Understanding The Trump Tax Bill's Healthcare Consequences: 5 Critical Points

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

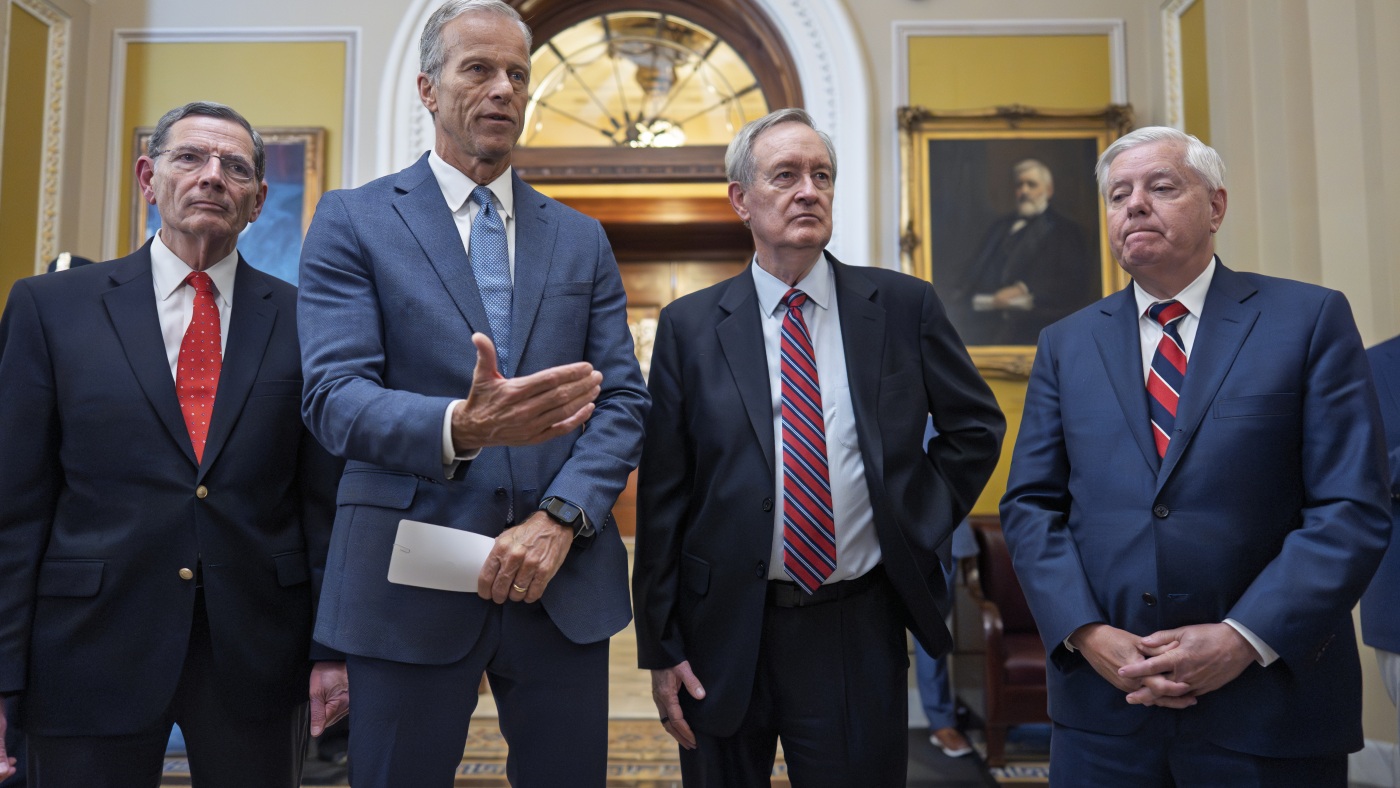

Understanding the Trump Tax Bill's Healthcare Consequences: 5 Critical Points

The 2017 Tax Cuts and Jobs Act, often referred to as the "Trump Tax Bill," significantly reshaped the American tax code. While primarily focused on tax reductions, its impact extended far beyond individual tax brackets, significantly altering the healthcare landscape. Many Americans felt the ripple effects, some positive, others profoundly negative. Understanding these consequences is crucial for navigating the complexities of the current healthcare system.

The Act's sweeping changes weren't explicitly about healthcare, but their indirect effects on healthcare costs and access are undeniable. This article delves into five critical points to help you understand the lasting consequences of this landmark legislation.

1. The Individual Mandate Penalty Elimination:

Perhaps the most significant healthcare-related change was the repeal of the individual mandate penalty. This penalty, part of the Affordable Care Act (ACA), required most Americans to obtain health insurance or pay a tax penalty. Its elimination aimed to reduce the cost of the ACA, but the outcome was a rise in the number of uninsured Americans. This directly impacted the insurance market, leading to increased premiums for those who remained insured, as a healthier risk pool was no longer guaranteed. [Link to relevant ACA information from a reputable source like the Kaiser Family Foundation].

2. Increased Premiums and Reduced Coverage:

The elimination of the individual mandate destabilized the insurance market. With fewer healthy individuals enrolling, insurance companies faced higher risks and responded by increasing premiums. This, in turn, led to reduced coverage options and higher out-of-pocket costs for many consumers. Those with pre-existing conditions, already a vulnerable population, faced particularly challenging circumstances, highlighting a critical weakness in the post-repeal system.

3. Impact on Medicaid Expansion:

While the Tax Cuts and Jobs Act didn't directly alter Medicaid expansion, its indirect effects were substantial. The bill's tax cuts, largely benefiting higher-income individuals and corporations, placed significant strain on federal and state budgets. This budgetary pressure indirectly reduced the capacity of states to expand or maintain their Medicaid programs, leading to reduced access to care for low-income individuals and families.

4. Changes to the Medical Expense Deduction:

The Tax Cuts and Jobs Act also altered the medical expense deduction. While the deduction itself remained, the threshold for deducting medical expenses was changed, raising the percentage of expenses that must be exceeded before the deduction becomes applicable. This alteration meant fewer individuals qualified for the deduction, leaving many to bear the full cost of their medical expenses.

5. Long-Term Uncertainty in Healthcare Policy:

The Trump Tax Bill’s healthcare consequences highlighted the inherent instability in the nation's healthcare policy. The sweeping changes underscore the need for comprehensive and long-term healthcare reform, a discussion that continues to dominate political discourse. The unpredictable nature of healthcare legislation leaves individuals and families struggling to plan for their future healthcare needs.

Conclusion:

The Trump Tax Bill's impact on healthcare is multifaceted and far-reaching. From rising premiums and reduced coverage to increased financial burdens for individuals and families, the consequences are significant. Understanding these five key points is critical for navigating the complexities of the current healthcare system and advocating for meaningful healthcare reforms. Staying informed about healthcare policy and engaging in discussions about healthcare access and affordability is crucial for ensuring a healthier future for all Americans. [Link to a resource offering further information on healthcare policy].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Trump Tax Bill's Healthcare Consequences: 5 Critical Points. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netflix Cancels The Sandman After Two Seasons Why

Jul 03, 2025

Netflix Cancels The Sandman After Two Seasons Why

Jul 03, 2025 -

The Titanic And Bournemouth A Surprising Relationship

Jul 03, 2025

The Titanic And Bournemouth A Surprising Relationship

Jul 03, 2025 -

The Unspoken Truths Men Reveal Their Toughest Explanations For Women

Jul 03, 2025

The Unspoken Truths Men Reveal Their Toughest Explanations For Women

Jul 03, 2025 -

New Call Of Duty Warzone And Black Ops 6 Trailer Beavis And Butt Head Arrive

Jul 03, 2025

New Call Of Duty Warzone And Black Ops 6 Trailer Beavis And Butt Head Arrive

Jul 03, 2025 -

While U S Is Distracted Hong Kong Democracy Suffers Setback

Jul 03, 2025

While U S Is Distracted Hong Kong Democracy Suffers Setback

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025