Analysis: How Trump's Tax Cuts Could Eliminate Health Coverage For Millions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: How Trump's Tax Cuts Could Eliminate Health Coverage for Millions

The 2017 tax cuts, championed by then-President Trump, may have inadvertently set the stage for a significant reduction in health insurance coverage across the United States. While touted as a boon for the economy, a closer examination reveals potential devastating consequences for millions of Americans reliant on affordable healthcare access. This analysis delves into the complex interplay between tax policy and healthcare affordability, highlighting the potential for widespread coverage loss.

The Connection Between Taxes and Healthcare: A Complex Web

The 2017 Tax Cuts and Jobs Act significantly altered the US tax code, resulting in lower tax rates for many individuals and corporations. However, a crucial element often overlooked is the impact on the Affordable Care Act (ACA), also known as Obamacare. The ACA relies on individual and employer mandates, alongside tax credits and subsidies, to ensure affordable healthcare access for millions. By lowering taxes, the Trump administration effectively reduced the revenue available to fund these crucial ACA provisions.

This reduction in funding had a ripple effect. Lower tax revenue meant less money for:

- Cost-sharing reductions (CSRs): These subsidies help individuals with lower incomes afford their health insurance deductibles and co-pays. Reduced funding for CSRs directly increased out-of-pocket costs for many ACA enrollees.

- Medicaid expansion: The ACA encouraged states to expand Medicaid eligibility, providing healthcare coverage to low-income adults. The tax cuts indirectly hampered this expansion by limiting federal funding available to participating states.

- Marketing and outreach programs: Funding cuts impacted the ability of organizations to effectively educate individuals about ACA enrollment and benefits, leading to lower enrollment numbers.

The Ripple Effect: Rising Premiums and Decreasing Enrollment

The combined effect of these funding cuts translated into higher premiums and deductibles for many Americans. This price increase, coupled with decreased outreach and confusion surrounding the changing landscape of healthcare coverage, resulted in a significant drop in the number of individuals enrolled in ACA marketplace plans. This decline was particularly pronounced among low and moderate-income families who heavily relied on the subsidies offered by the ACA.

The Human Cost: Millions Left Without Coverage

Studies conducted by various organizations, including the Kaiser Family Foundation (KFF) [link to KFF article], estimate that millions of Americans lost their health insurance coverage either directly or indirectly as a result of the 2017 tax cuts and their impact on the ACA. These individuals now face the daunting prospect of navigating the complexities of the healthcare system without the financial protection offered by health insurance, potentially leading to delayed or forgone medical care, resulting in worsened health outcomes and increased financial strain.

Looking Ahead: Policy Implications and Potential Solutions

The consequences of the Trump tax cuts highlight the intricate relationship between tax policy and healthcare affordability. Future policy discussions must address this connection directly, ensuring that tax reforms do not undermine the accessibility of healthcare for vulnerable populations. This requires a comprehensive approach, including:

- Increased funding for ACA subsidies and programs: Reinvesting in the ACA is crucial to ensuring affordable healthcare for millions.

- Expanding Medicaid coverage: Expanding access to Medicaid across all states would significantly improve healthcare access for low-income individuals.

- Addressing rising healthcare costs: Strategies to control the overall cost of healthcare are essential to making coverage more affordable.

The unintended consequences of the 2017 tax cuts serve as a stark reminder of the importance of careful consideration and thorough analysis when making policy decisions with far-reaching implications for public health and well-being. The human cost of these policy choices demands a renewed commitment to ensuring affordable and accessible healthcare for all Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: How Trump's Tax Cuts Could Eliminate Health Coverage For Millions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Call Of Duty Mobile Get Double Cod Points Event Launch Date And Prize Breakdown

Jul 03, 2025

Call Of Duty Mobile Get Double Cod Points Event Launch Date And Prize Breakdown

Jul 03, 2025 -

Your Guide To Love Island Usa Season 7 Episode Air Dates And Times

Jul 03, 2025

Your Guide To Love Island Usa Season 7 Episode Air Dates And Times

Jul 03, 2025 -

Continued Support For Lgbtqia Individuals In Maryland Despite Hotline Issues

Jul 03, 2025

Continued Support For Lgbtqia Individuals In Maryland Despite Hotline Issues

Jul 03, 2025 -

Trump Tax Bill 5 Ways It Could Restrict Healthcare Access

Jul 03, 2025

Trump Tax Bill 5 Ways It Could Restrict Healthcare Access

Jul 03, 2025 -

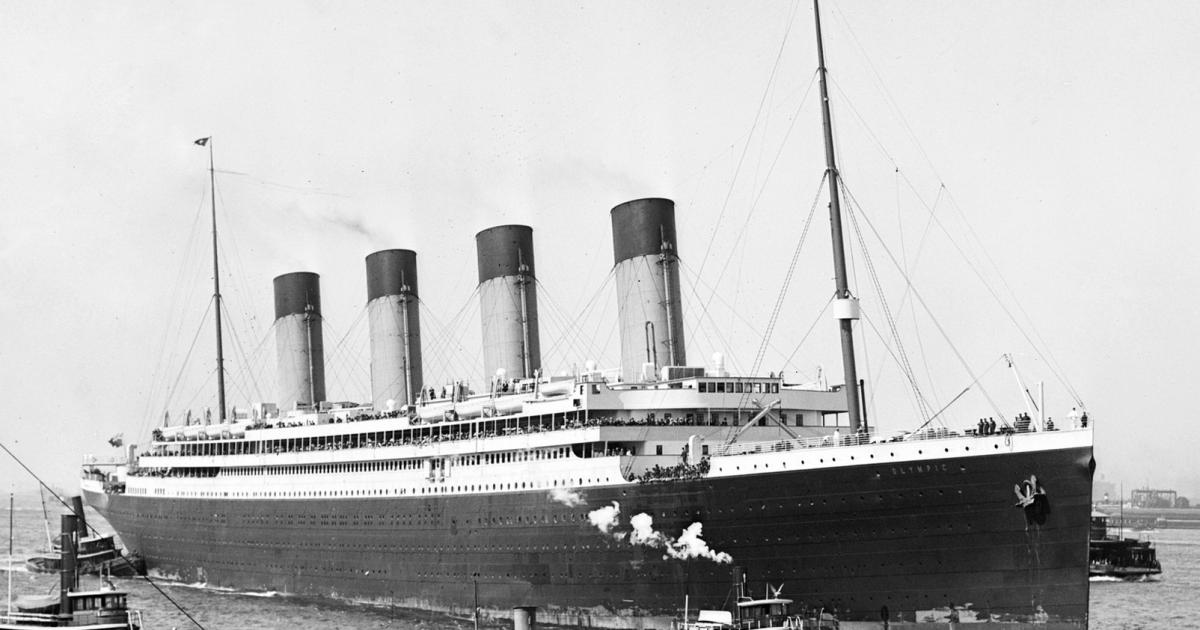

Uncovering Bournemouths Links To The Titanic Tragedy

Jul 03, 2025

Uncovering Bournemouths Links To The Titanic Tragedy

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6s Hilarious Beavis And Butt Head Collaboration Trailer

Call Of Duty Warzone And Black Ops 6s Hilarious Beavis And Butt Head Collaboration Trailer