Institutional Investors Fuel Bitcoin ETF Boom: A $5 Billion+ Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Fuel Bitcoin ETF Boom: A $5 Billion+ Market Analysis

The cryptocurrency market is buzzing with excitement as institutional investors pour billions into Bitcoin exchange-traded funds (ETFs), signaling a potential paradigm shift in the digital asset landscape. With assets under management (AUM) surpassing $5 billion and climbing, the Bitcoin ETF boom is no longer a niche trend; it's a major force shaping the future of finance. This surge reflects a growing confidence in Bitcoin's long-term viability as a valuable asset class.

The Rise of Bitcoin ETFs: A Catalyst for Institutional Adoption

The launch of the first Bitcoin futures ETFs in 2021 opened the floodgates for institutional participation. Previously, direct Bitcoin investment was complex, requiring specialized knowledge and infrastructure. ETFs, however, offered a familiar and regulated vehicle for large investors to gain exposure to Bitcoin's price movements. This accessibility played a crucial role in driving the current boom.

$5 Billion+ and Counting: A Market Analysis

The sheer scale of investment is staggering. Data reveals that AUM in Bitcoin ETFs have surpassed $5 billion, representing a significant portion of the overall cryptocurrency market capitalization. This figure is expected to grow exponentially as more ETFs are approved and more institutional investors enter the market. Several factors contribute to this rapid growth:

- Regulatory Clarity: The gradual increase in regulatory clarity surrounding cryptocurrencies, particularly in the US, has emboldened institutional investors to allocate funds to this previously unregulated asset class. While regulation is still evolving, the path toward greater clarity is a powerful driver.

- Diversification Strategies: Institutional investors are increasingly incorporating Bitcoin into their broader portfolio diversification strategies. Bitcoin's historically low correlation with traditional asset classes makes it an attractive hedge against inflation and market volatility.

- Growing Institutional Demand: The demand for Bitcoin ETFs is driven primarily by institutional investors seeking exposure to the digital asset space without the complexities and risks associated with direct Bitcoin ownership. The ETF structure offers a more streamlined and regulated approach.

- Technological Advancements: Advances in blockchain technology and custodial solutions have addressed previous concerns regarding security and scalability, further boosting institutional confidence.

Major Players Shaping the Market

Several prominent institutional investors are heavily involved in the Bitcoin ETF boom. While specific portfolio allocations are often confidential, the overall trend is unmistakable. These investors are leveraging ETFs to gain exposure to Bitcoin's price appreciation and potential long-term growth.

Future Outlook: Continued Growth and Potential Challenges

The future of the Bitcoin ETF market appears bright. However, challenges remain. Regulatory uncertainty persists in several jurisdictions, and potential price volatility remains a concern. Despite these hurdles, the ongoing institutional adoption and the increasing sophistication of the ETF market suggest sustained growth in the years to come. We can expect to see increased competition amongst ETF providers, leading to innovation in product design and potentially lower fees for investors.

Conclusion: A New Era in Cryptocurrency Investment

The $5 billion+ AUM milestone in Bitcoin ETFs marks a significant turning point in the history of cryptocurrencies. The increased institutional involvement heralds a new era of legitimacy and maturity for the digital asset space. While risks remain, the ongoing influx of institutional capital suggests that Bitcoin is here to stay, and its integration into mainstream finance is accelerating rapidly. For those seeking to understand and participate in this dynamic market, careful research and understanding of the risks are crucial.

Further Reading:

- [Link to a reputable article on Bitcoin ETF regulation]

- [Link to a reputable article on Bitcoin's price volatility]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Fuel Bitcoin ETF Boom: A $5 Billion+ Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Two Boys Arrested Following Church Bathroom Defacement

May 21, 2025

Two Boys Arrested Following Church Bathroom Defacement

May 21, 2025 -

Analysis Putins Recent Actions Highlight Trumps Reduced Leverage

May 21, 2025

Analysis Putins Recent Actions Highlight Trumps Reduced Leverage

May 21, 2025 -

Corporate Value Enhancement Through Nature Conservation 160 Japanese Companies Adopt New Strategies

May 21, 2025

Corporate Value Enhancement Through Nature Conservation 160 Japanese Companies Adopt New Strategies

May 21, 2025 -

How Medical And Scientific Research Drives American Innovation

May 21, 2025

How Medical And Scientific Research Drives American Innovation

May 21, 2025 -

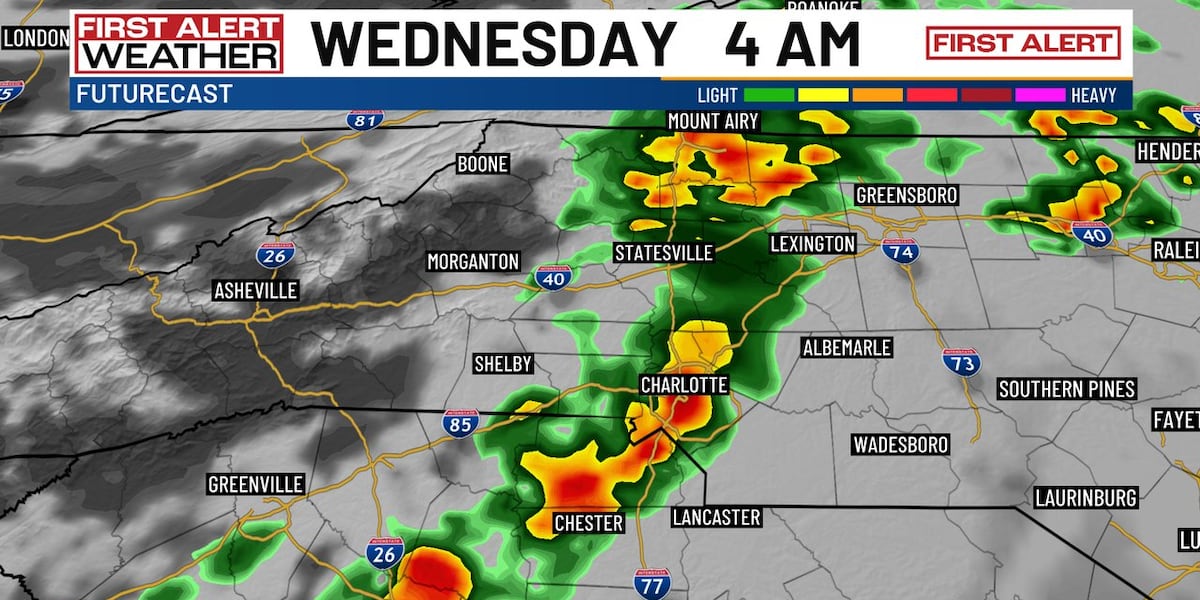

Incoming Cooldown Brings Overnight Storms To The Charlotte Area

May 21, 2025

Incoming Cooldown Brings Overnight Storms To The Charlotte Area

May 21, 2025