Record Bitcoin ETF Investments: A Deep Dive Into The $5B+ Influx

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: A Deep Dive into the $5 Billion+ Influx

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have witnessed a staggering influx of investment, surpassing the $5 billion mark in a remarkably short period. This unprecedented surge signifies a major shift in investor sentiment and opens up exciting – and potentially risky – avenues for the future of cryptocurrency investment. But what's driving this monumental shift, and what does it mean for the broader cryptocurrency market? Let's delve into the details.

The $5 Billion Question: What's Fueling the ETF Boom?

Several key factors contribute to this record-breaking investment in Bitcoin ETFs:

-

Increased Regulatory Clarity: The approval of Bitcoin ETFs in major markets like the US marks a significant turning point. Previously, the regulatory landscape was murky, deterring institutional investors. Now, with clearer guidelines and approved vehicles for investment, institutional money is flowing in. This legitimization is a crucial element in attracting mainstream investors.

-

Institutional Adoption: The entry of large institutional investors, such as pension funds and hedge funds, is a game-changer. These players bring substantial capital and further enhance the credibility of Bitcoin as an asset class. Their involvement signals a belief in Bitcoin's long-term potential and stability.

-

Inflation Hedge: With persistent inflation concerns globally, investors are seeking alternative assets to protect their portfolios. Bitcoin, often touted as a "digital gold," is viewed by many as a hedge against inflation and traditional market volatility. This perception is driving significant investment into ETFs offering exposure to Bitcoin.

-

Accessibility: Bitcoin ETFs offer a simple and regulated way for investors to gain exposure to Bitcoin without navigating the complexities of directly holding the cryptocurrency. This accessibility is a major draw for both individual and institutional investors who may lack the technical expertise or desire for direct cryptocurrency ownership.

Analyzing the Impact:

This massive investment influx has several potential consequences:

-

Price Volatility: While the increased investment brings stability in some ways, it can also lead to increased price volatility in the short term. Large inflows and outflows can significantly impact the Bitcoin price.

-

Market Maturity: The surge in ETF investment suggests a maturing cryptocurrency market. It signals a growing acceptance of Bitcoin as a legitimate asset class within the traditional financial system.

-

Increased Competition: The success of Bitcoin ETFs is likely to attract more competition, leading to a wider range of ETF products with varying strategies and fees. This increased competition benefits investors by offering more choices.

Looking Ahead: The Future of Bitcoin ETFs

The future of Bitcoin ETFs appears bright, but challenges remain. Regulatory changes, macroeconomic conditions, and technological advancements will all influence their trajectory. However, the current momentum suggests a sustained period of significant growth and adoption. This makes it crucial for investors to understand the risks and rewards associated with Bitcoin ETF investments and to conduct thorough research before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in Bitcoin ETFs carries significant risk, and you could lose some or all of your investment. Always consult with a qualified financial advisor before making any investment decisions. Learn more about (external link).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: A Deep Dive Into The $5B+ Influx. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

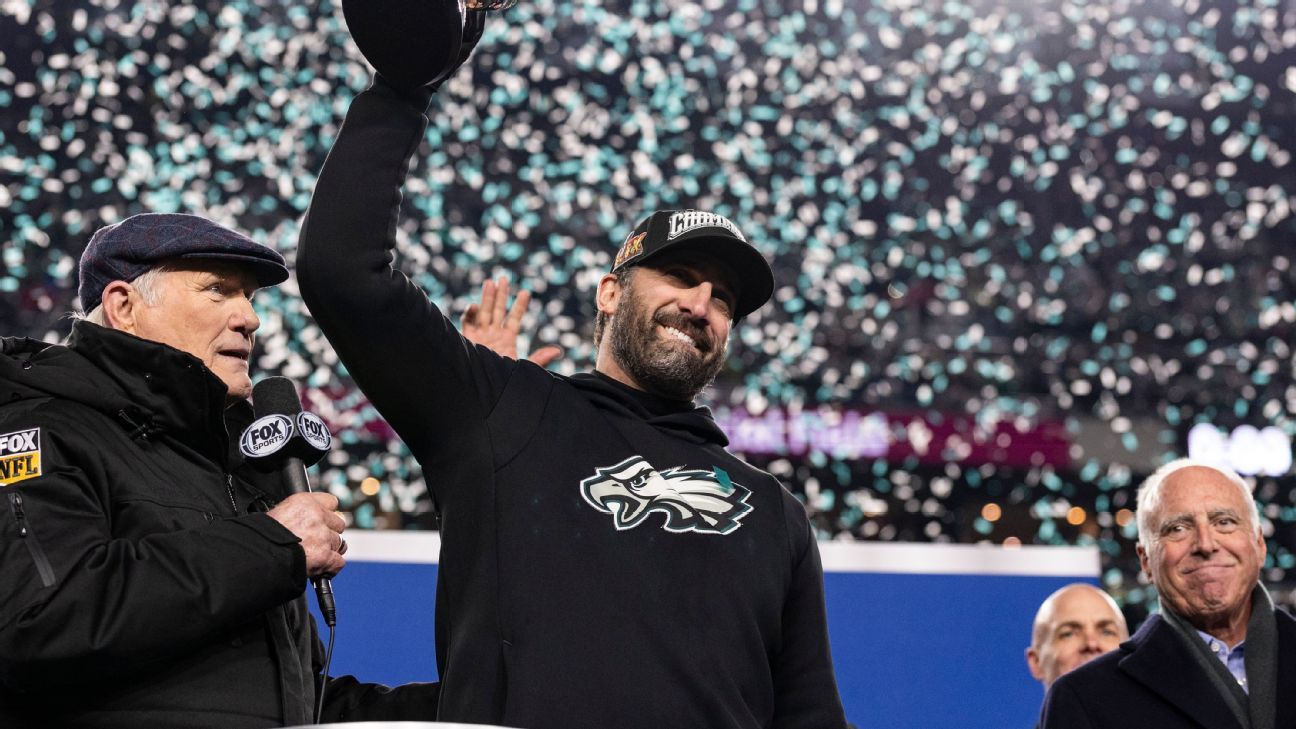

Eagles Lock Up Sirianni With Long Term Contract Deal

May 20, 2025

Eagles Lock Up Sirianni With Long Term Contract Deal

May 20, 2025 -

Supreme Court Ruling Jeopardizes Tps For Some Venezuelans Deportations Imminent

May 20, 2025

Supreme Court Ruling Jeopardizes Tps For Some Venezuelans Deportations Imminent

May 20, 2025 -

Limited Aid Reaches Gaza Strip Allies Weigh Sanctions Against Israel

May 20, 2025

Limited Aid Reaches Gaza Strip Allies Weigh Sanctions Against Israel

May 20, 2025 -

Us Treasury Market Reacts Fed Forecasts Only One Rate Cut By 2025

May 20, 2025

Us Treasury Market Reacts Fed Forecasts Only One Rate Cut By 2025

May 20, 2025 -

Helldivers 2 Warbond Event Masters Of Ceremony Rewards On May 15th

May 20, 2025

Helldivers 2 Warbond Event Masters Of Ceremony Rewards On May 15th

May 20, 2025