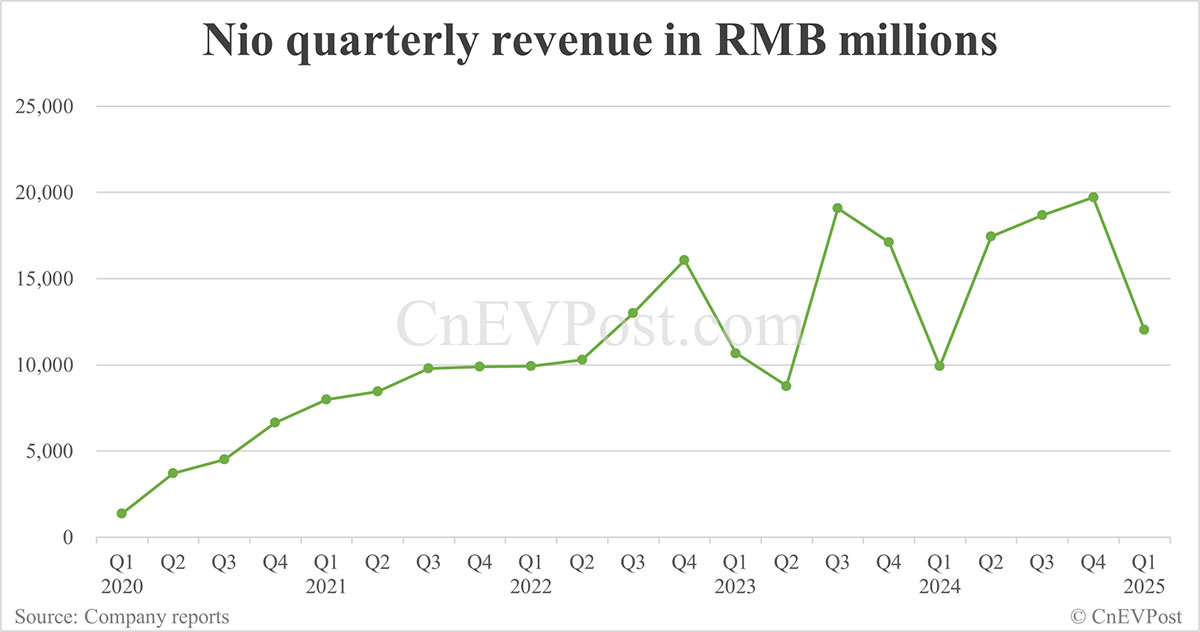

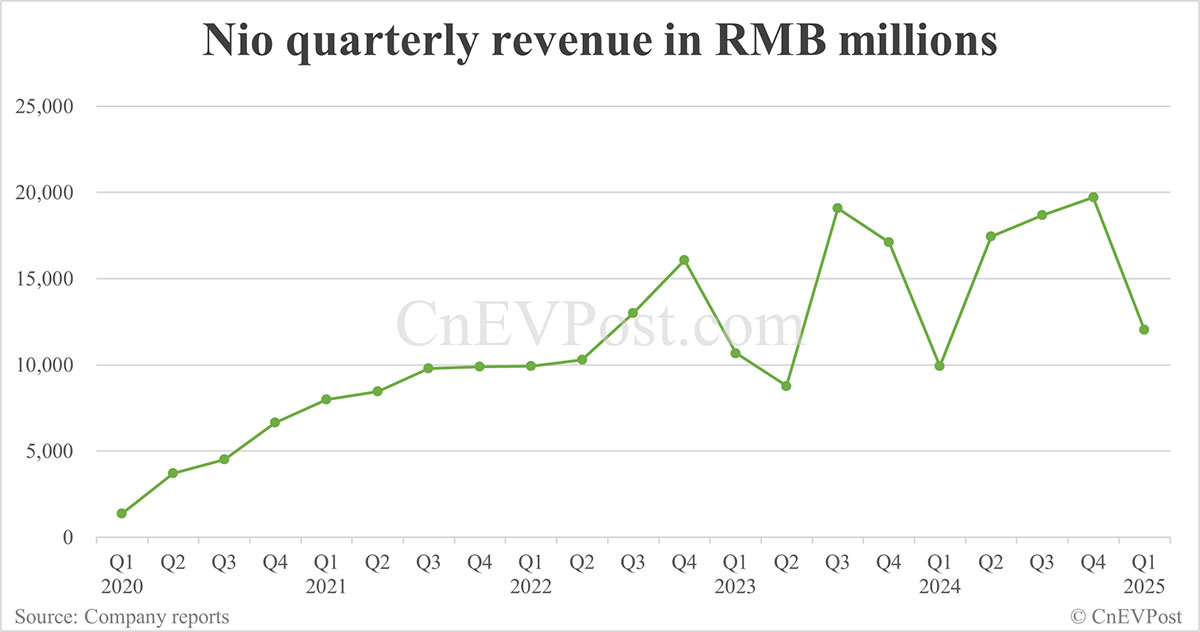

Nio Q1 2024 Revenue: 21% Year-on-Year Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Q1 2024 Revenue Surges 21% Year-on-Year, Defying Market Slowdown

Nio, the leading Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 financial results, revealing a robust 21% year-on-year revenue growth. This impressive performance comes despite a broader slowdown in the global automotive market and increased competition within the burgeoning EV sector. The results signal a continued strong performance for Nio, defying expectations and solidifying its position as a major player in the industry.

The company reported a total revenue of [Insert Actual Revenue Figure Here] for Q1 2024, exceeding analyst predictions and marking a significant achievement for the brand. This growth is largely attributed to increased vehicle deliveries, successful expansion into new markets, and the continued appeal of Nio's innovative battery-as-a-service (BaaS) model.

<h3>Nio's Strategic Success: Key Factors Driving Growth</h3>

Several key factors contributed to Nio's outstanding Q1 2024 performance:

-

Strong Vehicle Deliveries: Nio delivered a total of [Insert Actual Delivery Figures Here] vehicles during the first quarter, a substantial increase compared to the same period last year. This increase reflects growing consumer demand for Nio's premium EVs and successful marketing campaigns.

-

Battery-as-a-Service (BaaS) Model's Continued Success: Nio's innovative BaaS model, which allows customers to lease batteries separately from the vehicle, continues to attract buyers. This model offers greater affordability and flexibility, making Nio's vehicles more accessible to a wider range of consumers. The subscription-based revenue stream also provides a more predictable and stable income for the company.

-

Expansion into New Markets: Nio is actively expanding its global presence, entering new markets and strengthening its position in existing ones. This strategic move allows the company to tap into new customer bases and diversify its revenue streams. Further details on expansion plans are expected to be revealed in upcoming investor calls.

-

Technological Innovation: Nio continues to invest heavily in research and development, bringing innovative technologies to its vehicles. Features like advanced driver-assistance systems (ADAS) and cutting-edge battery technology are key differentiators in a competitive market.

<h3>Challenges and Future Outlook</h3>

While the Q1 2024 results are overwhelmingly positive, Nio faces ongoing challenges. The intense competition in the EV market, fluctuating raw material prices, and the overall economic climate remain potential headwinds. However, the company's strong performance suggests it is well-equipped to navigate these challenges.

Nio's management expressed confidence in the company's future prospects, highlighting the strong order backlog and continued investment in research and development. They emphasized their commitment to delivering high-quality vehicles and expanding their global reach.

<h3>Investor Reaction and Market Impact</h3>

The announcement of Nio's strong Q1 2024 results was met with positive reaction from investors. [Insert information on stock price changes and investor sentiment]. This positive market response reflects investor confidence in Nio's long-term growth potential.

In conclusion, Nio's 21% year-on-year revenue growth in Q1 2024 demonstrates the company's resilience and strategic effectiveness in a dynamic market. While challenges remain, Nio's strong performance and innovative approach position it for continued success in the competitive electric vehicle landscape. For further details, investors are encouraged to review Nio's official financial report.

Keywords: Nio, Q1 2024, Revenue, Electric Vehicle, EV, China, Battery-as-a-Service, BaaS, Financial Results, Stock Price, Growth, Automotive Industry, Competition, Technology, Innovation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Q1 2024 Revenue: 21% Year-on-Year Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Dimons Stark Warning China Tariffs And The Uss Miscalculation

Jun 03, 2025

Jamie Dimons Stark Warning China Tariffs And The Uss Miscalculation

Jun 03, 2025 -

Us Economic Outlook Imperiled Jp Morgan Ceo Highlights Internal Dangers

Jun 03, 2025

Us Economic Outlook Imperiled Jp Morgan Ceo Highlights Internal Dangers

Jun 03, 2025 -

Us China Trade Tensions Jamie Dimons Warning On Tariff Ineffectiveness

Jun 03, 2025

Us China Trade Tensions Jamie Dimons Warning On Tariff Ineffectiveness

Jun 03, 2025 -

Dimons Blunt Assessment The Impact Of Us China Tariffs On The Global Economy

Jun 03, 2025

Dimons Blunt Assessment The Impact Of Us China Tariffs On The Global Economy

Jun 03, 2025 -

Bondis Actions Diminish American Bar Associations Scrutiny Of Trumps Judges

Jun 03, 2025

Bondis Actions Diminish American Bar Associations Scrutiny Of Trumps Judges

Jun 03, 2025