US Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Federal Reserve Hints at Single 2025 Rate Cut

Market uncertainty eases as Fed signals cautious approach to future interest rate adjustments.

The US Treasury market experienced a noticeable dip in yields this week following Federal Reserve Chair Jerome Powell's latest comments hinting at a single interest rate cut in 2025. This tempered expectation marks a shift from previous predictions of multiple rate reductions, sending ripples through the bond market and sparking discussions about the future trajectory of the US economy. The subtle change in Fed rhetoric has been met with a cautiously optimistic response from investors.

The yield on the benchmark 10-year Treasury note fell to [insert current yield], while the 2-year note also experienced a decline. This movement indicates a shift in investor sentiment, suggesting a decreased expectation of future interest rate hikes by the Federal Reserve. The decrease in yields reflects increased demand for Treasury bonds, as investors seek safer havens in light of the evolving economic landscape.

Powell's Comments and Market Reaction

Powell's testimony before Congress emphasized the Fed's commitment to bringing inflation down to its 2% target. However, his acknowledgement of the possibility of a single rate cut in 2025, contingent on economic data, signaled a less aggressive stance than previously anticipated. This cautious approach, emphasizing data dependency, contributed significantly to the decline in Treasury yields. Analysts interpret this as a recognition of the potential for a softer economic landing than previously feared.

The market's reaction was swift. Investors, who had previously priced in multiple rate cuts, adjusted their portfolios to reflect this new information. This adjustment led to the observed decrease in yields, signifying a reduction in the perceived risk associated with holding longer-term Treasury bonds.

Implications for the US Economy

The Fed's shift in messaging has broader implications for the US economy. A single rate cut, if it materializes, suggests a more moderate economic slowdown than some had predicted. This could alleviate concerns about a potential recession, although the possibility of a mild recession remains a topic of ongoing debate among economists.

The impact on borrowing costs for businesses and consumers is also significant. Lower yields translate to lower borrowing costs, potentially boosting investment and consumer spending. However, the extent of this positive impact will depend on various factors, including the overall economic climate and inflation trends.

Factors Influencing Treasury Yields

Several factors contribute to the fluctuations in US Treasury yields, including:

- Inflation data: The Consumer Price Index (CPI) and Producer Price Index (PPI) reports are closely watched, as they provide insights into inflation trends. Unexpectedly high inflation could lead to an increase in yields, while lower-than-expected inflation could push yields lower.

- Economic growth: Strong economic growth can push yields higher, reflecting increased demand for credit. Conversely, weak economic growth can lead to lower yields.

- Federal Reserve policy: The Fed's actions, particularly its interest rate decisions, significantly influence Treasury yields.

- Global economic conditions: International events and economic developments can also impact US Treasury yields.

Looking Ahead

The future trajectory of US Treasury yields remains uncertain. The Fed's decision to potentially cut rates only once in 2025 suggests a carefully calibrated approach, contingent on evolving economic data. Investors will continue to monitor key economic indicators, including inflation and employment figures, to gauge the likelihood of further rate adjustments. This situation highlights the importance of staying informed about economic news and developments to make informed investment decisions. Consult with a financial advisor for personalized guidance.

Keywords: US Treasury yields, Federal Reserve, interest rates, rate cut, 2025, economic outlook, inflation, bond market, Treasury bonds, 10-year Treasury note, 2-year Treasury note, Jerome Powell, economic growth, investment, recession.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Santa Rosa Church Police Investigating Act Of Defecation And Urination By Two Teens

May 21, 2025

Santa Rosa Church Police Investigating Act Of Defecation And Urination By Two Teens

May 21, 2025 -

New Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy Where To Watch

May 21, 2025

New Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy Where To Watch

May 21, 2025 -

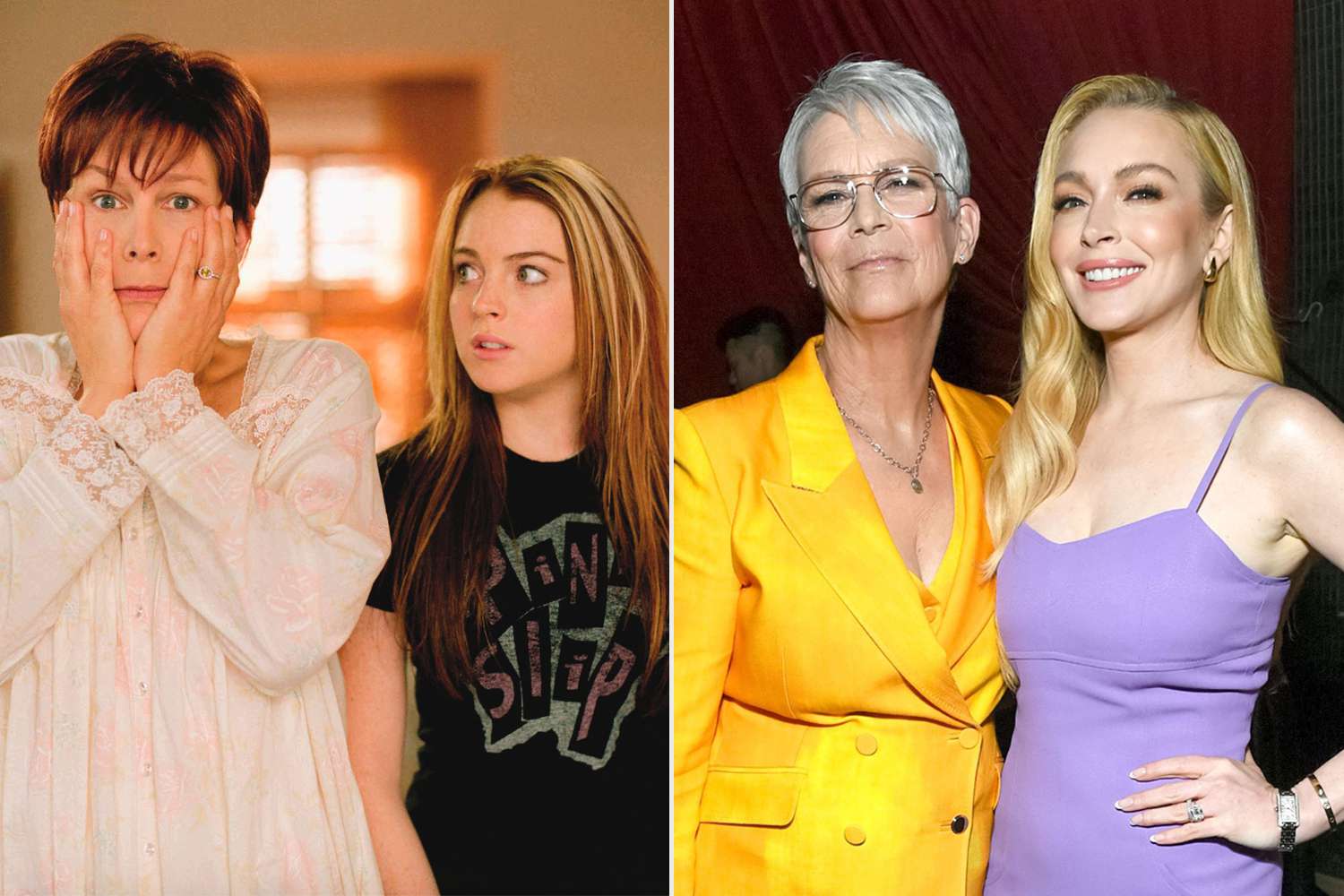

Jamie Lee Curtis Opens Up About Her Continued Friendship With Lindsay Lohan

May 21, 2025

Jamie Lee Curtis Opens Up About Her Continued Friendship With Lindsay Lohan

May 21, 2025 -

New Peaky Blinders Series Officially Announced A Major Shift For The Show

May 21, 2025

New Peaky Blinders Series Officially Announced A Major Shift For The Show

May 21, 2025 -

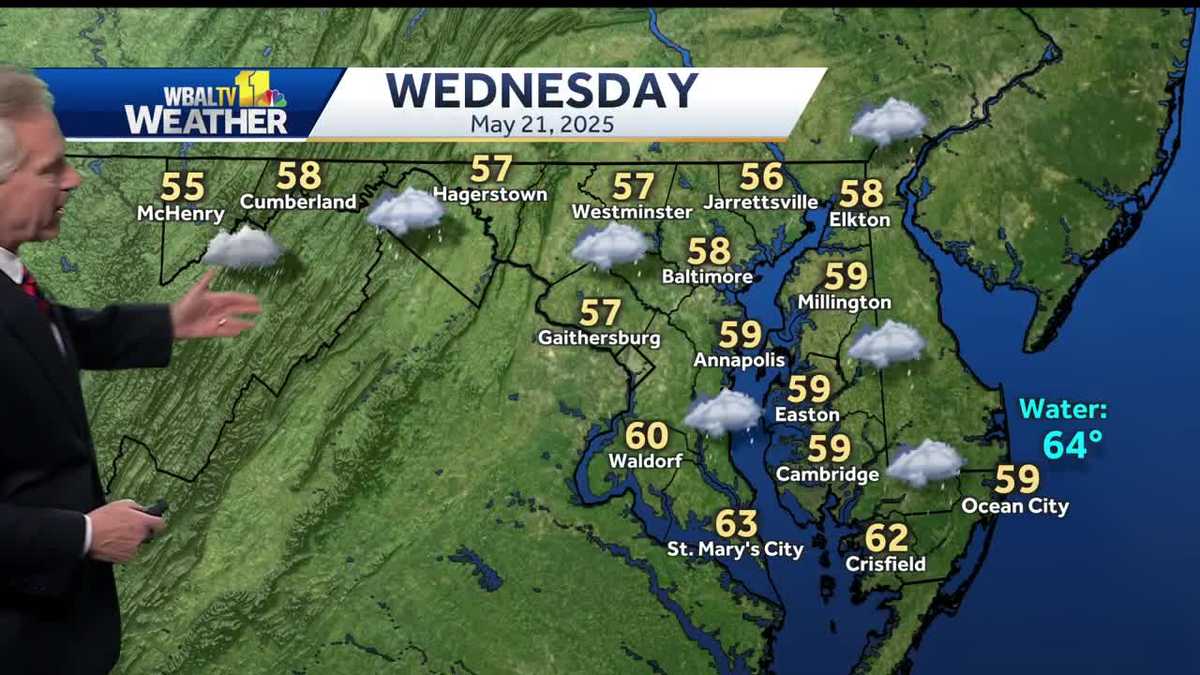

Wet And Cold Wednesdays Weather Forecast For The Region

May 21, 2025

Wet And Cold Wednesdays Weather Forecast For The Region

May 21, 2025