Trump Tax Cuts And Spending Bill: Impact On SNAP Benefits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tax Cuts and Spending Bill: The Unexpected Impact on SNAP Benefits

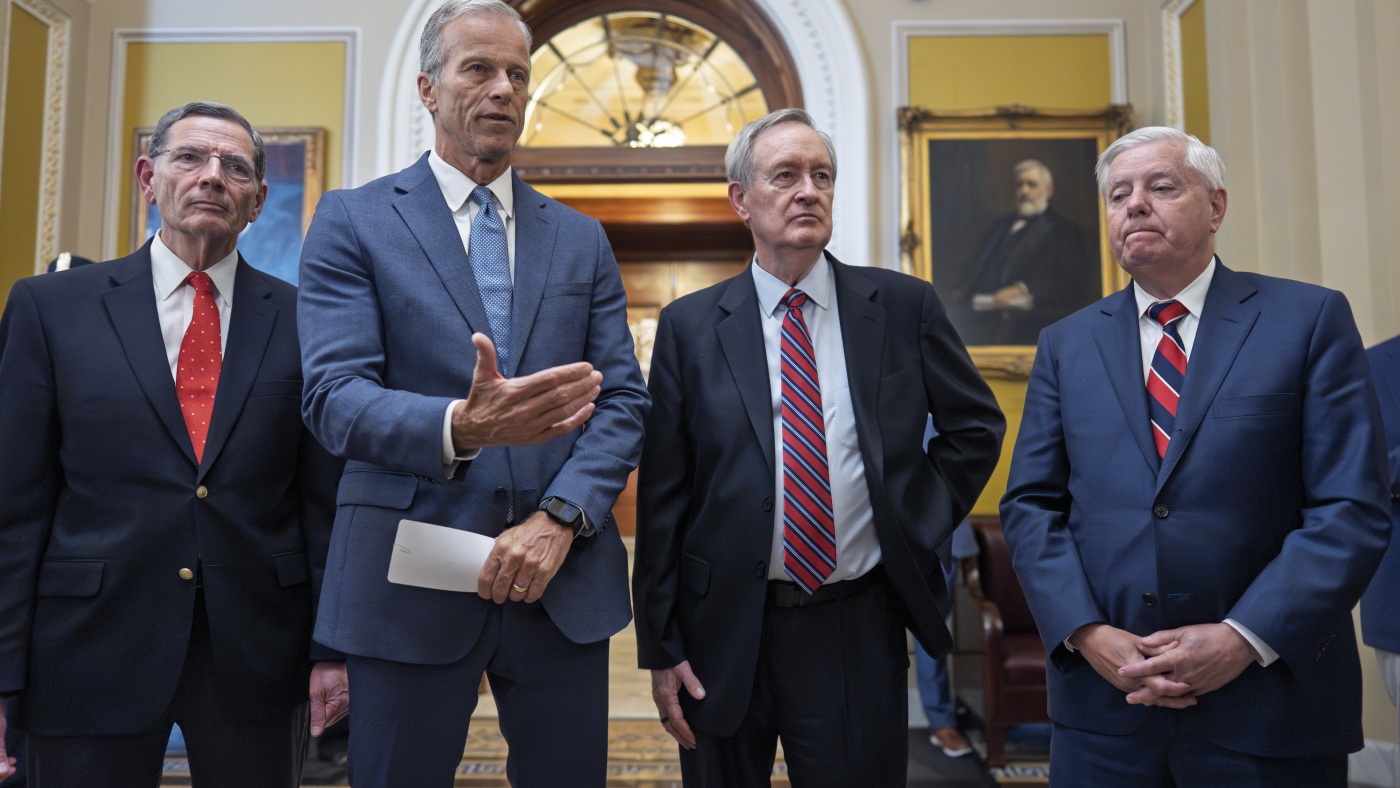

The 2017 Tax Cuts and Jobs Act, championed by then-President Donald Trump, significantly reshaped the American economic landscape. While often discussed in terms of corporate tax rates and individual income tax brackets, the bill's impact rippled outwards, affecting numerous social programs, including the Supplemental Nutrition Assistance Program (SNAP), often known as food stamps. This article delves into the complex relationship between the Trump tax cuts, the accompanying spending bill, and the resulting changes – both direct and indirect – to SNAP benefits.

Understanding the 2017 Tax Cuts and Jobs Act:

The Trump administration's tax cuts aimed to stimulate economic growth through significant reductions in corporate and individual income taxes. However, these cuts were coupled with a spending bill that, while increasing military spending, ultimately constrained funding for several domestic programs. This delicate balance, or lack thereof, played a crucial role in the future of SNAP benefits.

Direct vs. Indirect Impacts on SNAP:

The impact of the tax cuts on SNAP wasn't a direct result of benefit reductions. Instead, the changes were largely indirect, stemming from shifts in employment, income levels, and the overall economic climate.

-

Employment Changes: Proponents of the tax cuts argued they would stimulate job growth. While some sectors experienced growth, the overall effect on employment related to SNAP eligibility was complex and varied across states. Increased employment could theoretically reduce SNAP recipients, but the reality was more nuanced. Many newly created jobs offered low wages, leaving individuals still struggling to make ends meet.

-

Income Inequality: Critics argued the tax cuts disproportionately benefited the wealthy, exacerbating income inequality. This widening gap could have inadvertently increased the number of individuals relying on SNAP, as lower-income families faced greater financial strain.

-

State-Level Budgetary Constraints: The increased federal spending in other areas, coupled with the tax cuts, potentially strained state budgets. States often play a role in administering SNAP benefits, and reduced state funding could lead to challenges in program implementation and support services.

Long-Term Effects and Ongoing Debate:

The long-term consequences of the Trump tax cuts and their impact on SNAP remain a subject of ongoing debate among economists and policymakers. Studies have yielded mixed results, with some showing minimal impact on SNAP enrollment and others highlighting a subtle increase in recipients. The complexity of the issue, combined with the numerous interacting economic factors, makes definitive conclusions challenging.

Looking Ahead: The Future of SNAP and Fiscal Policy:

Understanding the interplay between tax policies, spending bills, and social safety nets like SNAP is crucial for informed policymaking. Future fiscal decisions must consider the potential indirect consequences of tax cuts and spending priorities on vulnerable populations who rely on these programs. The experience with the 2017 legislation serves as a reminder of the interconnectedness of these seemingly disparate policy areas.

Further Research and Resources:

For a deeper dive into the economic effects of the 2017 Tax Cuts and Jobs Act, explore resources from reputable organizations such as the Congressional Budget Office (CBO), the Brookings Institution, and the Tax Policy Center. These institutions provide in-depth analyses and data on the bill's impact across various sectors of the economy.

This article provides a comprehensive overview of a complex issue. Remember to consult multiple sources for a complete understanding and to form your own informed opinion.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tax Cuts And Spending Bill: Impact On SNAP Benefits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

5 Potential Healthcare Access Restrictions Under The Trump Tax Plan

Jul 03, 2025

5 Potential Healthcare Access Restrictions Under The Trump Tax Plan

Jul 03, 2025 -

Ohio Governor De Wines 67 Budget Vetoes A Detailed Breakdown

Jul 03, 2025

Ohio Governor De Wines 67 Budget Vetoes A Detailed Breakdown

Jul 03, 2025 -

New Hershey Biopic A First Look At Finn Wittrocks Performance

Jul 03, 2025

New Hershey Biopic A First Look At Finn Wittrocks Performance

Jul 03, 2025 -

The Man Who Conquered The Titanic And Wimbledon An Extraordinary Life

Jul 03, 2025

The Man Who Conquered The Titanic And Wimbledon An Extraordinary Life

Jul 03, 2025 -

Local Erie Arena Targeted In Latest Swatting Hoax

Jul 03, 2025

Local Erie Arena Targeted In Latest Swatting Hoax

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025