U.S. Treasury Yields Fall As Fed Hints At One 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Tumble as Fed Signals Potential 2025 Rate Cut

U.S. Treasury yields experienced a significant drop following Federal Reserve Chair Jerome Powell's recent comments hinting at a potential interest rate reduction in 2025. This shift marks a notable change in market sentiment, reflecting a growing belief that the aggressive interest rate hiking cycle may be nearing its end. Investors are now reassessing their expectations for future monetary policy and its impact on the bond market.

This unexpected development sent ripples through the financial world, impacting everything from mortgage rates to corporate borrowing costs. Understanding the implications of this shift is crucial for investors and economists alike.

Powell's Remarks Spark Yield Decline

The catalyst for the decline in Treasury yields was Powell's less hawkish-than-expected testimony before Congress. While he reiterated the Fed's commitment to bringing inflation down to its 2% target, his language regarding future rate hikes was more nuanced than in previous appearances. He acknowledged the possibility of rate cuts in 2025, contingent on the economic outlook and inflation trajectory. This subtle shift in tone was enough to trigger a significant market reaction.

What Does This Mean for Investors?

The fall in Treasury yields presents both opportunities and challenges for investors. Lower yields generally mean higher bond prices, offering potential gains for those holding existing bonds. However, it also suggests lower returns for future investments in government bonds. This necessitates a careful reassessment of investment strategies.

- Bondholders: Existing bondholders may see an increase in the value of their holdings.

- Potential Bond Buyers: Lower yields might make bonds less attractive compared to other investment options.

- Mortgage Rates: A potential future rate cut could eventually lead to lower mortgage rates, although the timing remains uncertain.

This situation underscores the importance of diversification and a long-term investment strategy. It's crucial to consult with a financial advisor to assess how these changes might impact your personal portfolio.

Economic Outlook Remains Uncertain

Despite the market's reaction, the economic outlook remains uncertain. Inflation, while cooling, is still above the Fed's target, and the labor market remains robust. These factors could influence the Fed's future decisions, making it difficult to predict with certainty whether the 2025 rate cut will materialize.

The Fed's projections are subject to revision based on incoming economic data. Factors like unexpected inflation surges or a significant economic slowdown could alter their plans. Keeping a close eye on key economic indicators like inflation data (CPI and PCE) and employment reports will be crucial in navigating this evolving landscape.

Looking Ahead: Navigating Market Volatility

The recent shift in Treasury yields highlights the inherent volatility of the financial markets. While the Fed's hints at a potential 2025 rate cut offer a glimmer of hope for lower interest rates, investors should remain cautious and adapt their strategies accordingly. Staying informed about economic developments and seeking professional financial advice is essential to successfully navigate this period of uncertainty. Remember to consult reputable financial news sources for the latest updates and analysis.

Keywords: U.S. Treasury Yields, Federal Reserve, Interest Rates, Bond Market, Inflation, Economic Outlook, Jerome Powell, Rate Cut, 2025, Monetary Policy, Investment Strategy, Financial Markets, Market Volatility

(CTA: For personalized financial advice tailored to your needs, consider consulting a qualified financial advisor.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall As Fed Hints At One 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 20, 2025

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 20, 2025 -

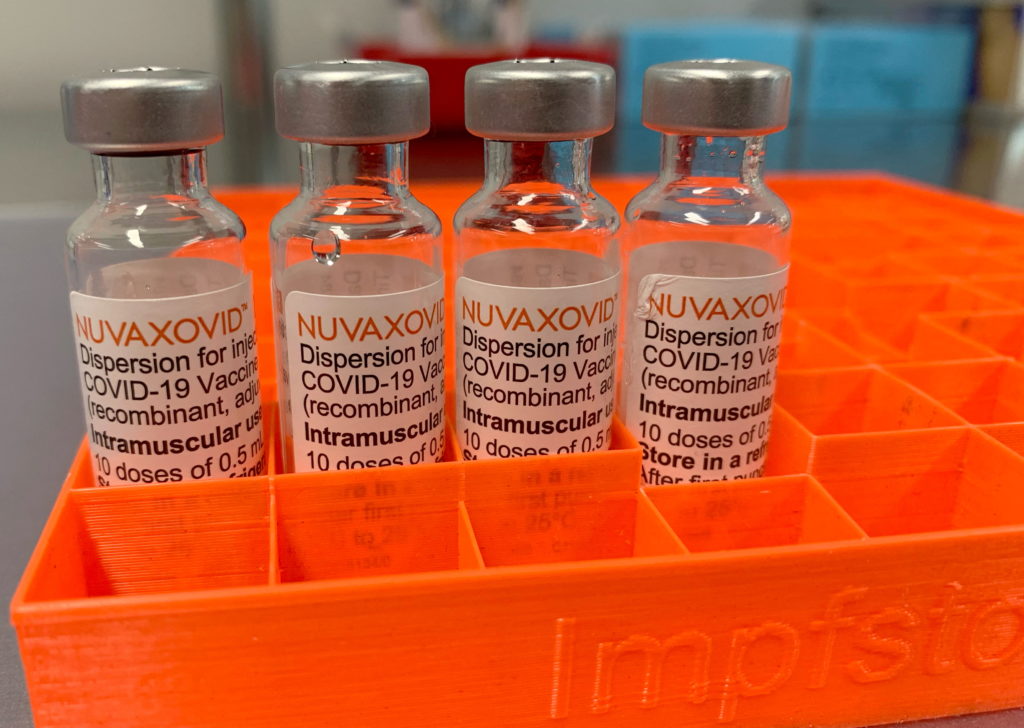

Novavax Covid 19 Vaccine Approved By Fda With Unusual Limitations

May 20, 2025

Novavax Covid 19 Vaccine Approved By Fda With Unusual Limitations

May 20, 2025 -

Climate Changes Effect On Pregnancy Infertility Miscarriage And Birth Outcomes

May 20, 2025

Climate Changes Effect On Pregnancy Infertility Miscarriage And Birth Outcomes

May 20, 2025 -

Big Changes Ahead Creator Confirms A New Peaky Blinders Series

May 20, 2025

Big Changes Ahead Creator Confirms A New Peaky Blinders Series

May 20, 2025 -

Jenn Sterger Details Emotional Toll Of Brett Favre Sext Scandal

May 20, 2025

Jenn Sterger Details Emotional Toll Of Brett Favre Sext Scandal

May 20, 2025