Moody's Downgrade Ignored: Stock Market Climbs, S&P 500 Extends Winning Streak

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Ignored: Stock Market Climbs, S&P 500 Extends Winning Streak

The stock market shrugged off Moody's downgrade of several US banks, continuing its impressive rally. Despite the negative credit rating news, the S&P 500 extended its winning streak, defying expectations and signaling strong investor confidence. This unexpected market behavior raises questions about the true impact of credit rating agencies and the overall health of the US economy.

The news sent ripples through the financial world on [Date of Moody's announcement], with Moody's citing concerns about [briefly state the reasons for the downgrade, e.g., rising interest rates, potential loan losses]. Many analysts predicted a market correction or at least a period of significant volatility. However, the market reacted quite differently.

A Bullish Market Defies Expectations

The S&P 500 closed [percentage change]% higher on [Date], marking its [number]th consecutive day of gains. This impressive run defies the conventional wisdom that negative news, particularly from a major credit rating agency like Moody's, would trigger a sell-off. Several factors may be contributing to this surprising resilience:

- Strong Corporate Earnings: Recent positive earnings reports from major corporations have boosted investor sentiment, outweighing concerns about the banking sector.

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively robust, indicating a strong underlying economy.

- Federal Reserve's Actions: While interest rate hikes are a contributing factor to the banking concerns, some analysts believe the Fed's actions are ultimately aimed at stabilizing the economy in the long term.

- Investor Confidence: It seems investors are increasingly confident in the ability of the US economy to weather the current challenges. This suggests a longer-term perspective that outweighs short-term concerns.

The Diminishing Influence of Credit Rating Agencies?

The market's reaction raises questions about the ongoing influence of credit rating agencies. While Moody's downgrade is a significant event, the market's indifference suggests that investors are increasingly relying on their own assessments of risk and opportunity. This may reflect a growing skepticism towards the pronouncements of these agencies, particularly in light of their role in the 2008 financial crisis.

This doesn't mean the Moody's downgrade is inconsequential. It serves as a crucial reminder of the underlying vulnerabilities within the financial system. However, the market's response highlights the complex interplay of various economic factors and investor sentiment.

What This Means for Investors

The current market situation presents both opportunities and challenges for investors. While the continued climb is encouraging, it's crucial to maintain a diversified portfolio and carefully assess your risk tolerance. Consider consulting with a financial advisor to develop a strategy that aligns with your individual goals.

Further Reading:

- [Link to a relevant article on Moody's downgrade]

- [Link to an article on recent corporate earnings]

- [Link to an article on current economic indicators]

Call to Action: Stay informed about market trends by subscribing to our newsletter for regular updates and expert analysis. [Link to Newsletter Signup]

Keywords: Moody's downgrade, stock market, S&P 500, US economy, credit rating agencies, investor confidence, banking sector, interest rates, market rally, economic indicators, financial markets, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Ignored: Stock Market Climbs, S&P 500 Extends Winning Streak. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Church Vandalism Two Boys Accused Of Breaking And Entering Defecating

May 21, 2025

Church Vandalism Two Boys Accused Of Breaking And Entering Defecating

May 21, 2025 -

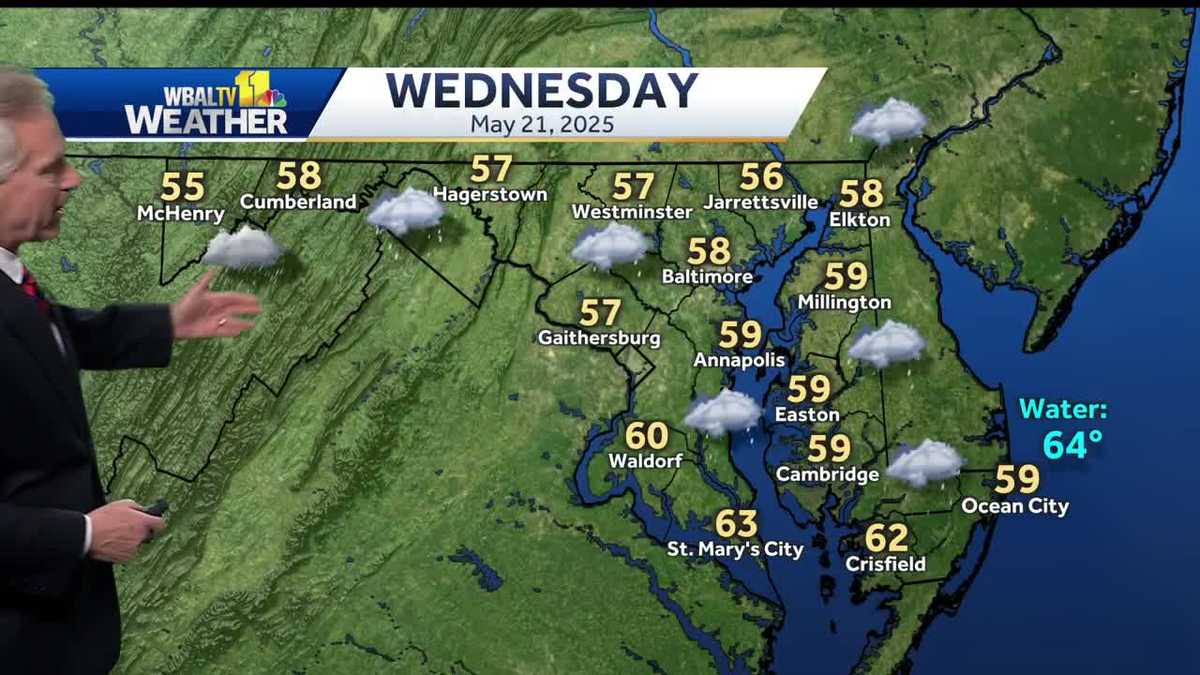

Wednesday Weather Alert Rain And Unseasonably Cold Temperatures

May 21, 2025

Wednesday Weather Alert Rain And Unseasonably Cold Temperatures

May 21, 2025 -

Juvenile Delinquency Church Break In And Sanitation Violation

May 21, 2025

Juvenile Delinquency Church Break In And Sanitation Violation

May 21, 2025 -

Ellen De Generes Re Emerges On Social Media Fans React

May 21, 2025

Ellen De Generes Re Emerges On Social Media Fans React

May 21, 2025 -

Master Of Ceremony Warbonds In Helldivers 2 May 15th Release Date

May 21, 2025

Master Of Ceremony Warbonds In Helldivers 2 May 15th Release Date

May 21, 2025