Over $5 Billion Invested In Bitcoin ETFs: Understanding The Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Understanding the Surge

The world of finance is buzzing. Investment in Bitcoin exchange-traded funds (ETFs) has exploded, surpassing a staggering $5 billion in a relatively short timeframe. This unprecedented surge signifies a major shift in how institutional and individual investors view Bitcoin and its place in the broader financial landscape. But what's driving this massive influx of capital? Let's delve into the factors fueling this Bitcoin ETF boom and explore what it means for the future of cryptocurrency.

The Allure of Accessibility and Regulation:

One of the primary reasons behind this surge is the increased accessibility and perceived regulatory legitimacy offered by Bitcoin ETFs. Unlike directly purchasing Bitcoin, which often involves navigating complex exchanges and security concerns, ETFs provide a simpler, more regulated pathway for investment. This is particularly appealing to institutional investors who are often bound by strict regulatory guidelines. The approval of the first spot Bitcoin ETF in the US, for example, dramatically lowered the barrier to entry for many large funds.

Diversification and Portfolio Hedging:

The growing acceptance of Bitcoin as a potential hedge against inflation and market volatility is another significant driver. Many investors view Bitcoin as a non-correlated asset, meaning its price doesn't necessarily move in tandem with traditional market indices. Adding Bitcoin ETFs to a diversified portfolio can help mitigate risk and potentially improve overall returns. This strategy is particularly attractive in times of economic uncertainty.

Growing Institutional Adoption:

The involvement of major institutional players is undeniable. Large financial institutions are increasingly allocating a portion of their assets to Bitcoin ETFs, signaling a growing confidence in the long-term viability of the cryptocurrency. This institutional backing lends credibility to Bitcoin and further encourages individual investors to participate.

Grayscale Bitcoin Trust (GBTC) and the ETF Conversion:

The conversion of the Grayscale Bitcoin Trust (GBTC) to an ETF has been a much-anticipated event. GBTC, a significant player in the Bitcoin investment space, has been trading at a significant discount to its Net Asset Value (NAV) for a considerable period. The potential conversion to an ETF could unlock substantial value for investors, further driving investment into the Bitcoin ETF market.

Challenges and Considerations:

While the future looks bright, it's crucial to acknowledge potential challenges. Regulatory uncertainty remains a key factor. While some jurisdictions have embraced Bitcoin ETFs, others maintain a cautious approach. Furthermore, the volatile nature of Bitcoin itself presents inherent risks. Investors should conduct thorough research and understand the potential risks before investing in Bitcoin ETFs.

The Future of Bitcoin ETFs:

The current surge in investment suggests a potentially transformative period for the cryptocurrency market. As more ETFs are approved and accessibility increases, we can expect further growth and mainstream adoption. This could lead to greater price stability for Bitcoin and potentially solidify its position as a viable asset class alongside traditional investments.

What this means for you:

The surge in Bitcoin ETF investment presents both opportunities and challenges. It's essential to stay informed about market developments and to make investment decisions based on your own risk tolerance and financial goals. Consider consulting with a qualified financial advisor before investing in any cryptocurrency-related products.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Bitcoin investment, cryptocurrency investment, ETF investment, institutional investment, regulatory approval, Grayscale Bitcoin Trust, GBTC, market volatility, inflation hedge, diversification, portfolio hedging, cryptocurrency ETF.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Understanding The Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ellen De Generes Heartbreak Details Emerge Following Family Loss Announcement

May 21, 2025

Ellen De Generes Heartbreak Details Emerge Following Family Loss Announcement

May 21, 2025 -

Assassins Creed Mirage Ubisoft Addresses Player Concerns About Animal Killing

May 21, 2025

Assassins Creed Mirage Ubisoft Addresses Player Concerns About Animal Killing

May 21, 2025 -

Heartwarming Return Ellen De Generes Re Emerges On Social Media

May 21, 2025

Heartwarming Return Ellen De Generes Re Emerges On Social Media

May 21, 2025 -

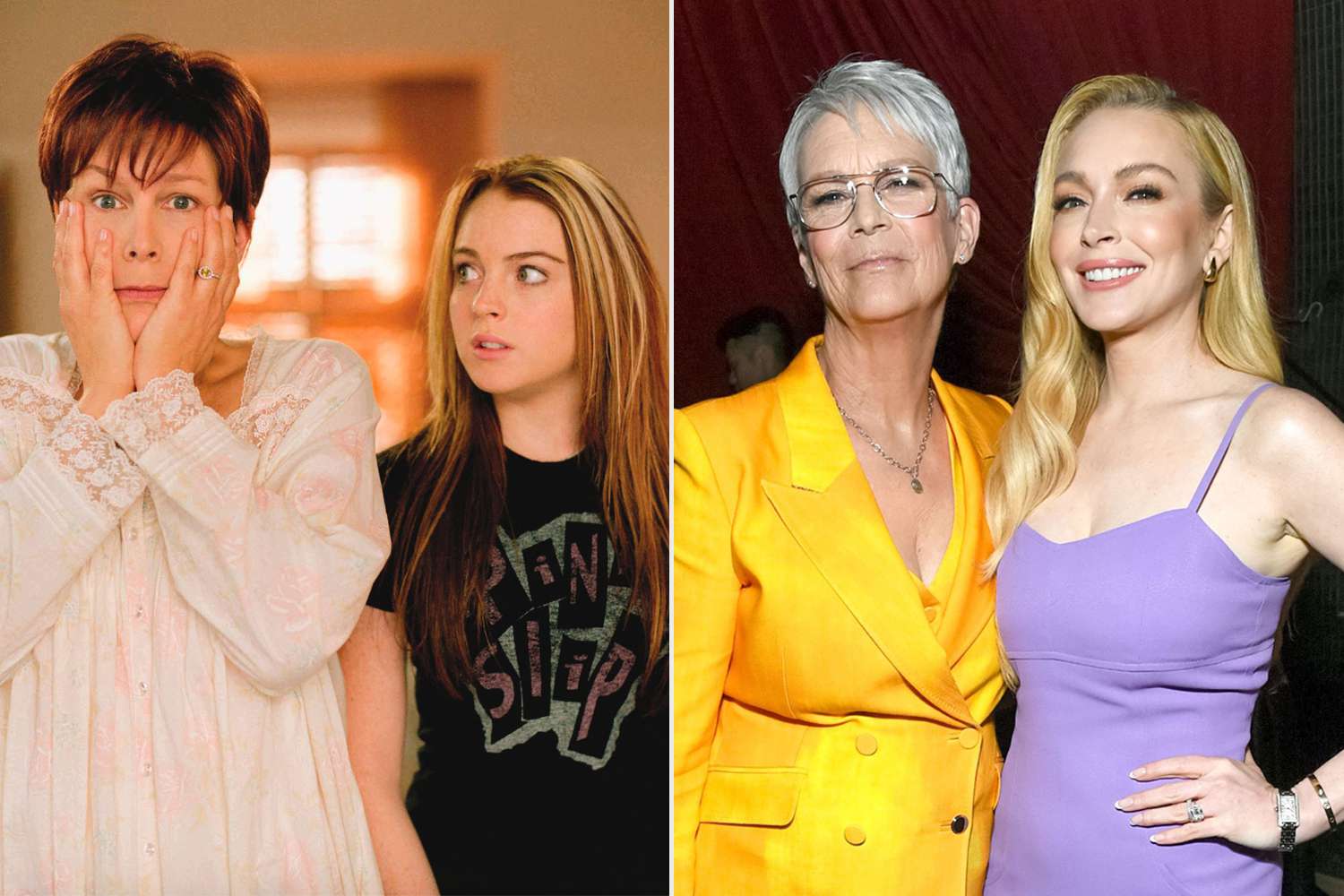

Jamie Lee Curtis Opens Up About Her Continued Friendship With Lindsay Lohan

May 21, 2025

Jamie Lee Curtis Opens Up About Her Continued Friendship With Lindsay Lohan

May 21, 2025 -

Mma World Reacts Jon Jones Latest Comments On Tom Aspinall Ignite Debate

May 21, 2025

Mma World Reacts Jon Jones Latest Comments On Tom Aspinall Ignite Debate

May 21, 2025