S&P 500, Dow, And Nasdaq Climb Despite Moody's Credit Rating Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, and Nasdaq Climb Despite Moody's Credit Rating Downgrade: A Surprising Market Rally

The US stock market defied expectations on Tuesday, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posting gains despite Moody's Investors Service downgrading the credit rating of several US banks and issuing a negative outlook on the nation's banking system. This unexpected rally raises questions about the resilience of the market and the impact of credit rating agencies on investor sentiment.

The Dow gained [Insert Percentage]% to close at [Insert Closing Value], while the S&P 500 climbed [Insert Percentage]% to finish at [Insert Closing Value]. The tech-heavy Nasdaq Composite also saw a positive day, rising [Insert Percentage]% to close at [Insert Closing Value]. These gains came after Moody's downgraded the ratings of 10 regional banks and placed six banking giants, including Bank of America and US Bancorp, on review for potential downgrades. The agency cited concerns about the deteriorating credit quality of US banks, rising interest rates, and potential economic slowdowns.

This seemingly contradictory market behavior begs the question: why did stocks rise despite the negative news? Several factors likely contributed to this surprising rally:

H2: Resilience in the Face of Adversity

-

Market anticipation: The market may have already priced in some of the negative sentiment surrounding the banking sector. Moody's downgrade, while significant, may not have been a complete surprise to investors who were already aware of the challenges facing the banking industry.

-

Strong corporate earnings: Recent strong corporate earnings reports have boosted investor confidence, potentially offsetting the impact of the credit rating downgrade. Companies showing healthy growth and profitability can insulate the market from negative external factors to a degree. [Link to a relevant article on recent corporate earnings].

-

Federal Reserve's actions: The Federal Reserve's recent pause in interest rate hikes could have also played a role. This move signaled a potential easing of monetary policy, which could be interpreted positively by investors. [Link to a relevant article on the Federal Reserve's actions].

-

Short-term trading: The market reaction might reflect short-term trading strategies rather than a fundamental shift in investor sentiment. Day traders and short-term investors may have seized opportunities presented by the initial market dip following the Moody's announcement.

H2: The Long-Term Outlook Remains Uncertain

While the market celebrated a short-term victory, the long-term implications of Moody's downgrade remain uncertain. The negative outlook on the banking sector raises concerns about potential future economic instability. Investors should remain cautious and carefully consider the risks involved before making any investment decisions.

H2: What to Watch For

In the coming days and weeks, investors should monitor:

- Further actions from credit rating agencies: Will other agencies follow Moody's lead, or will this be an isolated incident?

- The response of the Federal Reserve: Will the central bank take further action to support the banking sector?

- Economic data: Key economic indicators will be closely scrutinized to assess the overall health of the US economy.

The unexpected rally following Moody's downgrade highlights the complexities of the stock market and the unpredictable nature of investor sentiment. While the immediate reaction was positive, the long-term impact of the downgrade remains to be seen. Investors should remain vigilant and keep abreast of developing economic news to make informed investment decisions.

Call to Action: Stay informed about market developments by subscribing to our newsletter for daily updates. [Link to Newsletter Signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, And Nasdaq Climb Despite Moody's Credit Rating Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Moodys Downgrade Ignored Stock Market Climbs S And P 500 Extends Winning Streak

May 21, 2025

Moodys Downgrade Ignored Stock Market Climbs S And P 500 Extends Winning Streak

May 21, 2025 -

Institutional Investors Fuel Bitcoin Etf Boom A 5 Billion Market Analysis

May 21, 2025

Institutional Investors Fuel Bitcoin Etf Boom A 5 Billion Market Analysis

May 21, 2025 -

De Generes Grief A Heartwrenching Tribute Following Family Death

May 21, 2025

De Generes Grief A Heartwrenching Tribute Following Family Death

May 21, 2025 -

J D Vance On Bidens Cancer Diagnosis Questions Of Presidential Fitness

May 21, 2025

J D Vance On Bidens Cancer Diagnosis Questions Of Presidential Fitness

May 21, 2025 -

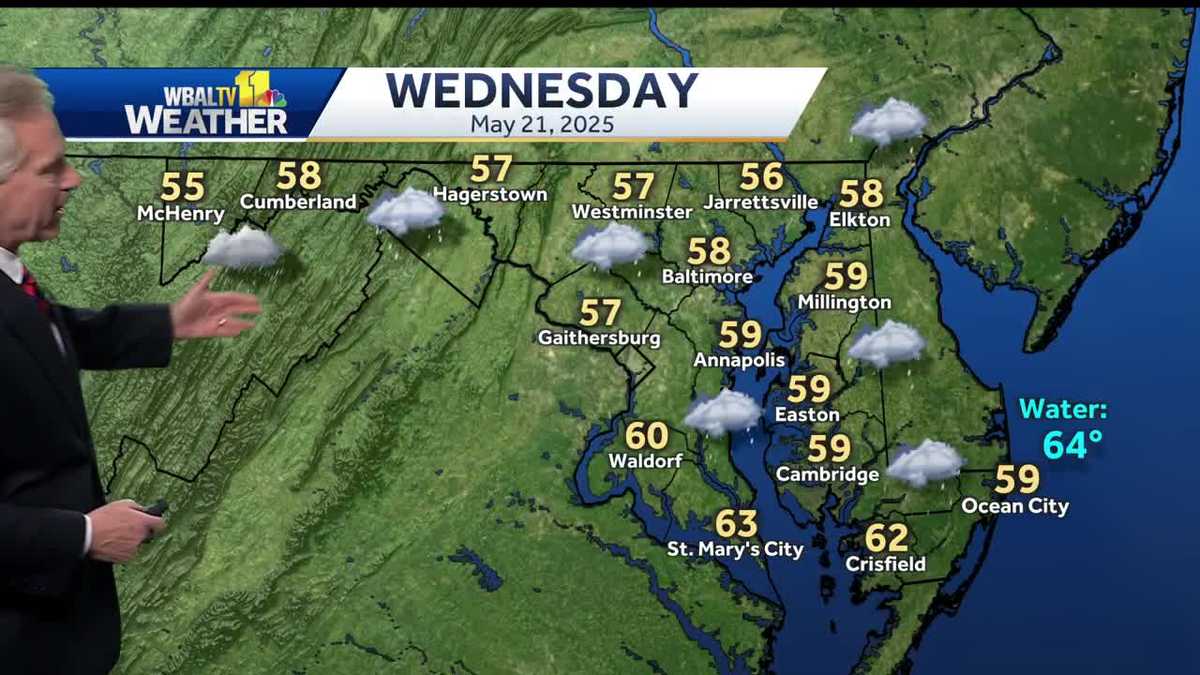

Regional Weather Update Expect Rain And Cold Throughout Wednesday

May 21, 2025

Regional Weather Update Expect Rain And Cold Throughout Wednesday

May 21, 2025