One And Done? Fed's 2025 Rate Cut Prediction And Its Effect On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One and Done? Fed's 2025 Rate Cut Prediction and its Effect on U.S. Treasury Yields

The Federal Reserve's recent hints at a potential rate cut in 2025 have sent ripples through the financial markets, sparking debate among economists and investors alike. This seemingly small shift in the Fed's forward guidance has significant implications for U.S. Treasury yields, a key indicator of the overall health of the American economy. Understanding this dynamic is crucial for anyone navigating the current investment landscape.

The Fed's Pivot: A Shift in Expectations

For much of 2023, the Federal Reserve maintained a hawkish stance, aggressively raising interest rates to combat persistent inflation. However, recent economic data showing a cooling inflation rate and a slowing economy has led to a more nuanced outlook. The subtle shift towards a potential rate cut in 2025, rather than continued hikes, suggests a belief that inflation will be tamed without the need for further drastic monetary tightening. This change in expectation is a key driver behind the current market movements.

Impact on U.S. Treasury Yields: A Closer Look

U.S. Treasury yields, which represent the return on investment for government bonds, are inversely related to bond prices. When investors expect interest rates to fall, the demand for existing higher-yielding bonds increases, driving up their prices and subsequently lowering their yields. The Fed's 2025 rate cut prediction has, therefore, led to a decrease in Treasury yields across the maturity spectrum.

Understanding the Mechanics:

- Lower Future Rates, Lower Current Yields: The anticipation of lower interest rates in the future diminishes the attractiveness of holding long-term bonds with higher yields. Investors might prefer to lock in current yields and reinvest later at potentially lower rates. This increased demand for existing bonds pushes yields down.

- Flight to Safety: In times of economic uncertainty, investors often flock to the perceived safety of U.S. Treasury bonds. The Fed's prediction, while suggesting a less aggressive approach, still introduces an element of uncertainty, potentially boosting demand for these safe-haven assets and further depressing yields.

- Market Speculation: The market's interpretation of the Fed's statements is crucial. Any ambiguity or conflicting signals can lead to increased volatility and unpredictable movements in Treasury yields.

What Does This Mean for Investors?

The implications of the Fed's prediction are multifaceted and depend heavily on individual investment strategies and risk tolerance.

- Bond Investors: Lower yields translate to lower returns for bond investors. However, this could also present opportunities for those willing to lock in current yields before further decreases.

- Stock Investors: Lower yields can potentially boost the stock market as lower borrowing costs can encourage corporate investment and economic growth. However, the overall economic outlook remains a crucial factor.

- Mortgage Rates: While not a direct consequence, lower Treasury yields often influence mortgage rates, potentially making borrowing more affordable for homeowners.

H2: The Uncertain Future: Risks and Considerations

While the Fed's prediction suggests a more optimistic outlook, several factors could alter this trajectory:

- Inflationary Pressures: A resurgence of inflation could force the Fed to revise its plans and maintain or even raise interest rates further.

- Geopolitical Events: Unforeseen global events can significantly impact economic conditions and influence the Fed's decisions.

- Economic Slowdown: A deeper-than-expected economic slowdown could also affect the Fed's policy decisions.

Conclusion: Navigating the Shifting Sands

The Fed's 2025 rate cut prediction introduces a significant element of uncertainty into the market. While lower Treasury yields present certain opportunities, investors should carefully consider the inherent risks and tailor their strategies accordingly. Staying informed about economic indicators and closely monitoring the Fed's communications will be essential for navigating the evolving financial landscape. Consult with a financial advisor to develop a personalized investment plan that aligns with your individual goals and risk tolerance. Remember that this is a complex issue, and seeking expert advice is highly recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One And Done? Fed's 2025 Rate Cut Prediction And Its Effect On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ellen De Generes Family Suffers Loss Star Shares Poignant Message

May 21, 2025

Ellen De Generes Family Suffers Loss Star Shares Poignant Message

May 21, 2025 -

Riots 2025 League Of Legends Hall Of Fame Choice Sparks Price Debate

May 21, 2025

Riots 2025 League Of Legends Hall Of Fame Choice Sparks Price Debate

May 21, 2025 -

New York Attorney General Under Federal Investigation Fbi Director Confirms

May 21, 2025

New York Attorney General Under Federal Investigation Fbi Director Confirms

May 21, 2025 -

Two Boys Arrested For Church Vandalism And Defecation

May 21, 2025

Two Boys Arrested For Church Vandalism And Defecation

May 21, 2025 -

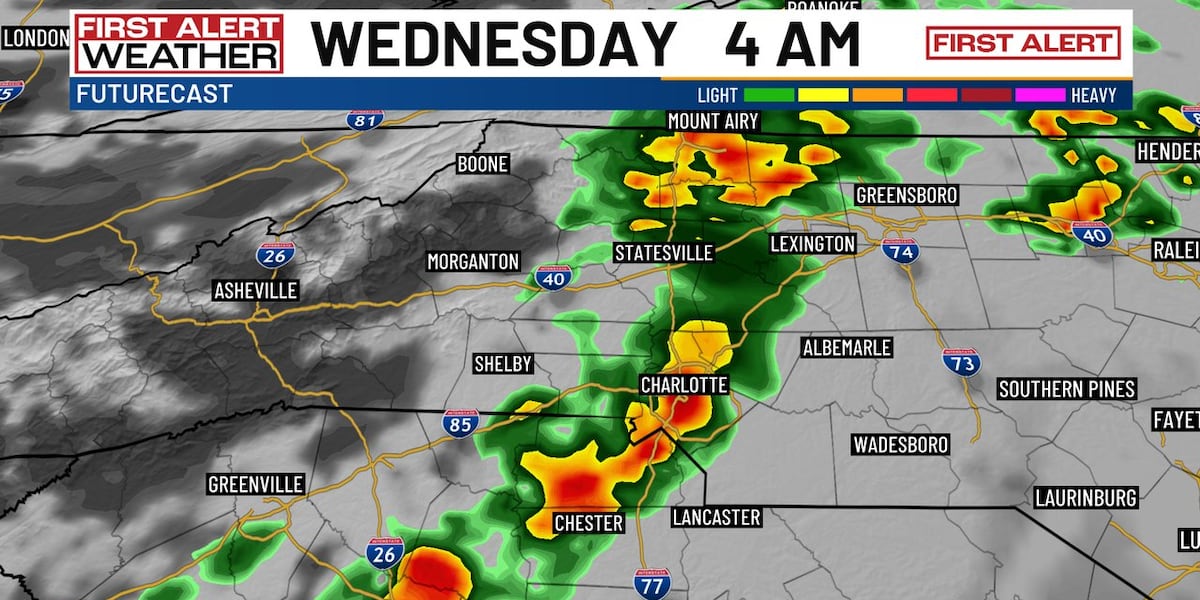

Charlotte Residents Brace For Overnight Storms Temperature Drop Expected

May 21, 2025

Charlotte Residents Brace For Overnight Storms Temperature Drop Expected

May 21, 2025