America's Energy Future: Examining The Economic Implications Of Clean Energy Taxes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

America's Energy Future: Examining the Economic Implications of Clean Energy Taxes

America stands at a crossroads, grappling with the urgent need to transition to cleaner energy sources while simultaneously navigating complex economic realities. The debate surrounding clean energy taxes – their potential benefits, drawbacks, and overall impact on the American economy – is at the forefront of this crucial discussion. This article delves into the multifaceted economic implications of these taxes, exploring both the potential for growth and the challenges that lie ahead.

The Promise of Clean Energy: A Boon for the Economy?

The transition to clean energy isn't just an environmental imperative; it's also a significant economic opportunity. Investing in renewable energy sources like solar, wind, and geothermal power creates jobs across a wide range of sectors, from manufacturing and installation to research and development. A recent report by the National Renewable Energy Laboratory (NREL) [link to NREL report] highlights the substantial job creation potential within the clean energy sector, exceeding that of traditional fossil fuel industries.

Furthermore, clean energy technologies often boast lower long-term operational costs compared to fossil fuels. This translates to potential savings for consumers and businesses alike, reducing energy bills and bolstering economic competitiveness. The development and adoption of energy-efficient technologies also contribute to this cost-saving effect, driving innovation and fostering a more sustainable economy.

The Economic Realities of Clean Energy Taxes: A Balancing Act

While the long-term economic benefits of clean energy are substantial, the implementation of clean energy taxes presents immediate challenges. One major concern is the potential for increased energy prices, particularly for consumers and businesses heavily reliant on fossil fuels. This could lead to inflationary pressures and reduced disposable income, potentially hindering economic growth in the short term.

However, well-designed clean energy tax policies can mitigate these negative impacts. For example, revenue generated from carbon taxes could be used to fund:

- Rebates and tax credits for low- and middle-income households: This helps offset the increased cost of energy for vulnerable populations, ensuring a just transition to a cleaner energy future.

- Investments in workforce retraining and education: This prepares workers displaced from the fossil fuel industry for jobs in the burgeoning clean energy sector, minimizing job losses and promoting economic mobility.

- Infrastructure development: Investing in smart grids, charging stations for electric vehicles, and other crucial infrastructure is essential for supporting the widespread adoption of clean energy technologies.

Carbon Pricing Mechanisms: A Key Consideration

Several carbon pricing mechanisms are under consideration, each with its own economic implications. A carbon tax, a direct tax on carbon emissions, provides a clear price signal for polluters and incentivizes emission reductions. A cap-and-trade system, on the other hand, sets a limit on total emissions and allows companies to buy and sell emission permits. Both mechanisms have their proponents and detractors, with ongoing debate surrounding their effectiveness and potential economic consequences.

Navigating the Path Forward: A Collaborative Approach

Successfully navigating the transition to clean energy requires a collaborative approach involving government, industry, and the public. Policymakers must carefully design clean energy tax policies that balance environmental goals with economic realities. This includes considering the distributional effects of these policies and implementing mechanisms to ensure a just and equitable transition for all. Open dialogue, transparency, and a commitment to evidence-based decision-making are crucial for building a sustainable and prosperous energy future for America.

Call to Action: Stay informed about the ongoing developments in clean energy policy and participate in the public conversation to shape America's energy future. Learn more about the economic implications of clean energy transitions by exploring resources from organizations like the Brookings Institution [link to Brookings Institution] and the Environmental Protection Agency [link to EPA].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on America's Energy Future: Examining The Economic Implications Of Clean Energy Taxes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

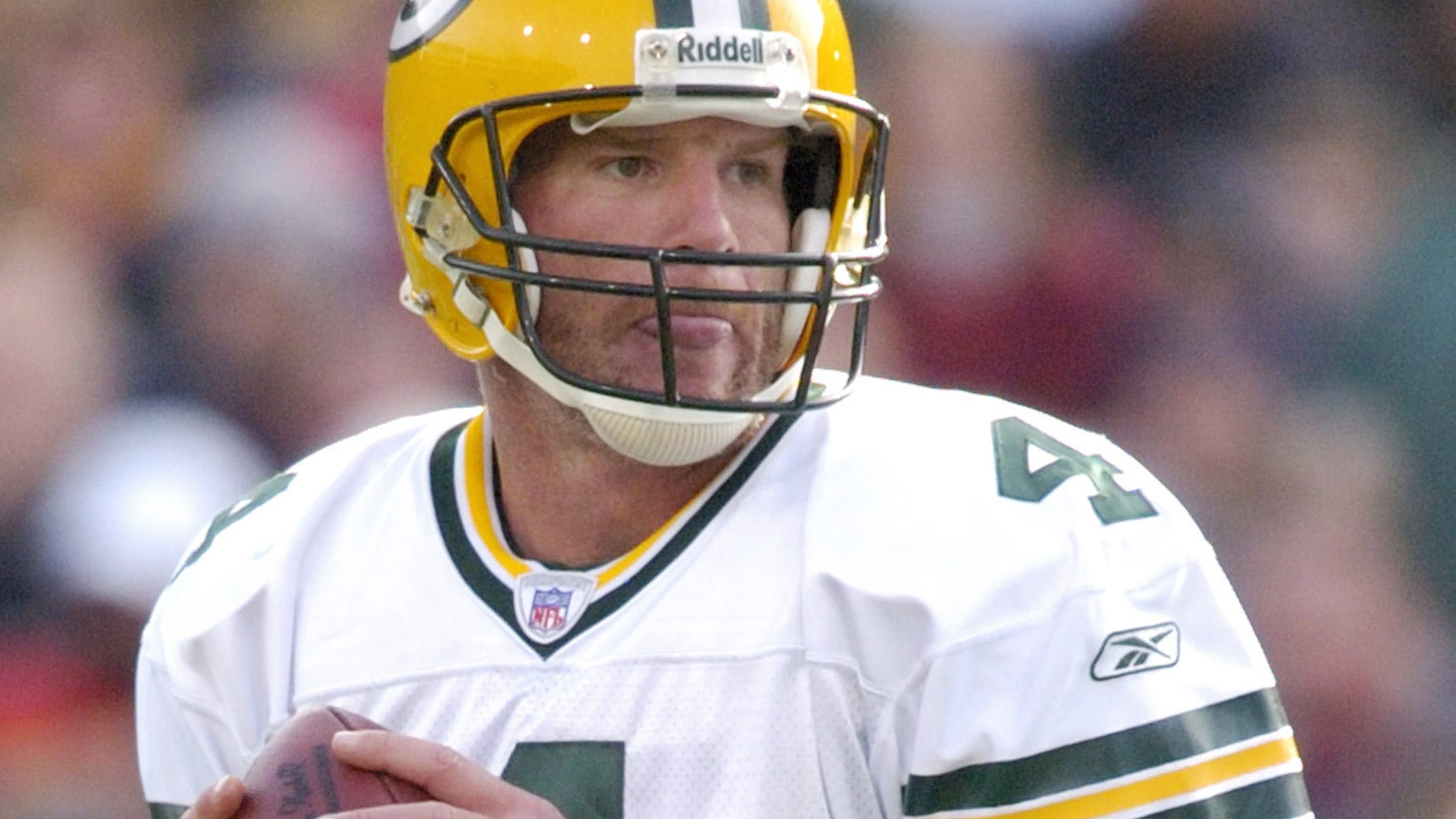

Fall Of Favre Director Discusses Brett Favres Complicated Legacy

May 20, 2025

Fall Of Favre Director Discusses Brett Favres Complicated Legacy

May 20, 2025 -

Jon Jones Retirement Speculation Intensifies After I M Done Comment

May 20, 2025

Jon Jones Retirement Speculation Intensifies After I M Done Comment

May 20, 2025 -

A Must See Wwi Movie Daniel Craig Cillian Murphy And Tom Hardy Deliver Powerful Performances

May 20, 2025

A Must See Wwi Movie Daniel Craig Cillian Murphy And Tom Hardy Deliver Powerful Performances

May 20, 2025 -

Confirmed A New Peaky Blinders Series Is Coming With A Twist

May 20, 2025

Confirmed A New Peaky Blinders Series Is Coming With A Twist

May 20, 2025 -

Trumps Surprise Announcement Russia And Ukraine To Hold Peace Talks

May 20, 2025

Trumps Surprise Announcement Russia And Ukraine To Hold Peace Talks

May 20, 2025