Will Clean Energy Tax Reforms Boost Or Hinder America's Economic Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Reforms Boost or Hinder America's Economic Growth?

America stands at a crossroads. The push for clean energy is undeniable, fueled by climate concerns and technological advancements. But the path forward is paved with complex economic questions. Will the proposed clean energy tax reforms stimulate economic growth, or will they inadvertently stifle it? This article delves into the potential impacts, examining both the optimistic projections and the potential downsides.

The Promise of Green Growth:

Proponents of clean energy tax reforms argue that investing in renewable energy sources like solar and wind power will unlock significant economic opportunities. These reforms often include tax credits, subsidies, and accelerated depreciation for clean energy technologies. The expected benefits are multifaceted:

-

Job Creation: The clean energy sector is a burgeoning job creator. Manufacturing solar panels, installing wind turbines, developing smart grids – these all require skilled labor, generating employment across various sectors. A recent report by the [link to reputable source, e.g., Department of Energy] highlights the substantial job growth potential in this area.

-

Technological Innovation: Tax incentives can spur innovation by encouraging investment in research and development of next-generation clean energy technologies. This could lead to breakthroughs in battery storage, energy efficiency, and carbon capture, fostering long-term economic competitiveness.

-

Attracting Investment: Favorable tax policies can attract significant foreign and domestic investment in the clean energy sector. This influx of capital can fuel further growth and create a positive ripple effect throughout the economy.

-

Reduced Healthcare Costs: The transition to cleaner energy sources can lead to improved air and water quality, resulting in lower healthcare costs associated with pollution-related illnesses. This represents a significant long-term economic benefit.

Potential Economic Headwinds:

However, concerns remain regarding the potential economic drawbacks of these reforms. Critics raise several key points:

-

Increased Energy Costs: The transition to renewable energy may initially lead to higher energy costs for consumers and businesses, potentially dampening economic activity, particularly for energy-intensive industries.

-

Job Displacement: While the clean energy sector creates jobs, it could also lead to job losses in traditional fossil fuel industries. A just transition strategy is crucial to mitigate this risk and provide retraining opportunities for affected workers. [Link to article discussing just transition initiatives].

-

Government Spending: Government subsidies and tax credits require significant public spending. The effectiveness of this spending in generating sufficient economic returns needs careful evaluation to avoid wasteful expenditure.

The Balancing Act:

The ultimate impact of clean energy tax reforms on America's economic growth hinges on several factors, including:

-

The design of the tax policies: Well-designed policies that incentivize innovation, job creation, and responsible transition will maximize economic benefits. Poorly designed policies can lead to unintended consequences and economic inefficiencies.

-

Technological advancements: Rapid technological advancements in clean energy technologies are crucial for reducing costs and making renewable energy sources competitive with fossil fuels.

-

Government regulation: A clear and consistent regulatory framework is essential to foster investment and ensure a smooth transition to a clean energy economy.

Conclusion:

Clean energy tax reforms present both opportunities and challenges for America's economic future. While the potential for green job creation, technological innovation, and long-term economic benefits is significant, careful consideration of potential downsides, such as increased energy costs and job displacement, is crucial. The success of these reforms ultimately depends on the careful design and implementation of policies that balance economic growth with environmental sustainability. Further research and ongoing monitoring are essential to accurately assess the long-term economic impacts of these transformative policies. The path towards a sustainable and prosperous future requires a nuanced approach, ensuring that the transition to clean energy is both economically viable and socially equitable.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Reforms Boost Or Hinder America's Economic Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bali Tourism A Joint Effort For Safety And Responsible Travel

May 20, 2025

Bali Tourism A Joint Effort For Safety And Responsible Travel

May 20, 2025 -

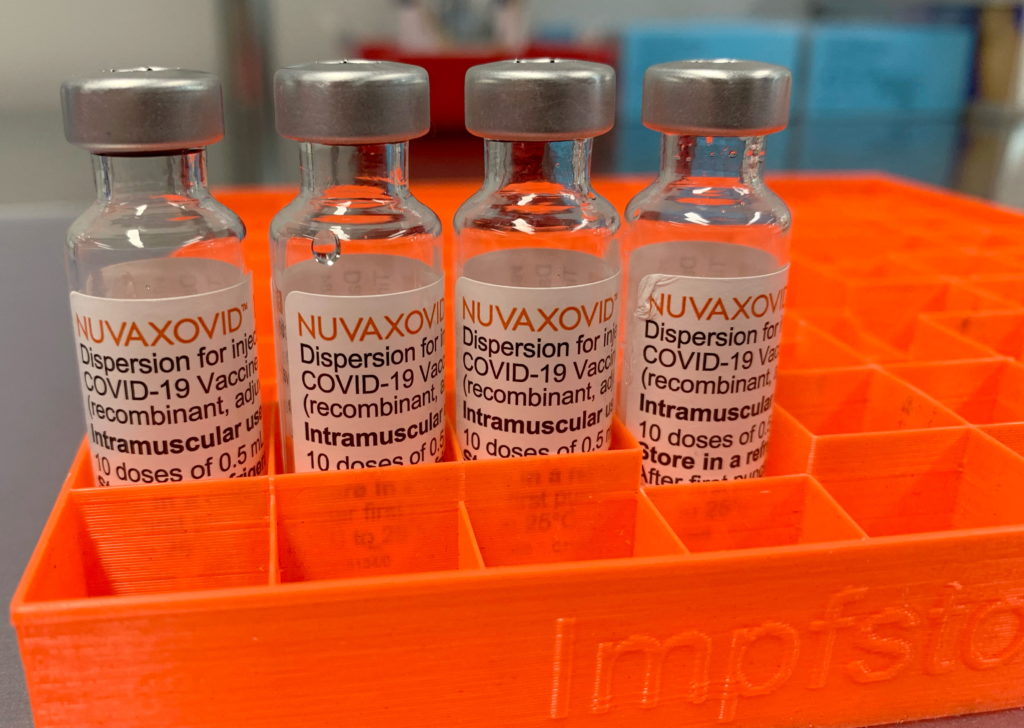

Novavax Covid 19 Vaccine Gets Fda Nod But With Unusual Usage Constraints

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Unusual Usage Constraints

May 20, 2025 -

Trump Announces Call With Putin On Monday To Stop The Violence In Ukraine

May 20, 2025

Trump Announces Call With Putin On Monday To Stop The Violence In Ukraine

May 20, 2025 -

Hong Kongs Cathay Pacific Welcomes First Training Program Graduates

May 20, 2025

Hong Kongs Cathay Pacific Welcomes First Training Program Graduates

May 20, 2025 -

Potential Global Blackouts Nasas Forecast Of Intense Solar Activity

May 20, 2025

Potential Global Blackouts Nasas Forecast Of Intense Solar Activity

May 20, 2025