Slight Dip In U.S. Treasury Yields After Fed's Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Dip in U.S. Treasury Yields After Fed's Rate Cut Outlook: What it Means for Investors

The U.S. Treasury market experienced a slight dip in yields following the Federal Reserve's recent indication of a potential rate cut. This shift, while modest, has sent ripples through the financial world, prompting investors to reassess their strategies. Understanding the nuances of this movement is crucial for navigating the current economic landscape.

The Fed's Signal and Market Reaction:

The Federal Open Market Committee (FOMC) hinted at a possible pivot from its aggressive interest rate hiking cycle, fueling speculation about a rate cut in the near future. This outlook, while not explicitly confirmed, was enough to trigger a downward movement in Treasury yields. Yields on 2-year and 10-year Treasury notes, key indicators of investor sentiment, both saw a modest decline. This reaction underscores the market's sensitivity to even subtle shifts in the Fed's monetary policy stance. The provides further context.

Understanding the Relationship Between Fed Policy and Treasury Yields:

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When the Fed cuts interest rates, it becomes less expensive for investors to borrow money. This, in turn, reduces the demand for relatively safer assets like Treasury bonds, causing their prices to rise and their yields to fall. Conversely, rising interest rates increase the demand for higher-yielding bonds, pushing prices down and yields up.

What This Means for Investors:

This recent dip in Treasury yields presents both opportunities and challenges for investors.

- For Bond Investors: Lower yields mean lower returns on newly purchased bonds. However, existing bondholders may see an increase in the value of their holdings. This dynamic highlights the importance of diversification and a well-defined investment strategy.

- For Stock Investors: A potential rate cut is often viewed positively by the stock market, as it can stimulate economic growth and boost corporate earnings. However, the impact can be complex and depends on various macroeconomic factors.

- For Businesses: Lower borrowing costs can facilitate investment and expansion. This could lead to increased job creation and economic activity, but it also carries the risk of fueling inflation if not managed carefully.

Looking Ahead: Uncertainty Remains:

While the slight dip in Treasury yields reflects a shift in market sentiment, uncertainty still persists. The Fed's future actions will depend heavily on evolving economic data, including inflation rates and employment figures. Factors like geopolitical instability and global economic growth also play a significant role.

Analyzing the broader economic picture is crucial. Experts are divided on the likelihood and timing of a rate cut, with some predicting further rate hikes before any reduction. Closely monitoring economic indicators and Fed communications is essential for investors to make informed decisions.

Call to Action: Stay informed about economic developments and consult with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals. Understanding the intricacies of the bond market and its relationship with monetary policy is paramount in today's dynamic financial environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Dip In U.S. Treasury Yields After Fed's Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufc Fans React Jon Jones Future In Jeopardy Amidst Aspinall Negotiations

May 21, 2025

Ufc Fans React Jon Jones Future In Jeopardy Amidst Aspinall Negotiations

May 21, 2025 -

Severe Weather Emergency Tornadoes Cause Widespread Damage In U S

May 21, 2025

Severe Weather Emergency Tornadoes Cause Widespread Damage In U S

May 21, 2025 -

Immediate Truce Talks Between Russia And Ukraine Trumps Call For Peace

May 21, 2025

Immediate Truce Talks Between Russia And Ukraine Trumps Call For Peace

May 21, 2025 -

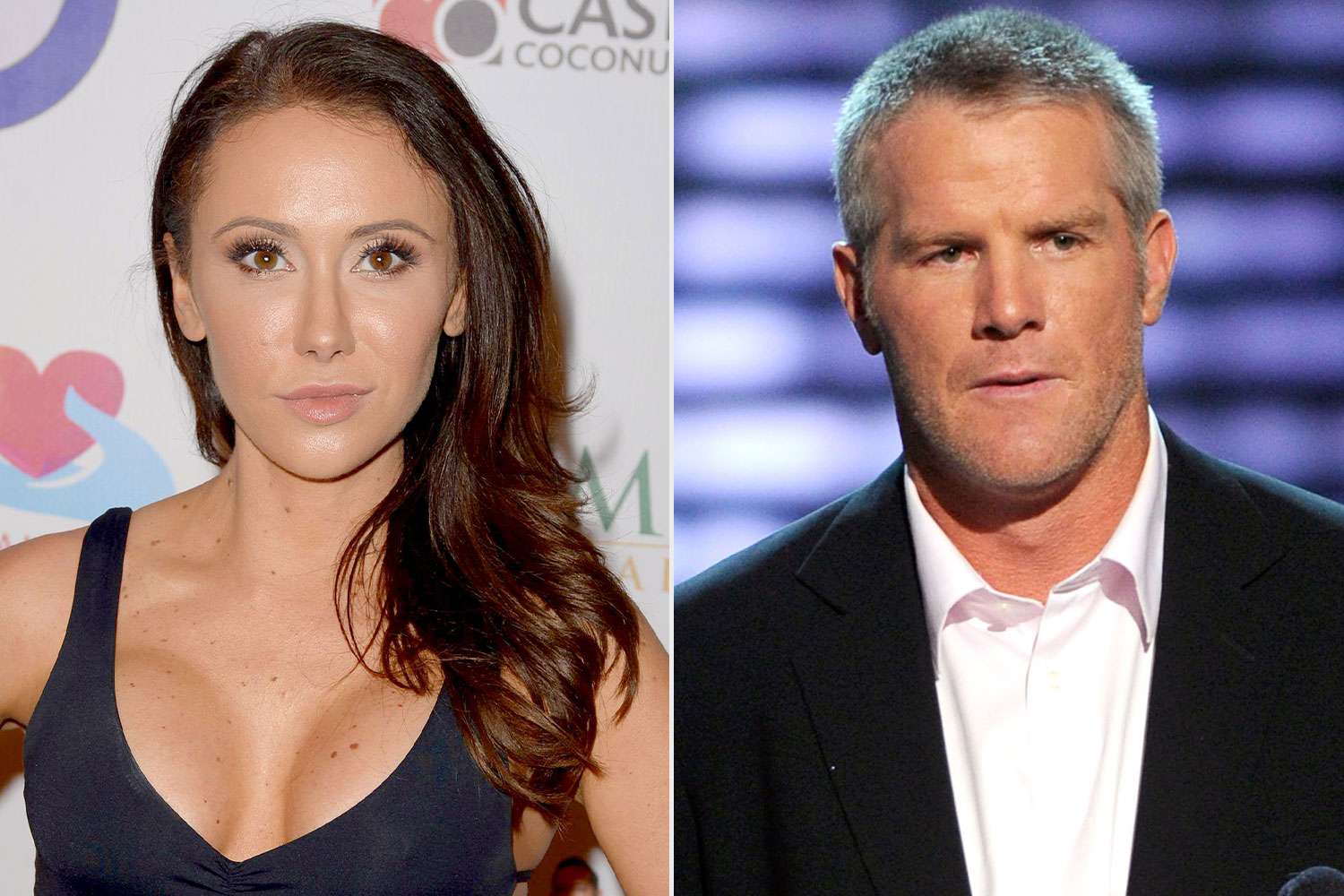

Jenn Sterger Details Emotional Impact Of Brett Favre Sext Scandal

May 21, 2025

Jenn Sterger Details Emotional Impact Of Brett Favre Sext Scandal

May 21, 2025 -

Rain And Decreasing Temperatures This Weeks Forecast

May 21, 2025

Rain And Decreasing Temperatures This Weeks Forecast

May 21, 2025