Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Recent Influx

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Surges Past $5 Billion: Analyzing the Recent Influx

The world of finance is buzzing with excitement as Bitcoin ETF (Exchange-Traded Fund) investments have officially surpassed the staggering $5 billion mark. This monumental surge signifies a significant shift in investor sentiment towards Bitcoin and the growing acceptance of cryptocurrencies within traditional financial markets. But what's driving this unprecedented influx of capital? Let's delve into the factors contributing to this remarkable milestone and analyze the implications for the future of Bitcoin and the broader crypto landscape.

The Catalyst for Growth: Increased Regulatory Clarity and Institutional Adoption

Several key factors have converged to fuel this explosive growth in Bitcoin ETF investment. One prominent driver is the increasing regulatory clarity surrounding cryptocurrencies in major markets. The recent approval of several Bitcoin ETFs in the United States, for example, has significantly reduced the barriers to entry for institutional investors who previously hesitated due to regulatory uncertainty. This newfound regulatory certainty has opened the floodgates, allowing institutional funds, pension plans, and other large investors to confidently allocate capital to Bitcoin ETFs.

Institutional Investors Embrace Bitcoin's Potential

The participation of institutional investors is crucial. Their significant capital injections not only boost the overall market value but also lend credibility and legitimacy to Bitcoin as an asset class. Many institutional players are recognizing Bitcoin's potential as a hedge against inflation and a diversification tool within their portfolios. This strategic shift is a key indicator of Bitcoin's growing maturity and its potential for long-term growth.

Beyond the Numbers: Understanding the Implications

This $5 billion milestone represents more than just a numerical achievement. It's a powerful statement about the evolving relationship between traditional finance and the cryptocurrency market. Several key implications emerge from this significant influx of investment:

- Increased Market Liquidity: The increased investment significantly improves the liquidity of Bitcoin, making it easier for investors to buy and sell their holdings without significantly impacting the price.

- Price Stability (Potentially): While price volatility remains a characteristic of Bitcoin, the influx of institutional capital could potentially contribute to greater price stability in the long term.

- Mainstream Adoption: The success of Bitcoin ETFs signals a broader acceptance of cryptocurrencies within the mainstream financial system. This could lead to further innovation and adoption of blockchain technology across various industries.

- Further Regulatory Scrutiny: The increased popularity of Bitcoin ETFs might also lead to increased regulatory scrutiny, which could both present challenges and opportunities for the cryptocurrency industry.

Looking Ahead: Navigating the Future of Bitcoin ETFs

The future of Bitcoin ETFs remains dynamic and unpredictable. While the $5 billion milestone marks a significant achievement, several challenges persist. These include ongoing regulatory uncertainties in different jurisdictions, the inherent volatility of cryptocurrency markets, and the potential for market manipulation.

However, the overall trend suggests a continued upward trajectory for Bitcoin ETF investment. As regulatory frameworks mature and institutional adoption accelerates, we can expect even greater capital inflows into this burgeoning asset class. This makes staying informed about market developments and regulatory changes crucial for investors navigating the ever-evolving world of cryptocurrency.

Call to Action: Stay tuned to our website for further updates and analysis on Bitcoin and the cryptocurrency market. We will continue to provide insightful coverage on the latest developments and their implications for investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Recent Influx. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

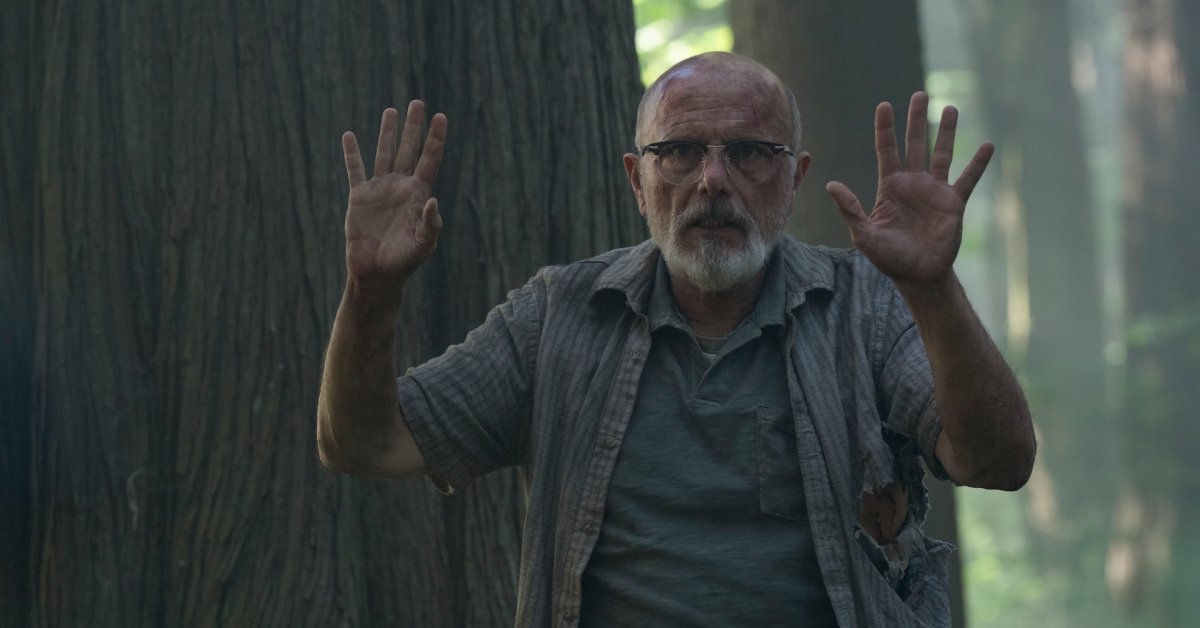

Joel And Ellies Evolving Dynamic A Comparison Of The Last Of Us Game And Show

May 21, 2025

Joel And Ellies Evolving Dynamic A Comparison Of The Last Of Us Game And Show

May 21, 2025 -

Supreme Court Upholds Trump Era Policy Venezuelan Migrants Lose Key Protections

May 21, 2025

Supreme Court Upholds Trump Era Policy Venezuelan Migrants Lose Key Protections

May 21, 2025 -

Fans Erupt As Ellen De Generes Returns To Social Media After Grief

May 21, 2025

Fans Erupt As Ellen De Generes Returns To Social Media After Grief

May 21, 2025 -

Brett Favres Untold Story A J Perez Recounts Threats And Controversy

May 21, 2025

Brett Favres Untold Story A J Perez Recounts Threats And Controversy

May 21, 2025 -

Brett Favres Untold Story A J Perez On Threats And The Documentarys Impact

May 21, 2025

Brett Favres Untold Story A J Perez On Threats And The Documentarys Impact

May 21, 2025