S&P 500, Dow, Nasdaq Rise: Market Resilience In The Face Of Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, Nasdaq Rise: Market Resilience in the Face of Moody's Downgrade

Wall Street defies expectations, showcasing surprising strength despite negative outlook.

The US stock market defied predictions on Tuesday, staging a remarkable rally even after Moody's Investors Service downgraded the country's credit rating. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed higher, showcasing a surprising resilience in the face of what many analysts considered a significant negative event. This unexpected market performance raises important questions about investor sentiment and the overall health of the US economy.

The Dow Jones Industrial Average surged over 300 points, marking a robust 0.9% increase. The S&P 500 followed suit, climbing approximately 1%, while the tech-heavy Nasdaq Composite also gained significant ground, finishing up over 1%. This broad-based rally suggests a level of confidence amongst investors that may not be fully reflected in the Moody's downgrade.

Moody's Downgrade: A Catalyst for Unexpected Market Growth?

Moody's cited the US government's increasing debt burden and the erosion of governance strength as reasons for the downgrade from Aaa to Aa1 – its highest rating to second highest. While this move was anticipated by some, the market’s positive response was far from expected. Some analysts believe the market may have already priced in much of the negative sentiment surrounding the debt ceiling debate earlier this year. The subsequent resolution, albeit at the eleventh hour, may have instilled a sense of relief amongst investors.

Factors Contributing to the Market's Resilience:

Several factors may have contributed to the market's surprising strength:

- Market anticipation: As mentioned, much of the negative news surrounding the debt ceiling and potential downgrade may have already been factored into stock prices.

- Strong corporate earnings: Recent positive corporate earnings reports have helped bolster investor confidence, offsetting some of the concerns related to the downgrade.

- Resilient consumer spending: Despite inflation, consumer spending remains relatively robust, suggesting a degree of economic strength.

- Federal Reserve's stance: While interest rates remain high, the Federal Reserve's recent pause on rate hikes might be interpreted as a sign of confidence in the economy's ability to withstand current challenges.

Looking Ahead: Uncertainty Remains

While Tuesday's rally was impressive, it's crucial to approach the future with caution. The Moody's downgrade does raise serious concerns about the long-term economic outlook for the United States. The impact of higher borrowing costs for the government and the potential for further downgrades from other rating agencies remain significant uncertainties.

What this means for investors:

The market's unexpected strength demonstrates the complex interplay of factors that influence investor sentiment. While this rally offers a temporary reprieve, investors should remain vigilant and continue monitoring key economic indicators. Diversification remains a crucial strategy for managing risk in a volatile market. Consulting with a financial advisor is always recommended before making significant investment decisions.

Keywords: S&P 500, Dow Jones, Nasdaq, Moody's, credit rating downgrade, stock market, market rally, US economy, investor sentiment, economic outlook, financial markets, investment strategy.

Further Reading:

- [Link to a relevant article on Moody's rationale for the downgrade]

- [Link to an article discussing the Federal Reserve's monetary policy]

- [Link to a reputable source discussing current economic indicators]

This unexpected market resilience underscores the often unpredictable nature of financial markets. While the long-term effects of the Moody's downgrade remain to be seen, Tuesday's performance offers a compelling case study in the market's ability to surprise.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, Nasdaq Rise: Market Resilience In The Face Of Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get Ready For Helldivers 2s Masters Of Ceremony Warbond Drop May 15th

May 20, 2025

Get Ready For Helldivers 2s Masters Of Ceremony Warbond Drop May 15th

May 20, 2025 -

Lsg Vs Srh Live Score Ipl 2025 Verbal Sparring Mars Intense Match

May 20, 2025

Lsg Vs Srh Live Score Ipl 2025 Verbal Sparring Mars Intense Match

May 20, 2025 -

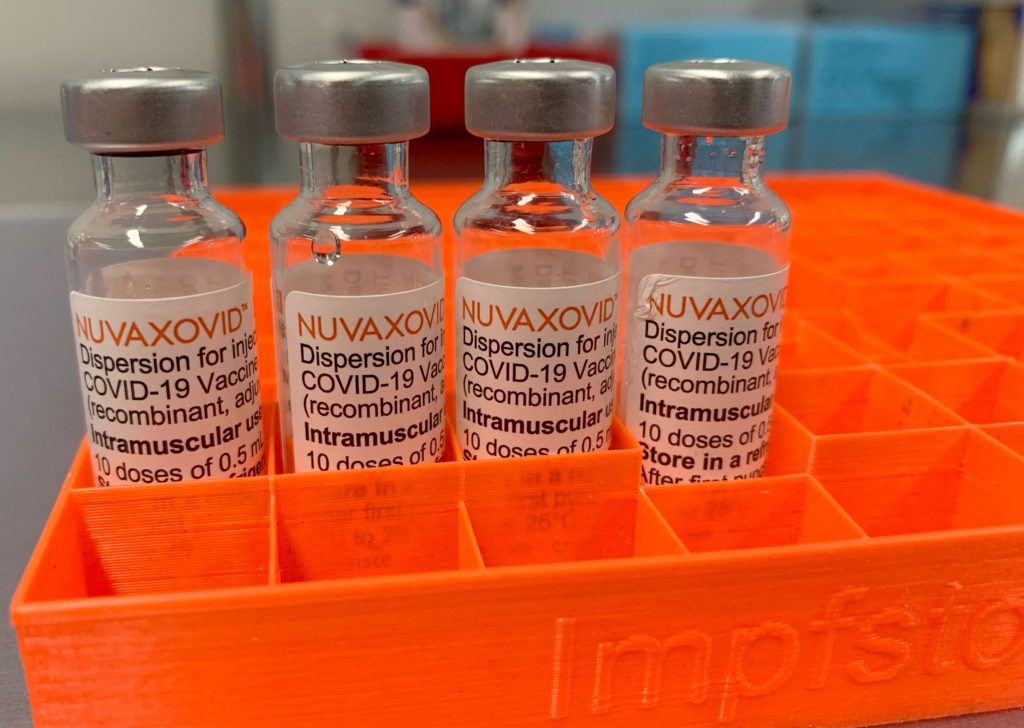

Novavax Covid 19 Vaccine Gets Fda Nod Significant Usage Restrictions Apply

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod Significant Usage Restrictions Apply

May 20, 2025 -

I M Done Jon Jones Hints At Ufc Retirement Amidst Aspinall Negotiation Breakdown

May 20, 2025

I M Done Jon Jones Hints At Ufc Retirement Amidst Aspinall Negotiation Breakdown

May 20, 2025 -

Record Bitcoin Etf Investments A Deep Dive Into The 5 B Influx

May 20, 2025

Record Bitcoin Etf Investments A Deep Dive Into The 5 B Influx

May 20, 2025