Will Trump's Tax And Spending Bill Reduce SNAP Benefits? A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Trump's Tax and Spending Bill Reduce SNAP Benefits? A Deep Dive

The passage of significant legislation often leaves citizens wondering about the practical implications on their daily lives. One such area of concern following the enactment of certain tax and spending bills under the Trump administration was the potential impact on the Supplemental Nutrition Assistance Program (SNAP), often known as food stamps. This deep dive explores the complexities of the issue, separating fact from fiction and examining the lasting effects, if any, on SNAP benefits.

Understanding the Trump Administration's Approach to Welfare Programs:

The Trump administration, characterized by a focus on fiscal conservatism and reduced government spending, often faced criticism regarding its policies affecting social safety nets. While the specific details varied across different legislative packages, a recurring theme was the pursuit of greater efficiency and, in some cases, reduced expenditure in welfare programs. This naturally led to anxieties about potential cuts to programs like SNAP.

The Impact of Tax Cuts and Their Indirect Effects:

The 2017 Tax Cuts and Jobs Act, a cornerstone of the Trump administration's economic agenda, significantly lowered corporate and individual income taxes. While proponents argued this would stimulate economic growth, critics pointed to the potential for increased national debt and a subsequent need for spending cuts elsewhere. The indirect effect on programs like SNAP was a key point of contention. A stronger economy, the argument went, could potentially reduce the number of individuals requiring SNAP benefits. However, the reality was far more nuanced.

Analyzing Specific Legislative Proposals:

Several proposed budget blueprints during the Trump years included potential reductions to SNAP funding. However, the actual implementation of these cuts often faced significant political hurdles and opposition in Congress. It's crucial to differentiate between proposed legislation and the actual laws that were enacted and their impact. Many proposed cuts never made it through the legislative process.

The Role of Congressional Opposition:

The impact on SNAP was not solely determined by the executive branch. Congress played a pivotal role in shaping the final legislation and often acted as a check on proposals deemed too drastic or detrimental to vulnerable populations. This meant that even when the administration pushed for reductions, the final outcome often reflected a compromise that mitigated the severity of potential cuts.

Evidence and Data:

Analyzing data on SNAP enrollment and benefit levels during the Trump administration is vital to understanding the actual consequences. While there may have been some fluctuations due to various economic factors, a significant, widespread reduction in SNAP benefits directly attributable to the tax and spending bills is not clearly supported by the available data.

Long-Term Consequences and Ongoing Debate:

The debate surrounding the relationship between the Trump administration's fiscal policies and SNAP benefits continues. While some argue that indirect economic effects might have had a marginal influence, a direct and substantial reduction in SNAP benefits as a direct result of these policies is not convincingly demonstrable. Further research and analysis are needed to fully understand the long-term consequences of these policies on food security and poverty levels in the US.

Conclusion:

While the Trump administration's fiscal policies aimed for a leaner government, the impact on SNAP benefits was ultimately far less drastic than initially feared by many. Proposed reductions often faced significant political opposition, and the actual changes to the program were far more nuanced and less significant than some predicted. Examining the specific legislation, the roles of both the executive and legislative branches, and the available data is crucial to understanding the complex reality of this issue. For further in-depth information, consult reports from the USDA and Congressional Budget Office.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Trump's Tax And Spending Bill Reduce SNAP Benefits? A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

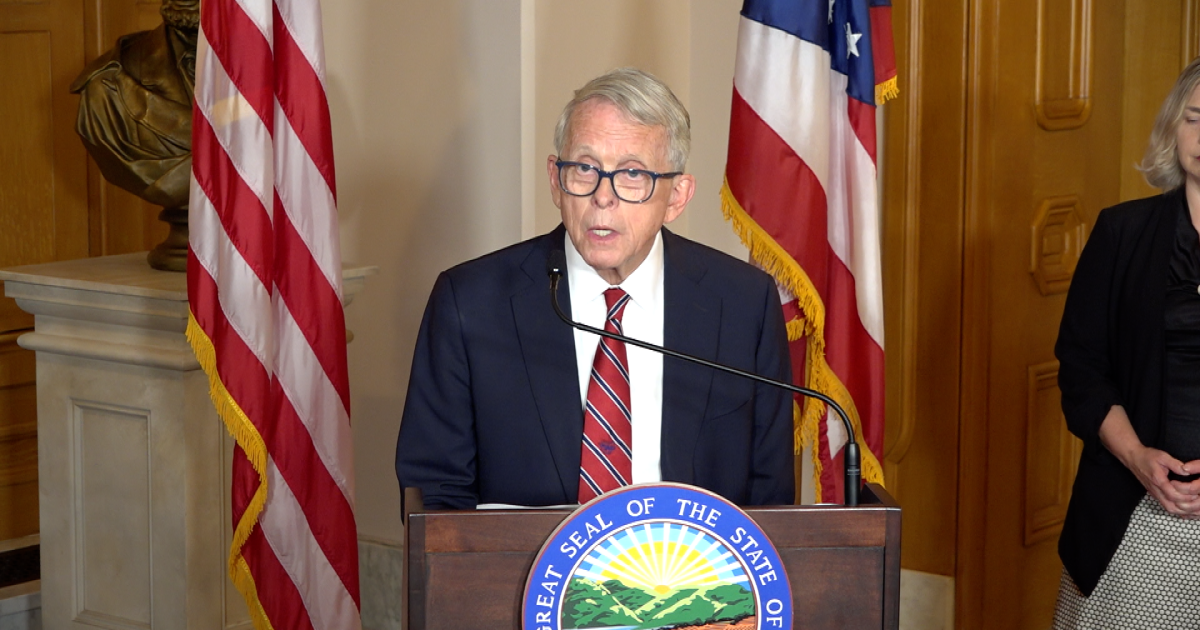

De Wine Budget Veto What Made The Cut And What Didnt

Jul 03, 2025

De Wine Budget Veto What Made The Cut And What Didnt

Jul 03, 2025 -

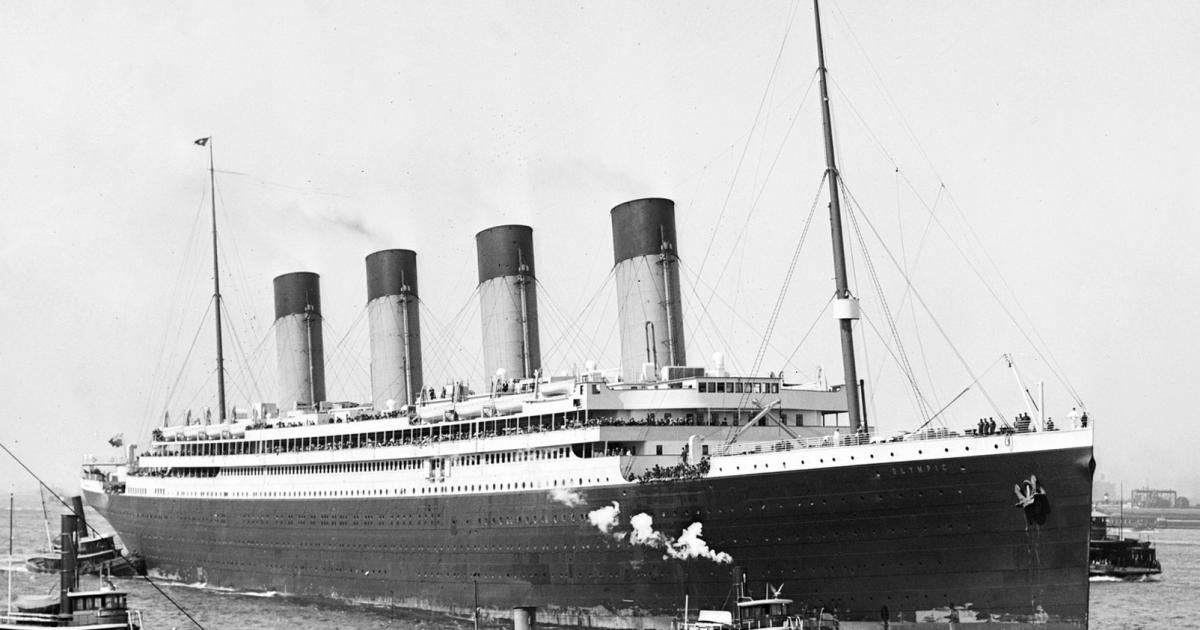

Bournemouths Untold Story The Titanics Impact

Jul 03, 2025

Bournemouths Untold Story The Titanics Impact

Jul 03, 2025 -

Call Of Duty Mobile Get Double Cod Points Event Launch Date And Prize Breakdown

Jul 03, 2025

Call Of Duty Mobile Get Double Cod Points Event Launch Date And Prize Breakdown

Jul 03, 2025 -

Relationship Dynamics Men Share Their Most Difficult Explanations To Women

Jul 03, 2025

Relationship Dynamics Men Share Their Most Difficult Explanations To Women

Jul 03, 2025 -

Will Snap Benefits Change Under Trumps Tax And Spending Legislation

Jul 03, 2025

Will Snap Benefits Change Under Trumps Tax And Spending Legislation

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025