U.S. Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at Single 2025 Rate Cut: What it Means for Investors

U.S. Treasury yields experienced a noticeable dip following recent comments from the Federal Reserve, hinting at a potential single interest rate cut in 2025. This shift in expectations has sent ripples through the financial markets, prompting questions about the future trajectory of interest rates and the overall economic outlook. Understanding this development is crucial for investors navigating the current landscape.

The Fed's Subtle Shift and Market Reaction

The Federal Reserve's recent statements, while cautious, suggested a less aggressive approach to future interest rate hikes than previously anticipated. Instead of multiple cuts, the implied expectation is now leaning towards a single rate reduction sometime in 2025. This subtle change in language has had a significant impact on Treasury yields, which are inversely related to bond prices. Lower yields suggest increased demand for these bonds, reflecting a growing sense of caution and a potential flight to safety amongst investors.

Why the Shift? Analyzing the Economic Indicators

Several factors likely contributed to the Fed's more tempered stance. Recent economic data, while showing resilience in some sectors, also revealed signs of slowing growth. Inflation, while still a concern, has shown signs of moderating, albeit at a slower pace than initially hoped. This nuanced picture led the Fed to adjust its projections, suggesting a less hawkish approach to monetary policy in the coming year. Key indicators to watch include the Consumer Price Index (CPI), Producer Price Index (PPI), and employment data.

What Does This Mean for Investors?

The dip in Treasury yields presents both opportunities and challenges for investors.

-

Fixed-Income Investors: Lower yields mean lower returns on new investments in Treasury bonds. However, existing bondholders may see their holdings appreciate in value. Diversification across different maturities remains a key strategy.

-

Stock Market Investors: The shift could signal a less aggressive tightening of monetary policy, potentially supporting stock market growth. However, the overall economic outlook remains uncertain, and volatility should be expected.

-

Real Estate Investors: Lower interest rates generally translate into lower mortgage rates, potentially boosting the real estate market. However, other economic factors, such as inflation and housing supply, will also play a significant role.

Looking Ahead: Uncertainty Remains

While the Fed's hint at a single rate cut in 2025 provides some clarity, significant uncertainty remains. The economic landscape is dynamic, and unforeseen events could easily alter the trajectory of interest rates. Geopolitical factors, unexpected inflation surges, and shifts in consumer spending could all impact the Fed's future decisions.

Staying Informed is Key

For investors, staying informed about economic indicators and the Fed's pronouncements is critical. Regularly monitoring key economic data and following financial news sources will help investors make informed decisions and adapt their portfolios accordingly. Consider consulting with a qualified financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals. This is especially important in navigating the complexities of the current market environment.

Keywords: US Treasury Yields, Federal Reserve, Interest Rate Cut, 2025, Bond Prices, Economic Indicators, Inflation, Monetary Policy, Investment Strategy, Stock Market, Real Estate, Financial News, Economic Outlook

(Note: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Protected Status Revoked Supreme Court Sides With Trump On Venezuelan Migrants

May 20, 2025

Protected Status Revoked Supreme Court Sides With Trump On Venezuelan Migrants

May 20, 2025 -

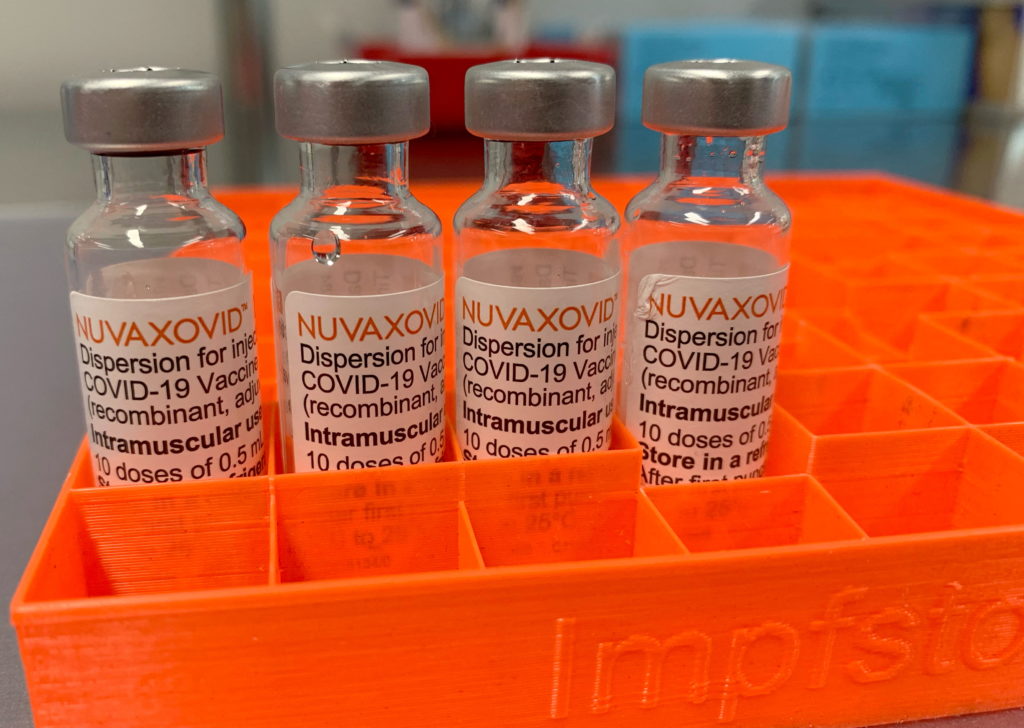

Fda Clears Novavax Covid 19 Vaccine Imposing Uncommon Usage Restrictions

May 20, 2025

Fda Clears Novavax Covid 19 Vaccine Imposing Uncommon Usage Restrictions

May 20, 2025 -

Spains Tourism Sector Faces Shake Up 65 000 Rental Restrictions

May 20, 2025

Spains Tourism Sector Faces Shake Up 65 000 Rental Restrictions

May 20, 2025 -

Trump Putin Dialogue Scheduled For Monday Ukraine Conflict At Center

May 20, 2025

Trump Putin Dialogue Scheduled For Monday Ukraine Conflict At Center

May 20, 2025 -

Slight Decrease In Us Treasury Yields Following Feds Rate Cut Projection

May 20, 2025

Slight Decrease In Us Treasury Yields Following Feds Rate Cut Projection

May 20, 2025