Slight Decrease In US Treasury Yields Following Fed's Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decrease in US Treasury Yields Following Fed's Rate Cut Projection

The US Treasury market experienced a subtle shift following the Federal Reserve's latest projection of potential interest rate cuts. Yields on benchmark Treasury bonds saw a modest decline, signaling a cautious optimism among investors about the future trajectory of monetary policy. This move reflects a nuanced response to the Fed's announcement, highlighting the complexities of the current economic climate.

Fed's Rate Cut Projection: A Cautious Approach

The Federal Reserve's recent statement hinted at the possibility of future interest rate reductions, aiming to mitigate the risks of a potential economic slowdown. However, the language used was carefully calibrated, emphasizing a data-dependent approach. This cautious tone underscores the Fed's ongoing assessment of inflation and economic growth, suggesting that any rate cuts would be gradual and contingent upon further economic indicators. This cautious approach, while offering some relief to the market, hasn't sparked widespread exuberance.

Impact on Treasury Yields: A Modest Dip

The projected rate cuts led to a slight decrease in Treasury yields. The yield on the benchmark 10-year Treasury note, a key indicator of long-term borrowing costs, experienced a minor dip. This reflects investors' anticipation of potentially lower future interest rates, making existing bonds relatively more attractive. However, the decline was not dramatic, indicating that market participants remain somewhat wary of the overall economic outlook.

Factors Influencing Market Sentiment:

Several factors contributed to the measured response in the Treasury market:

- Persistent Inflation: While inflation has shown signs of cooling, it remains stubbornly above the Fed's target. This persistent inflation continues to exert upward pressure on interest rates, counteracting the impact of potential rate cuts.

- Geopolitical Uncertainty: Ongoing geopolitical tensions and global economic instability also contribute to market uncertainty, making investors hesitant to make significant bets on either direction.

- Strong Labor Market: A surprisingly robust labor market adds another layer of complexity. While a strong job market is generally positive, it can also fuel inflationary pressures, making the Fed's decision-making more challenging.

What This Means for Investors:

The slight decrease in Treasury yields presents a mixed bag for investors. While lower yields can be seen as a positive sign for bondholders, the underlying uncertainty surrounding the economy requires careful consideration. Investors should carefully evaluate their risk tolerance and investment horizon before making any significant changes to their portfolio. Diversification remains a crucial strategy in this complex and dynamic market environment.

Looking Ahead:

The coming months will be crucial in determining the actual trajectory of interest rates. Close monitoring of key economic indicators, such as inflation data and employment figures, will be essential. The Fed's future actions will heavily depend on these data points, and the Treasury market will undoubtedly react accordingly. For updated information and analysis on the US Treasury market, stay tuned to reputable financial news sources. Understanding the interplay between economic indicators and monetary policy is critical for informed investment decisions. Remember to consult with a financial advisor before making any significant investment choices.

Keywords: US Treasury Yields, Federal Reserve, Interest Rate Cuts, Bond Market, 10-Year Treasury Note, Inflation, Economic Growth, Monetary Policy, Investment Strategy, Financial News, Economic Indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decrease In US Treasury Yields Following Fed's Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A J Perez Reveals Intimidation Attempts During Production Of Brett Favre Documentary

May 20, 2025

A J Perez Reveals Intimidation Attempts During Production Of Brett Favre Documentary

May 20, 2025 -

Master Of Ceremony Warbonds Helldivers 2s May 15th Drop Revealed

May 20, 2025

Master Of Ceremony Warbonds Helldivers 2s May 15th Drop Revealed

May 20, 2025 -

Tragic Loss My 600 Lb Lifes Latonya Pottain Dies At 40

May 20, 2025

Tragic Loss My 600 Lb Lifes Latonya Pottain Dies At 40

May 20, 2025 -

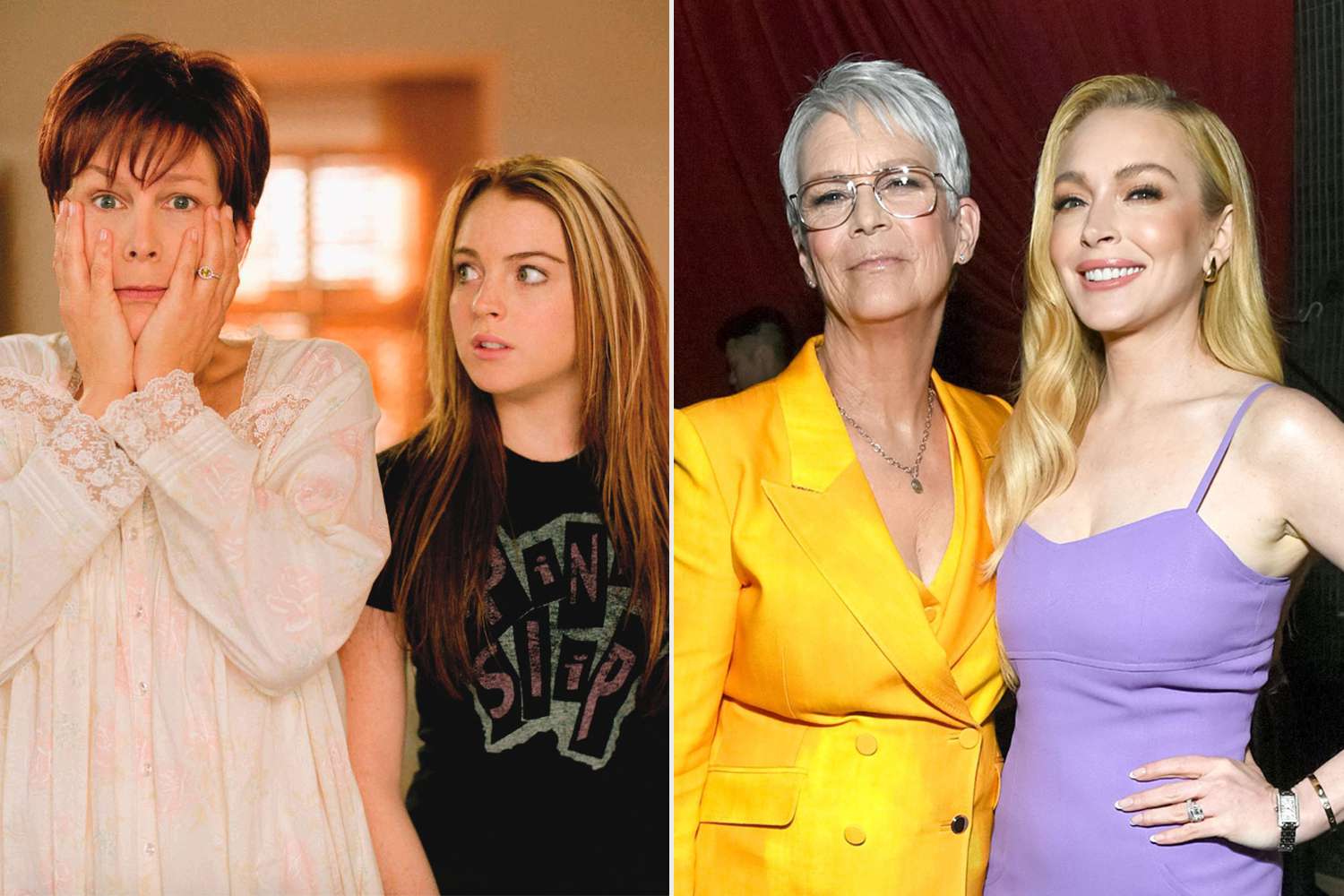

Jamie Lee Curtis And Lindsay Lohans Post Freaky Friday Friendship An Exclusive Update

May 20, 2025

Jamie Lee Curtis And Lindsay Lohans Post Freaky Friday Friendship An Exclusive Update

May 20, 2025 -

Balancing Act The Director Of Netflixs Fall Of Favre On The Films Complexities

May 20, 2025

Balancing Act The Director Of Netflixs Fall Of Favre On The Films Complexities

May 20, 2025