Trump's Tax Reform And Healthcare: 5 Ways Access May Be Reduced

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Tax Reform and Healthcare: 5 Ways Access May Be Reduced

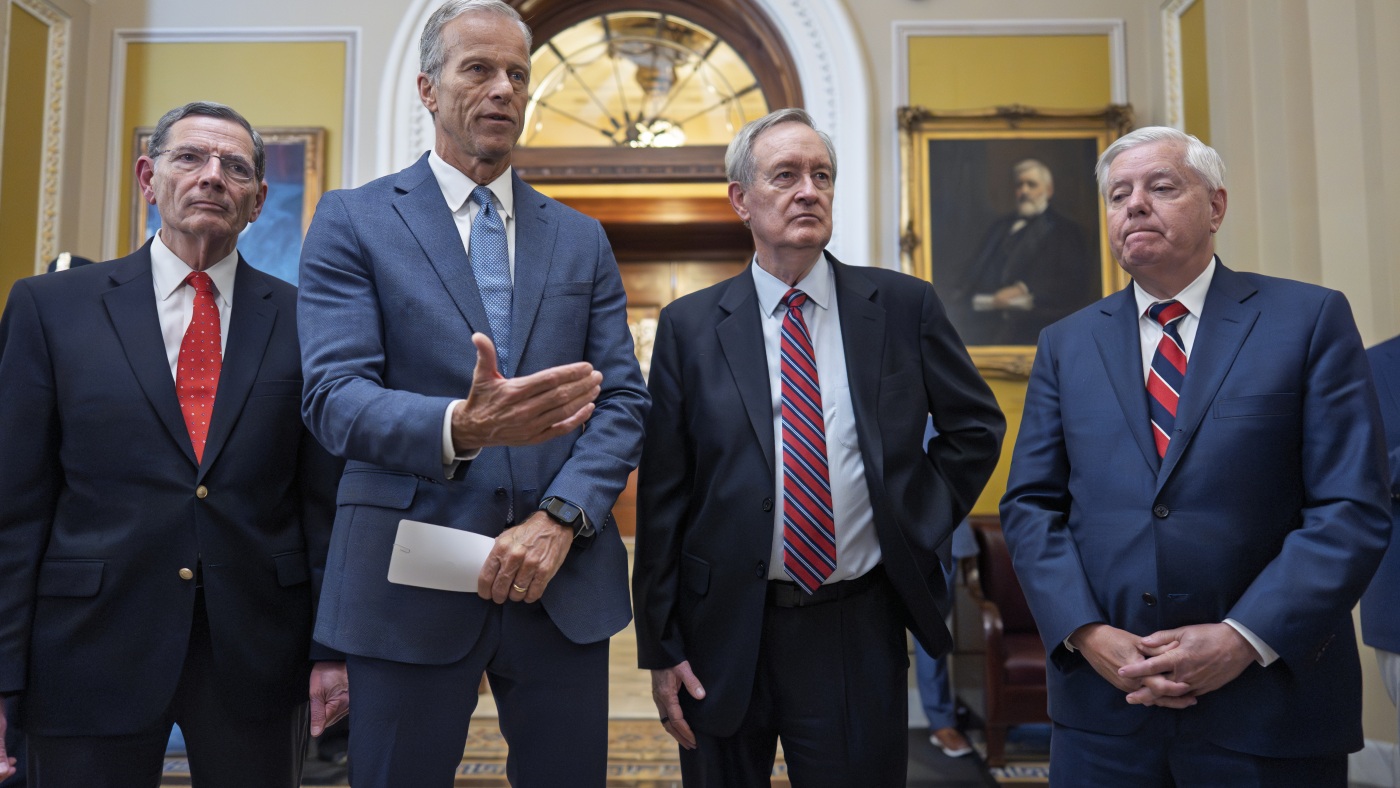

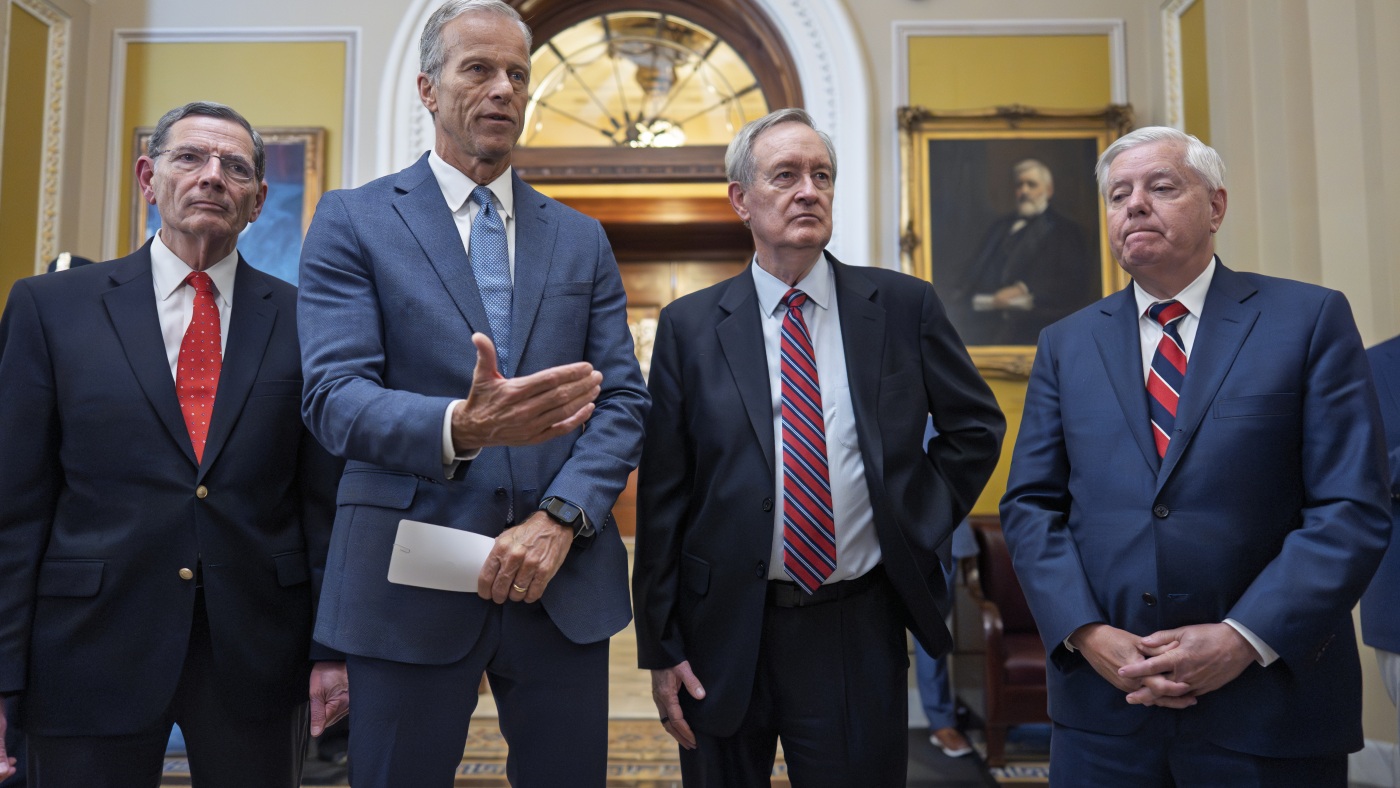

The Trump administration's policies, particularly tax reform and healthcare changes, have had a significant and multifaceted impact on healthcare access for many Americans. While proponents argued these policies would stimulate the economy and improve the healthcare system, critics pointed to potential negative consequences for access to care. This article explores five key ways in which access to healthcare may have been reduced as a result.

1. Increased Premiums and Deductibles due to Tax Changes:

The 2017 Tax Cuts and Jobs Act significantly altered the individual mandate penalty, effectively eliminating it. This penalty, a key component of the Affordable Care Act (ACA), incentivized individuals to obtain health insurance. Its removal led to a decrease in enrollment in the ACA marketplaces. Fewer enrollees mean a smaller risk pool, resulting in higher premiums and deductibles for those who remain insured. This directly impacts access, as higher costs make insurance unaffordable for many, forcing them to forgo necessary care. [Link to a reputable source on ACA enrollment changes].

2. Medicaid Expansion Rollback:

The Trump administration actively discouraged states from expanding Medicaid under the ACA. Medicaid expansion, which aimed to provide coverage to low-income adults, was a key element in increasing healthcare access. States that chose not to expand saw a significant portion of their population remain uninsured, exacerbating existing health disparities and limiting access to preventative and essential care. [Link to a report on Medicaid expansion and its impact].

3. Weakening of the ACA's Consumer Protections:

The Trump administration pursued various legal challenges and regulatory changes aimed at weakening the ACA. These actions, such as attempts to repeal the ACA outright and the loosening of regulations on health insurance plans, led to reduced consumer protections. This includes provisions that guaranteed coverage for pre-existing conditions and essential health benefits. The weakening of these protections directly impacts access by making insurance less comprehensive and potentially more expensive for individuals with pre-existing conditions. [Link to information on legal challenges to the ACA].

4. Reduced Funding for Public Health Programs:

Budgetary decisions under the Trump administration resulted in reduced funding for crucial public health programs. These cuts impacted areas such as preventative care, disease control, and community health centers, which serve as vital access points for vulnerable populations. Decreased funding leads to fewer resources, longer wait times, and reduced access to essential services for millions of Americans. [Link to data on public health funding cuts].

5. Increased Barriers to Affordable Prescription Drugs:

While not directly a result of tax reform, the administration's approach to drug pricing contributed to challenges in accessing affordable medications. Lack of meaningful action to address high drug prices has left many individuals struggling to afford the prescriptions they need, hindering their ability to manage chronic conditions and receive adequate healthcare. [Link to information on prescription drug prices in the US].

Conclusion:

The interplay of tax reform and healthcare policy changes under the Trump administration has created a complex landscape impacting access to healthcare for many Americans. While the economic effects of the tax cuts were debated, the potential consequences for healthcare access are significant and warrant further investigation and discussion. Understanding these challenges is crucial for policymakers and healthcare advocates working towards ensuring equitable and affordable healthcare for all. Further research into the long-term impact of these policies is needed to fully assess their consequences. [Link to a reputable organization focused on healthcare access].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Tax Reform And Healthcare: 5 Ways Access May Be Reduced. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Honest Truths Women Share Behaviors That Turn Them Off

Jul 03, 2025

Honest Truths Women Share Behaviors That Turn Them Off

Jul 03, 2025 -

Louisville Community Rallies Against Elimination Of Lgbtq Youth Suicide Prevention Services

Jul 03, 2025

Louisville Community Rallies Against Elimination Of Lgbtq Youth Suicide Prevention Services

Jul 03, 2025 -

Javier Tebas Descarta Inscripcion Inmediata De Nico Para El Fc Barcelona

Jul 03, 2025

Javier Tebas Descarta Inscripcion Inmediata De Nico Para El Fc Barcelona

Jul 03, 2025 -

Chris Pauls Free Agency Narrowed Down To Two Former Teams

Jul 03, 2025

Chris Pauls Free Agency Narrowed Down To Two Former Teams

Jul 03, 2025 -

Understanding The Trump Tax Bills Healthcare Consequences 5 Critical Points

Jul 03, 2025

Understanding The Trump Tax Bills Healthcare Consequences 5 Critical Points

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025