Plummeting Mortgage Refinance Rates: Your May 19, 2025, Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Plummeting Mortgage Refinance Rates: Your May 19, 2025, Guide

Are you feeling the pinch of high interest rates on your existing mortgage? Good news! Mortgage refinance rates are plummeting, presenting a potentially significant opportunity to save money and improve your financial situation. This May 19, 2025, guide will help you navigate this dynamic market and determine if refinancing is right for you.

The Current Mortgage Refinance Landscape (May 19, 2025)

As of May 19, 2025, we're seeing a noticeable shift in the mortgage refinance market. Several factors contribute to this decline, including easing inflation, adjustments in Federal Reserve policy, and increased competition among lenders. This means lower interest rates are available for those who qualify. However, it's crucial to understand that rates vary depending on several factors, including your credit score, loan type, and the loan-to-value ratio (LTV).

Is Refinancing Right for You? Key Considerations:

Before you jump into refinancing, consider these crucial factors:

-

Your Current Interest Rate: Compare your current interest rate to the rates currently offered. A significant difference is needed to justify the costs associated with refinancing. Use online mortgage calculators to estimate potential savings. [Link to reputable mortgage calculator]

-

Your Credit Score: A higher credit score typically translates to lower interest rates. Check your credit report for accuracy and work on improving your score if necessary. [Link to reputable credit score checking website]

-

The Length of Your Current Loan: How much of your loan term remains? Refinancing may not be worthwhile if you only have a few years left on your mortgage.

-

Refinancing Costs: Remember, refinancing involves closing costs, including appraisal fees, title insurance, and lender fees. These costs need to be factored into your decision to determine your overall savings.

-

Your Financial Goals: Are you aiming to lower your monthly payments, shorten your loan term, or access your home equity? Understanding your goals will help you choose the right refinance option.

Types of Mortgage Refinances:

Several refinance options are available:

-

Rate and Term Refinance: This allows you to lower your interest rate and potentially shorten your loan term.

-

Cash-Out Refinance: This allows you to borrow against your home's equity, receiving a lump sum of cash. This option can be useful for home improvements, debt consolidation, or other major expenses. However, it increases your overall loan amount and potential interest paid.

-

Cash-In Refinance: With this option, you pay down your loan principal using additional funds to reduce the loan balance and potentially shorten the repayment term.

Finding the Best Mortgage Refinance Rate:

Shopping around is crucial to secure the best possible rate. Compare offers from multiple lenders, including banks, credit unions, and online lenders. Consider using a mortgage broker who can compare rates from various lenders for you.

Important Considerations for May 19, 2025:

While rates are declining, it's vital to act swiftly. The market is dynamic, and rates could shift again. Therefore, securing a pre-approval will help solidify your position and demonstrate your readiness when suitable rates become available. A pre-approval demonstrates your seriousness to lenders.

Conclusion:

Plummeting mortgage refinance rates present a significant opportunity for many homeowners. By carefully considering your financial situation and exploring available options, you can potentially save thousands of dollars and improve your financial well-being. Remember to shop around, compare offers, and consult with a financial advisor if needed. Don't delay – seize this opportunity while rates remain favorable.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial professional before making any decisions related to refinancing your mortgage.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Plummeting Mortgage Refinance Rates: Your May 19, 2025, Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Xfl Week 8 Dc Defenders Vs Arlington Renegades Game Preview And Prediction

May 19, 2025

Xfl Week 8 Dc Defenders Vs Arlington Renegades Game Preview And Prediction

May 19, 2025 -

Sundays Ufl Showdown Defenders Vs Renegades Betting Odds And Expert Picks

May 19, 2025

Sundays Ufl Showdown Defenders Vs Renegades Betting Odds And Expert Picks

May 19, 2025 -

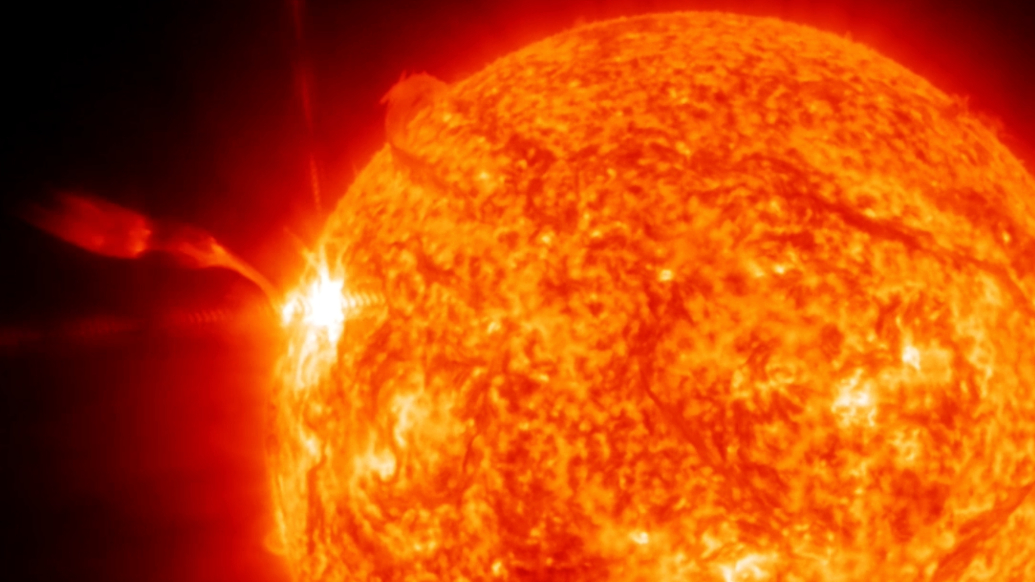

Geomagnetic Storm Major Solar Flare Triggers Radio Blackouts Globally

May 19, 2025

Geomagnetic Storm Major Solar Flare Triggers Radio Blackouts Globally

May 19, 2025 -

65 000 Holiday Rentals Blocked In Spain New Ruling Impacts Tourism

May 19, 2025

65 000 Holiday Rentals Blocked In Spain New Ruling Impacts Tourism

May 19, 2025 -

Tennessee Lady Vols Win Pickens Performance Secures Regional Final Berth

May 19, 2025

Tennessee Lady Vols Win Pickens Performance Secures Regional Final Berth

May 19, 2025