Moody's Downgrade Unfazed: S&P 500, Dow, And Nasdaq Post Strong Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Unfazed: S&P 500, Dow, and Nasdaq Post Strong Gains

Despite Moody's downgrade of several US banks, the stock market roared back to life, defying expectations and posting impressive gains across major indices. The unexpected resilience showcased investor confidence and a continued appetite for risk, leaving many analysts scrambling to explain the market's seemingly contradictory behavior. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all experienced significant increases, suggesting a disconnect between credit rating concerns and overall market sentiment.

This surprising market performance comes on the heels of Moody's decision to downgrade the credit ratings of 10 mid-sized US banks and place others on review for potential downgrades. The rating agency cited concerns about rising interest rates and potential losses from commercial real estate loans as key factors driving their decision. This news, typically a catalyst for market volatility and declines, proved to be surprisingly ineffective in dampening investor enthusiasm.

<h3>Strong Gains Across the Board</h3>

The market's robust performance was widespread. The S&P 500 surged by [Insert Percentage]% on [Date], closing at [Closing Value]. Similarly, the Dow Jones Industrial Average climbed [Insert Percentage]%, reaching [Closing Value], while the Nasdaq Composite experienced a remarkable [Insert Percentage]% increase, settling at [Closing Value]. These gains represent a significant turnaround from the initial negative reaction to Moody's announcement, indicating a potential shift in investor perception.

<h3>Why the Market Defied Expectations</h3>

Several factors may explain this unexpected market resilience:

- Positive Earnings Reports: Stronger-than-expected earnings reports from several major companies could have offset the negative impact of Moody's downgrade. Positive corporate news often outweighs broader economic concerns in the short term.

- Resilient Economic Data: Recent economic data, including [mention specific positive economic indicators, e.g., employment figures, consumer spending], may have boosted investor confidence, mitigating the anxieties surrounding the banking sector.

- Market Overreaction to Moody's Downgrade: Some analysts suggest that the initial market reaction to Moody's announcement might have been an overreaction. The subsequent surge could represent a correction back to a more balanced valuation.

- Federal Reserve Actions: The Federal Reserve's recent actions and communication regarding interest rate policy may have also played a role in influencing investor sentiment. [Mention specific Fed actions and their potential impact].

<h3>What This Means for Investors</h3>

The market's unexpected resilience presents a complex picture for investors. While the strong gains are encouraging, it’s crucial to remain cautious. The underlying concerns about the banking sector and the broader economic outlook remain. Investors should carefully consider their risk tolerance and diversify their portfolios accordingly. Seeking advice from a qualified financial advisor is recommended before making any significant investment decisions.

<h3>Looking Ahead</h3>

The coming weeks will be crucial in determining whether this market surge is sustainable or a temporary reprieve. Close monitoring of economic indicators, corporate earnings, and further developments in the banking sector will be essential for navigating the market's uncertainty. Further analysis of Moody's rationale and the potential implications of their downgrade on other financial institutions will also be key for investors. The market's response will be a valuable indicator of investor confidence in the face of future economic challenges.

Call to Action: Stay informed about market developments by subscribing to our newsletter [link to newsletter signup]. We provide daily updates and in-depth analysis to help you make informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Unfazed: S&P 500, Dow, And Nasdaq Post Strong Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

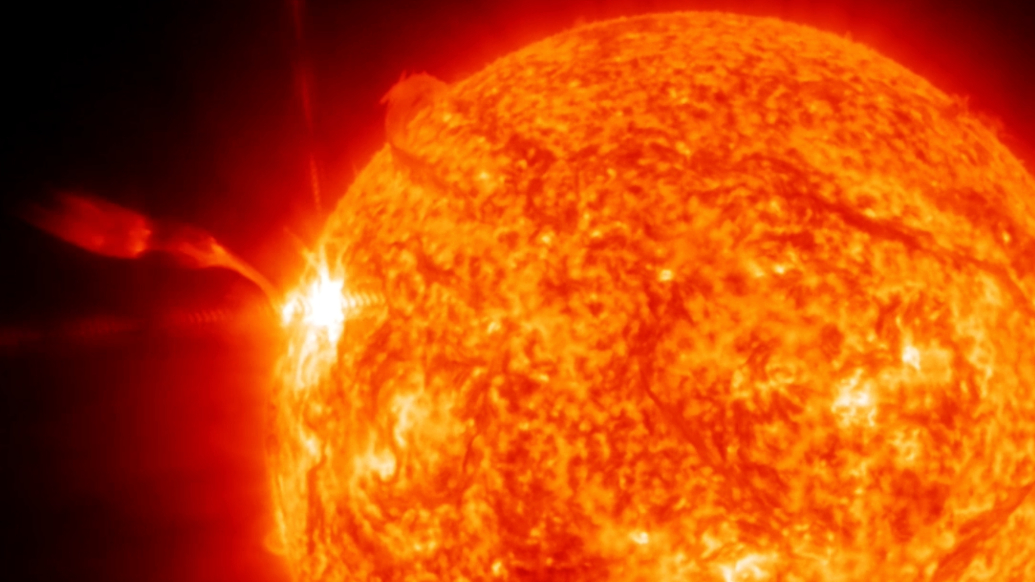

Severe Solar Storm Triggers Continent Wide Communications Blackouts

May 20, 2025

Severe Solar Storm Triggers Continent Wide Communications Blackouts

May 20, 2025 -

2025s Largest Solar Flare Impact Assessment And Radio Blackout Analysis

May 20, 2025

2025s Largest Solar Flare Impact Assessment And Radio Blackout Analysis

May 20, 2025 -

Is A Homeland Security Reality Show For Citizenship In The Works

May 20, 2025

Is A Homeland Security Reality Show For Citizenship In The Works

May 20, 2025 -

Jon Jones Aspinall Comments Spark Outrage Fans React To Strip The Duck Remark

May 20, 2025

Jon Jones Aspinall Comments Spark Outrage Fans React To Strip The Duck Remark

May 20, 2025 -

Ipl 2025 Live Score Lsg Srh Match Marked By Player Dispute Follow Live Updates

May 20, 2025

Ipl 2025 Live Score Lsg Srh Match Marked By Player Dispute Follow Live Updates

May 20, 2025