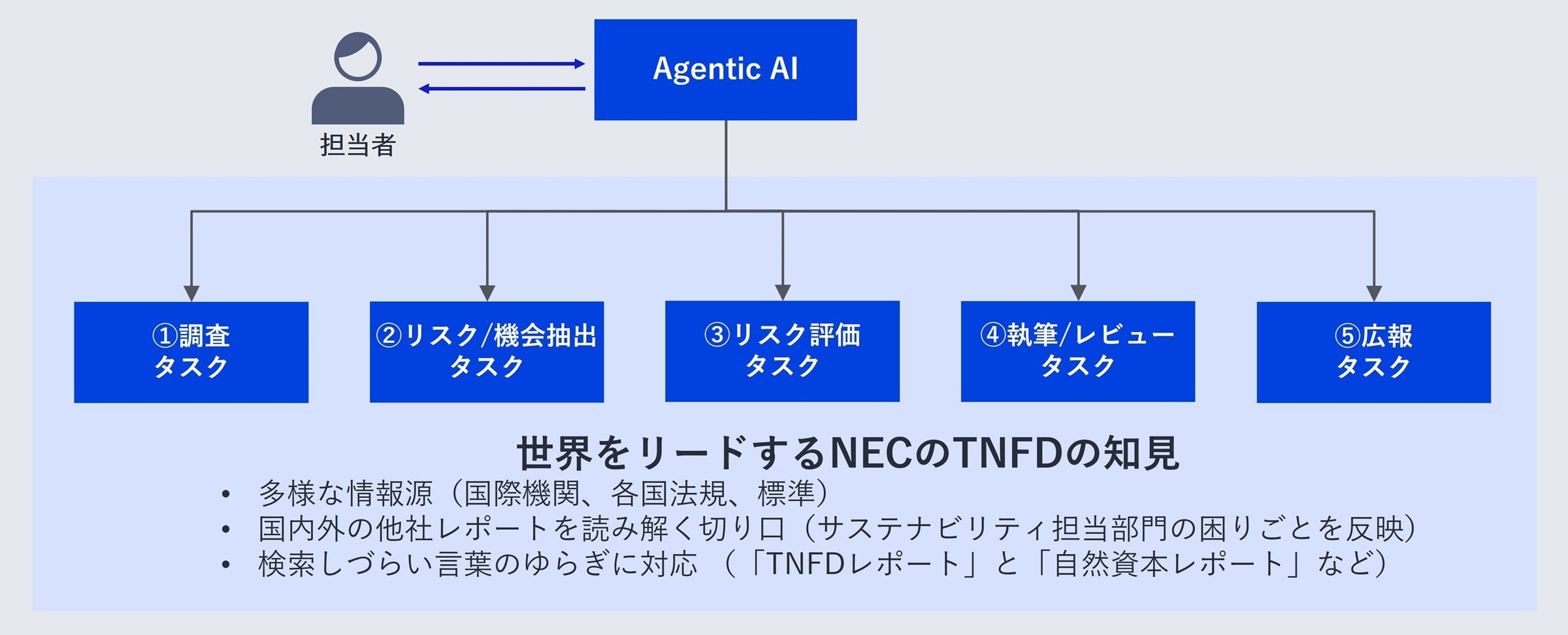

Agentic Ai Nec Tnfd Ai

May 21, 2025

Agentic Ai Nec Tnfd Ai

May 21, 2025 -

Stock Market Rally S And P 500s 6 Day Winning Streak Dow And Nasdaq Gains

May 21, 2025

Stock Market Rally S And P 500s 6 Day Winning Streak Dow And Nasdaq Gains

May 21, 2025 -

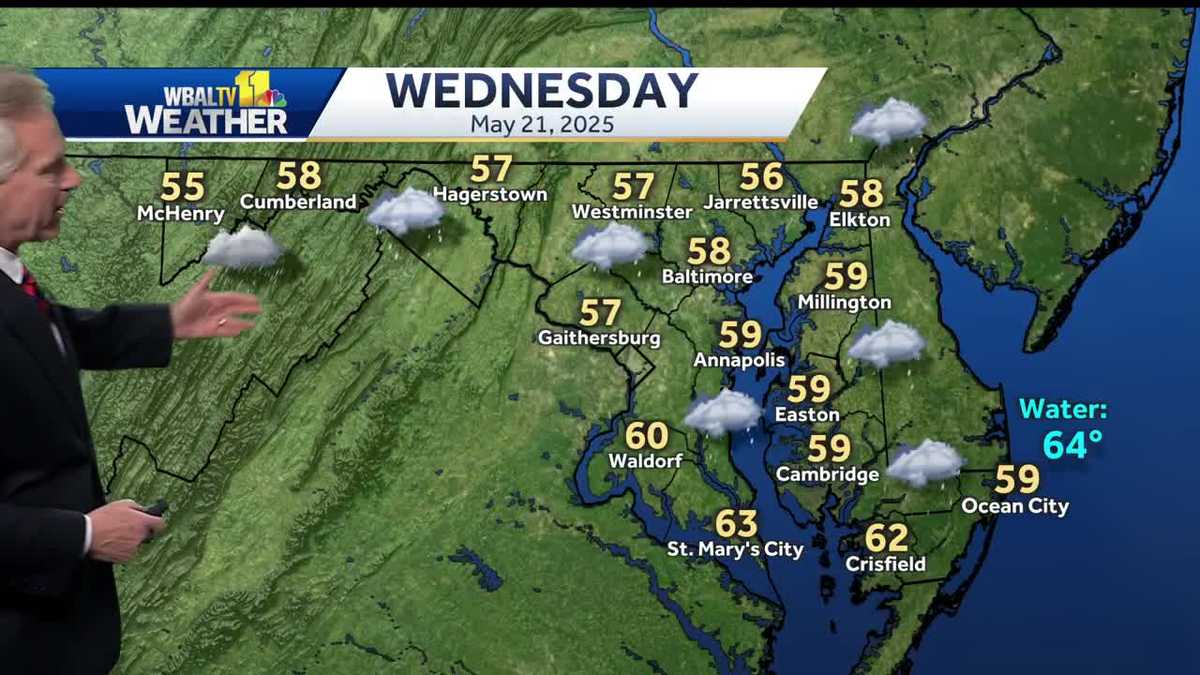

Region Faces Rainy Cold Wednesday Weather Alert

May 21, 2025

Region Faces Rainy Cold Wednesday Weather Alert

May 21, 2025 -

Japanese Companies 160 Enhance Value With Nature Conservation Initiatives Sector Specific Guidelines Released

May 21, 2025

Japanese Companies 160 Enhance Value With Nature Conservation Initiatives Sector Specific Guidelines Released

May 21, 2025 -

New Rayman Game Ubisoft Milans Job Openings For Aaa Development

May 21, 2025

New Rayman Game Ubisoft Milans Job Openings For Aaa Development

May 21, 2025