Economic Impacts Of Clean Energy Tax Policies In The United States

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Shifting Sands: Economic Impacts of Clean Energy Tax Policies in the United States

The United States is undergoing a significant energy transition, driven in part by ambitious clean energy tax policies aimed at combating climate change and boosting domestic industries. But what are the real economic impacts of these policies? Are they creating jobs, stimulating innovation, and fostering economic growth, or are they imposing undue burdens on businesses and consumers? The answer, as with most complex issues, is nuanced.

This article will delve into the multifaceted economic effects of clean energy tax incentives in the US, examining both the benefits and drawbacks, and analyzing the long-term implications for the economy.

H2: The Carrot and the Stick: Incentives and Their Effects

The core of US clean energy policy lies in a combination of tax credits, deductions, and investment incentives designed to encourage the development and deployment of renewable energy sources like solar, wind, and geothermal power. These incentives aim to:

- Reduce the cost of clean energy: Tax credits directly lower the upfront costs of installing solar panels, building wind farms, and investing in energy efficiency upgrades. This makes these technologies more competitive with fossil fuels.

- Stimulate innovation: By making clean energy investments more attractive, these policies encourage research and development in areas like battery storage, smart grids, and advanced biofuels.

- Create jobs: The clean energy sector is a significant job creator, encompassing manufacturing, installation, maintenance, and research positions. Tax incentives accelerate this job growth.

H2: The Winners and Losers: Distributional Effects

While the overall economic impact is generally positive, the benefits aren't distributed equally.

- Winners: Clean energy companies, manufacturers of renewable energy equipment, installers, and workers in the renewable energy sector are clear beneficiaries. Consumers who adopt renewable energy technologies also see savings on their energy bills over the long term.

- Losers: The fossil fuel industry faces challenges as clean energy becomes more competitive. This can lead to job losses in traditional energy sectors, although some argue that these losses are offset by gains in the clean energy sector. Furthermore, some argue that the cost of these incentives is ultimately borne by taxpayers.

H3: The Debate Over Costs and Benefits

A significant debate surrounds the net economic cost of these policies. Critics point to the significant financial outlay required to fund tax credits and argue that these costs outweigh the benefits. Proponents, on the other hand, highlight the long-term economic benefits of a cleaner energy system, including reduced healthcare costs associated with air pollution and increased national security due to reduced reliance on foreign oil. Independent analyses often present varying conclusions, depending on the methodologies and assumptions used.

H2: Looking Ahead: Policy Evolution and Future Impacts

The economic impact of clean energy tax policies is an evolving story. Policy changes, technological advancements, and evolving market dynamics will continue to shape the landscape. Future research and data analysis will be crucial in evaluating the effectiveness and efficiency of these policies, allowing for adjustments and improvements to maximize the economic benefits while mitigating potential negative consequences. Further analysis on the impact on specific sectors, like transportation and manufacturing, is also needed to understand the full picture.

H2: Conclusion: A Balancing Act

The economic impacts of clean energy tax policies in the United States present a complex picture. While these policies offer significant potential for job creation, economic growth, and environmental benefits, careful consideration must be given to managing the transition and ensuring equitable distribution of both costs and benefits. Ongoing monitoring, rigorous evaluation, and adaptive policy adjustments will be vital in maximizing the positive economic effects and navigating the challenges of this crucial shift in the nation's energy landscape. Further research and transparent data sharing are essential to informing future policy decisions and ensuring a sustainable and prosperous economic future powered by clean energy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Impacts Of Clean Energy Tax Policies In The United States. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Confirmado Al 90 Inminente Llegada Al Real Madrid Tras Encuentro Con Alonso

May 20, 2025

Confirmado Al 90 Inminente Llegada Al Real Madrid Tras Encuentro Con Alonso

May 20, 2025 -

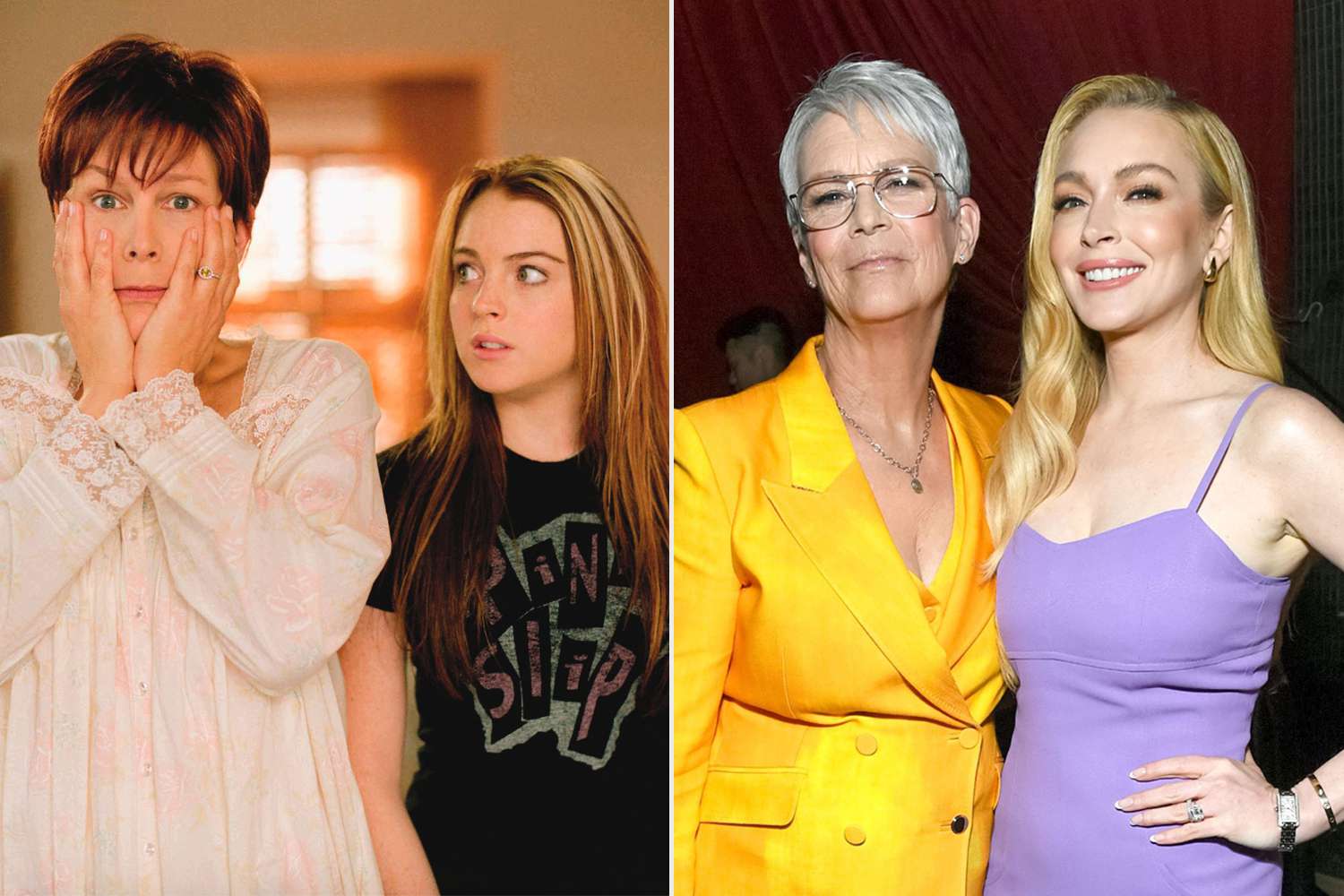

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan

May 20, 2025 -

From Frenemies To Friends Jamie Lee Curtis On Her Relationship With Lindsay Lohan

May 20, 2025

From Frenemies To Friends Jamie Lee Curtis On Her Relationship With Lindsay Lohan

May 20, 2025 -

Stock Market Soars S And P 500 Extends Winning Streak Dow And Nasdaq Join Rally

May 20, 2025

Stock Market Soars S And P 500 Extends Winning Streak Dow And Nasdaq Join Rally

May 20, 2025 -

War 2 Teaser Released Hrithik Roshan Jr Ntr And Kiara Advani Star

May 20, 2025

War 2 Teaser Released Hrithik Roshan Jr Ntr And Kiara Advani Star

May 20, 2025