Fed Signals One Rate Cut In 2025, Sending U.S. Treasury Yields Lower

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Signals One Rate Cut in 2025, Sending U.S. Treasury Yields Lower

The Federal Reserve's latest projections sent ripples through the financial markets, signaling a potential interest rate cut as early as 2025. This unexpected shift, revealed in the updated Summary of Economic Projections (SEP), immediately impacted U.S. Treasury yields, pushing them lower. The move reflects a nuanced assessment of the economy, balancing persistent inflation concerns with growing anxieties about potential recessionary risks.

This news marks a significant departure from previous pronouncements, where the Fed maintained a hawkish stance, emphasizing the need for sustained higher rates to combat inflation. The change in tone suggests a growing confidence that inflation is gradually cooling, although the path to achieving the Fed's 2% inflation target remains uncertain.

What Drove the Fed's Decision?

The Fed's decision to project one rate cut in 2025 rests on several key factors:

- Cooling Inflation: While inflation remains above the Fed's target, recent data suggests a slowing trend. The decline in inflation, although gradual, has provided the Fed with some room for maneuver.

- Economic Slowdown: Concerns are mounting about the possibility of a recession. Recent economic indicators, such as weakening consumer spending and a softening labor market, have fueled these anxieties.

- Balancing Act: The Fed is attempting to navigate a delicate balancing act. They need to combat inflation without triggering a significant economic downturn. Projecting a future rate cut may be a preemptive measure to alleviate market concerns and support economic growth.

Impact on U.S. Treasury Yields:

The announcement immediately impacted the Treasury market. The expectation of lower interest rates in the future led to a decline in U.S. Treasury yields. Investors, anticipating less aggressive monetary policy, sold off higher-yielding bonds and flocked to longer-term bonds, pushing their prices up and yields down. This dynamic highlights the interconnectedness of Fed policy and the bond market. This also has implications for mortgage rates and other interest-sensitive loans.

What Does This Mean for Investors?

The Fed's projection of a future rate cut has significant implications for investors. It suggests a potentially less volatile environment in the coming years, although uncertainty remains. Investors should carefully consider their portfolio allocation, taking into account the potential impact of lower interest rates on various asset classes. Diversification remains key in navigating this shifting landscape.

Looking Ahead:

The Fed's projections are not set in stone. The path of monetary policy will depend heavily on incoming economic data. Further signs of cooling inflation and a stabilizing economy could reinforce the current projection. Conversely, a resurgence of inflation or a sharper economic slowdown could lead the Fed to adjust its course. Closely monitoring key economic indicators, such as inflation data, employment numbers, and consumer spending, is crucial for investors and market analysts alike. The coming months will be critical in determining the ultimate trajectory of interest rates and their effect on the broader economy. Keep an eye on the Federal Open Market Committee (FOMC) meetings for further updates and guidance.

Further Reading:

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Signals One Rate Cut In 2025, Sending U.S. Treasury Yields Lower. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

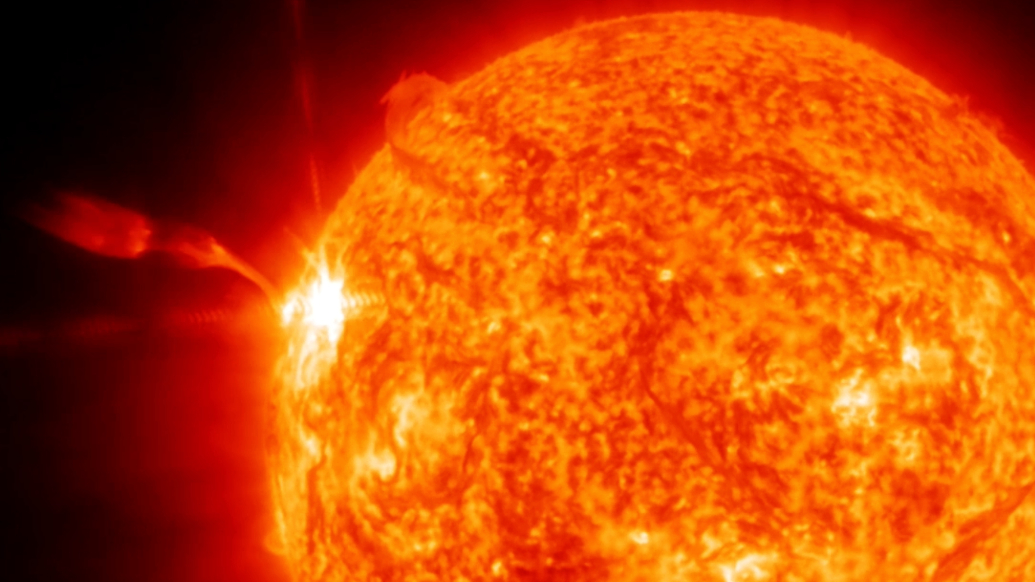

2025s Strongest Solar Flare Widespread Radio Disruptions In Europe Asia And The Middle East

May 20, 2025

2025s Strongest Solar Flare Widespread Radio Disruptions In Europe Asia And The Middle East

May 20, 2025 -

Major Crackdown 65 000 Airbnb Rentals In Spain Face Suspension

May 20, 2025

Major Crackdown 65 000 Airbnb Rentals In Spain Face Suspension

May 20, 2025 -

Jon Jones Latest Comments On Tom Aspinall A Controversial Strip The Duck Statement

May 20, 2025

Jon Jones Latest Comments On Tom Aspinall A Controversial Strip The Duck Statement

May 20, 2025 -

Brett Favres Legacy And Downfall A Conversation With The Director Of Fall Of Favre

May 20, 2025

Brett Favres Legacy And Downfall A Conversation With The Director Of Fall Of Favre

May 20, 2025 -

Exclusive Interview The Making Of Netflixs Fall Of Favre And Its Controversial Subject

May 20, 2025

Exclusive Interview The Making Of Netflixs Fall Of Favre And Its Controversial Subject

May 20, 2025