5 Potential Healthcare Access Restrictions Under The Trump Tax Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

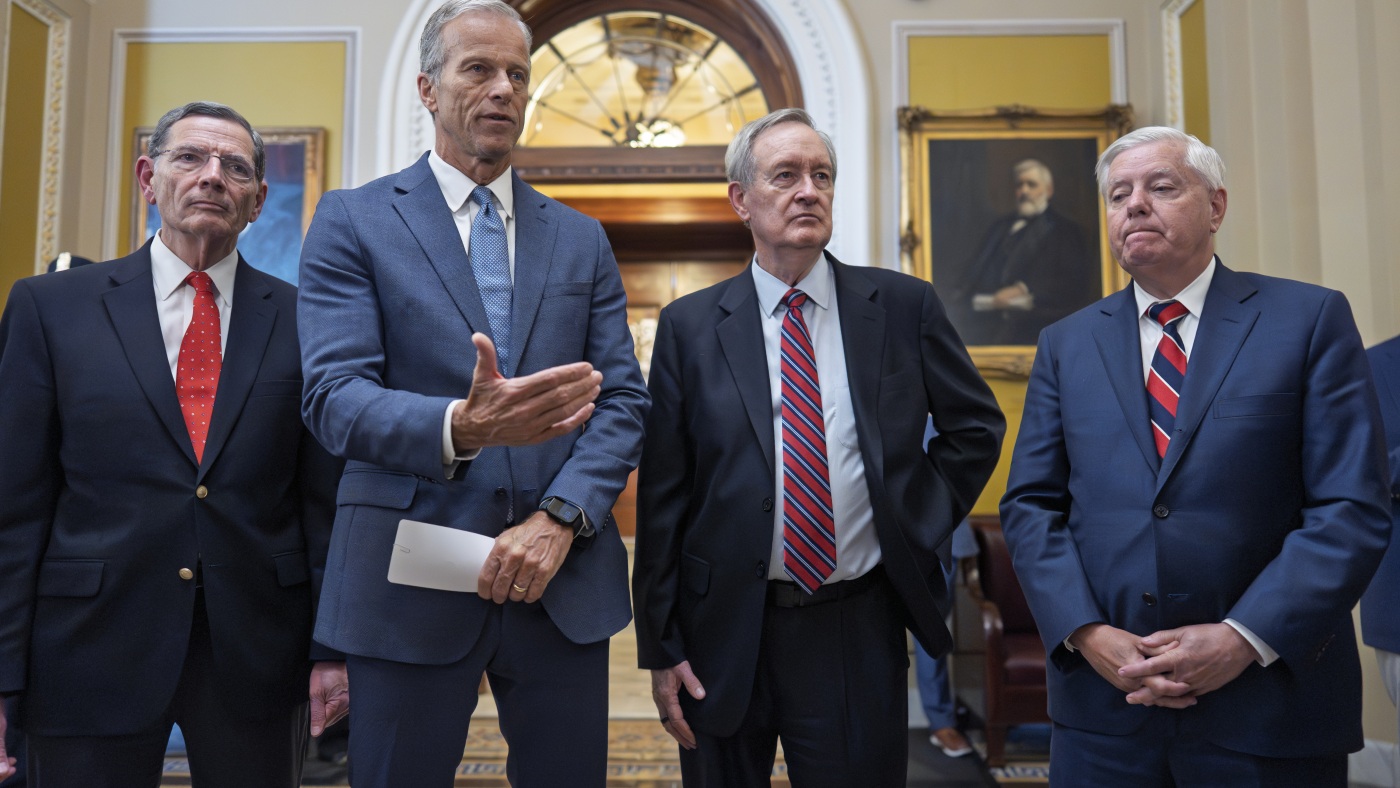

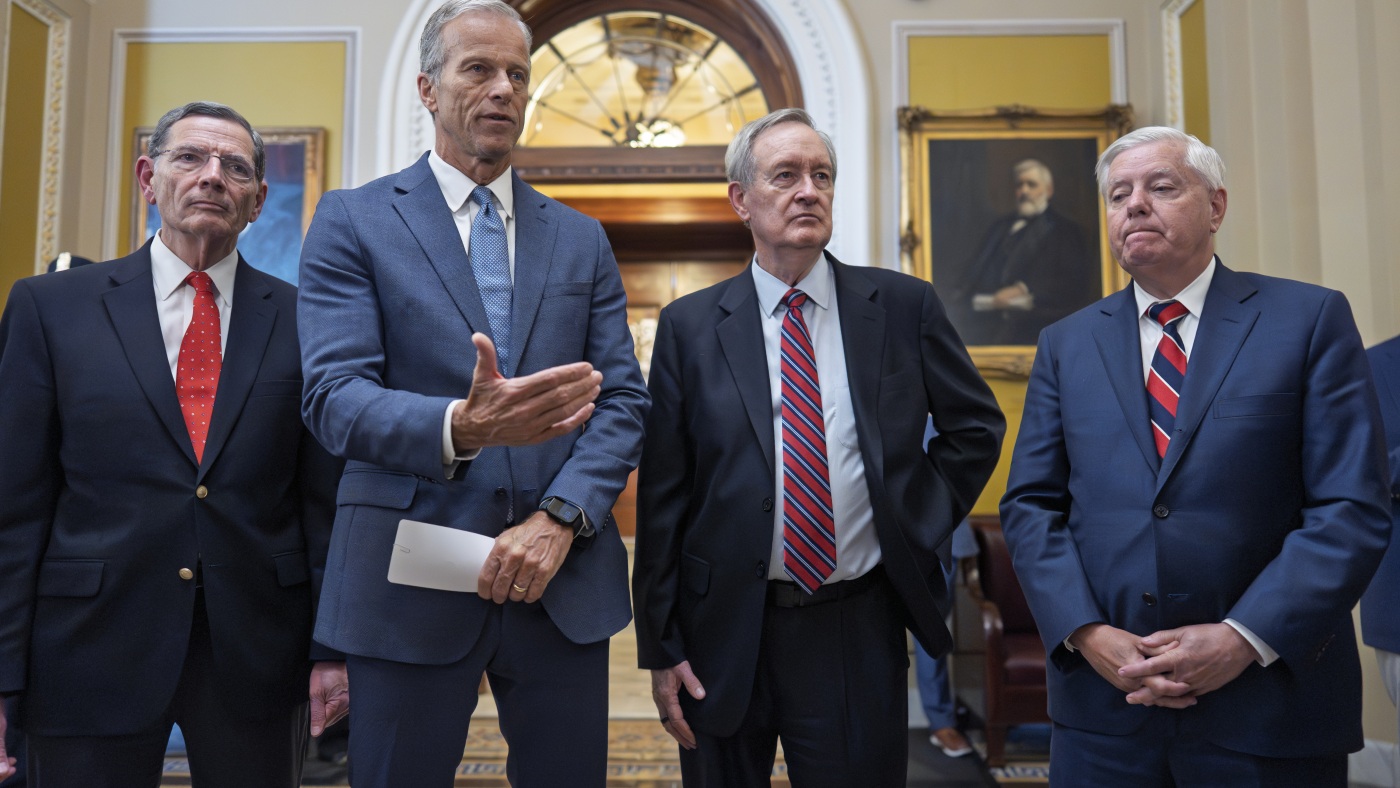

5 Potential Healthcare Access Restrictions Under the Trump Tax Plan: A Deeper Dive

The 2017 Tax Cuts and Jobs Act, spearheaded by the Trump administration, significantly reshaped the American healthcare landscape. While primarily focused on tax reductions, the act indirectly impacted healthcare access, potentially creating significant hurdles for millions of Americans. This article delves into five key areas where the tax plan's ramifications could restrict healthcare access.

Understanding the Indirect Impact: It's crucial to understand that the Trump tax plan didn't directly eliminate healthcare programs. Instead, its impact was largely indirect, stemming from significant cuts to federal funding and changes to tax provisions affecting healthcare coverage.

1. Increased Premiums and Reduced Coverage Under the Affordable Care Act (ACA): The tax plan repealed the individual mandate penalty, a key component of the ACA designed to encourage enrollment. This resulted in a smaller risk pool for insurers, leading to increased premiums and reduced coverage options in some markets. Many individuals found themselves facing higher out-of-pocket costs or having less comprehensive coverage. [Link to a reputable source discussing ACA enrollment changes post-2017]

2. Medicaid Expansion Rollback: While the ACA expanded Medicaid eligibility, the Trump administration actively discouraged states from participating. The tax plan, by not providing additional funding for Medicaid expansion, further hampered states' ability to provide coverage to low-income individuals. This resulted in a significant number of uninsured individuals in states that opted not to expand Medicaid. [Link to a report on Medicaid expansion rates]

3. Cuts to Public Health Funding: The tax plan's focus on tax cuts for corporations and the wealthy meant less funding for crucial public health initiatives. These cuts impacted essential programs addressing preventative care, disease control, and public health infrastructure. Reduced funding for these programs translates directly to reduced access to vital healthcare services for vulnerable populations. [Link to a study on the impact of public health funding cuts]

4. Reduced Funding for Community Health Centers (CHCs): Community Health Centers play a critical role in providing healthcare to underserved communities. While not directly targeted by the tax plan, the overall reduction in federal funding indirectly affected CHCs, leading to potential service limitations and longer wait times. These centers often serve as a primary healthcare source for low-income individuals and families. [Link to the National Association of Community Health Centers website]

5. Increased Medical Debt: The combination of higher premiums, reduced coverage, and cuts to public health programs led to an increase in medical debt for many Americans. This financial burden further restricts access to healthcare as individuals struggle to afford necessary treatment and medications. The inability to pay medical bills can result in delayed or forgone care, ultimately leading to worse health outcomes. [Link to data on medical debt in the US]

Looking Ahead: The long-term consequences of the 2017 Tax Cuts and Jobs Act on healthcare access are still unfolding. Understanding the indirect impacts of this legislation is crucial for policymakers, healthcare providers, and individuals seeking to navigate the complexities of the American healthcare system. Advocacy groups continue to work towards expanding healthcare access for all Americans, highlighting the ongoing need for affordable and comprehensive healthcare coverage.

Call to Action: Stay informed about healthcare policy changes and advocate for policies that expand access to quality, affordable healthcare for everyone. Learn more about the resources available in your community to help manage healthcare costs and access necessary services. [Link to a relevant healthcare advocacy organization]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 5 Potential Healthcare Access Restrictions Under The Trump Tax Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Hollywood To Reality Jaws And The Decline Of Shark Populations

Jul 03, 2025

From Hollywood To Reality Jaws And The Decline Of Shark Populations

Jul 03, 2025 -

Sentimental Value Trailer Released Heartfelt Story Promises Powerful Performances

Jul 03, 2025

Sentimental Value Trailer Released Heartfelt Story Promises Powerful Performances

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Wiener Challenges Pelosi 2028 Congressional Race Heats Up

Jul 03, 2025

Wiener Challenges Pelosi 2028 Congressional Race Heats Up

Jul 03, 2025 -

Local Erie Arena Targeted In Latest Swatting Hoax

Jul 03, 2025

Local Erie Arena Targeted In Latest Swatting Hoax

Jul 03, 2025

Latest Posts

-

New Research Explores The Potential Of Cough Medicine In Dementia Prevention

Jul 03, 2025

New Research Explores The Potential Of Cough Medicine In Dementia Prevention

Jul 03, 2025 -

Analysis How Trumps Tax Cuts Could Eliminate Health Coverage For Millions

Jul 03, 2025

Analysis How Trumps Tax Cuts Could Eliminate Health Coverage For Millions

Jul 03, 2025 -

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025