Clean Energy Tax Credits: Analyzing The Economic Benefits And Challenges For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Credits: Analyzing the Economic Benefits and Challenges for America

America's ambitious push towards clean energy is significantly fueled by a robust system of tax credits. These incentives, designed to accelerate the transition away from fossil fuels, offer substantial economic benefits but also present unique challenges. This article delves into the intricacies of these tax credits, examining their positive impacts and potential drawbacks for the nation's economy.

The Allure of Incentives: Boosting Clean Energy Investment

The Inflation Reduction Act (IRA), signed into law in 2022, represents a landmark achievement in clean energy policy. It significantly expanded existing tax credits and introduced new ones, creating a powerful incentive for investment in renewable energy sources like solar, wind, and geothermal. These credits are structured to incentivize both large-scale energy projects and residential installations.

Economic Benefits: A Multifaceted Approach

The economic benefits of these tax credits are far-reaching:

-

Job Creation: The clean energy sector is a significant job creator. Tax credits stimulate investment, leading to the construction of renewable energy facilities, manufacturing plants for solar panels and wind turbines, and a growing workforce in installation and maintenance. This translates into thousands of well-paying jobs across various skill levels. [Link to Bureau of Labor Statistics data on clean energy jobs]

-

Economic Growth: Investment in clean energy infrastructure leads to overall economic growth. This is evident in increased spending on materials, equipment, and services, boosting local economies and stimulating broader economic activity. [Link to relevant economic report on clean energy investment]

-

Reduced Energy Costs: Increased adoption of renewable energy sources, spurred by tax credits, can potentially lead to lower electricity costs for consumers in the long run, mitigating the impact of volatile fossil fuel prices.

-

Technological Innovation: Tax credits foster innovation by providing funding for research and development in areas like energy storage, advanced materials, and smart grids. This competitive environment pushes the boundaries of clean energy technology.

Challenges and Considerations: Navigating the Complexities

While the economic advantages are substantial, several challenges need addressing:

-

Equity Concerns: Ensuring equitable access to these benefits is crucial. Tax credits might disproportionately benefit wealthier individuals and regions unless carefully designed with equity considerations in mind. Targeted programs and outreach are necessary to reach underserved communities.

-

Implementation Complexity: The intricate nature of the tax code can make accessing these credits challenging for smaller businesses and individuals. Streamlining the application process and providing clear guidance are essential for maximizing the impact of these incentives.

-

Environmental Justice: While transitioning to clean energy offers immense environmental benefits, careful planning is needed to avoid unintended negative consequences. For example, the siting of large-scale renewable energy projects must consider potential impacts on local ecosystems and communities.

The Future of Clean Energy Tax Credits in America

The long-term success of clean energy tax credits hinges on effective implementation and continuous evaluation. Regular assessments of their impact on job creation, economic growth, and environmental justice are crucial. Further refinement of the existing system, focusing on simplification and equity, will maximize the benefits while minimizing potential drawbacks. The future of clean energy in America, and its contribution to a sustainable economy, is intrinsically linked to the success of these crucial tax incentives.

Call to Action: Stay informed about updates to clean energy policies and explore available resources to understand how you can benefit from these tax credits. [Link to relevant government website or resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Credits: Analyzing The Economic Benefits And Challenges For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

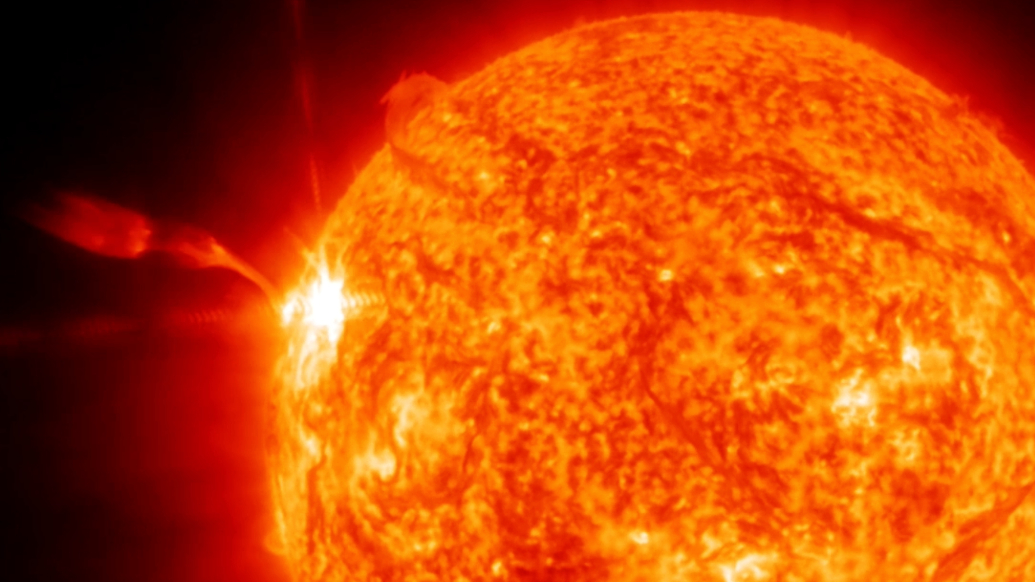

Geomagnetic Storm Major Solar Flare Impacts Radio Networks Globally Video

May 20, 2025

Geomagnetic Storm Major Solar Flare Impacts Radio Networks Globally Video

May 20, 2025 -

Post Pectra Upgrade Ethereum Attracts 200 Million In Fresh Investment

May 20, 2025

Post Pectra Upgrade Ethereum Attracts 200 Million In Fresh Investment

May 20, 2025 -

Bold Bets Drive 5 B Investment In Bitcoin Etfs The Future Of Crypto Investing

May 20, 2025

Bold Bets Drive 5 B Investment In Bitcoin Etfs The Future Of Crypto Investing

May 20, 2025 -

Philadelphia Eagles Lock Up Head Coach Nick Sirianni With New Deal

May 20, 2025

Philadelphia Eagles Lock Up Head Coach Nick Sirianni With New Deal

May 20, 2025 -

Investors Bet Big On Ethereum 200 M In New Funds After Pectra Upgrade

May 20, 2025

Investors Bet Big On Ethereum 200 M In New Funds After Pectra Upgrade

May 20, 2025