Jamie Dimon's Stark Warning: China Tariffs And The US's Miscalculation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jamie Dimon's Stark Warning: China Tariffs and the US's Miscalculation

JPMorgan Chase CEO Jamie Dimon issued a stark warning about the potential economic consequences of escalating tariffs on Chinese goods, suggesting a significant miscalculation in US trade policy. His comments, delivered during a recent earnings call, highlight growing concerns amongst business leaders about the long-term impact of the trade war and its ripple effects on global markets. Dimon's influential voice adds weight to the debate, pushing the conversation beyond partisan politics and into the realm of serious economic forecasting.

Dimon's warning isn't simply a knee-jerk reaction; it's grounded in a deep understanding of global finance and the interconnectedness of the US and Chinese economies. He argued that the current tariff strategy, while intended to protect American businesses and jobs, may have inadvertently inflicted more harm than good. The implications, he suggests, are far-reaching and demand a reassessment of the current approach.

The Economic Fallout: More Than Just Tariffs

The impact of the tariffs extends far beyond the immediate cost increase for consumers. Dimon highlighted several key areas of concern:

-

Inflationary Pressures: Increased import costs due to tariffs directly contribute to inflation, impacting consumer spending and potentially slowing economic growth. This effect is exacerbated by already existing supply chain disruptions, further fueling price increases across various sectors.

-

Supply Chain Disruptions: The reliance on Chinese manufacturing for numerous goods means tariffs disrupt established supply chains, leading to delays, shortages, and increased production costs. This instability impacts businesses of all sizes, from small businesses to multinational corporations.

-

Geopolitical Instability: The escalating trade tensions between the US and China contribute to broader geopolitical instability, creating uncertainty for investors and potentially hindering global economic growth. This uncertainty impacts investment decisions and can lead to a slowdown in economic activity.

-

Impact on American Consumers: Ultimately, the burden of these tariffs is often shifted to the American consumer in the form of higher prices for goods and services. This erodes purchasing power and can negatively impact consumer confidence.

Dimon's Call for a Re-evaluation

Dimon didn't simply criticize the current approach; he explicitly called for a reassessment of the US's trade policy with China. He emphasized the need for a more nuanced strategy that considers the long-term consequences and the complex interplay of global economics. His suggestion underscores the need for a more comprehensive approach that balances protectionist measures with the need for stable and predictable global trade relationships.

This isn't the first time Dimon has expressed concerns about the economic landscape. He has consistently warned about potential risks, offering insightful commentary that often influences market sentiment. [Link to a previous article about Dimon's economic predictions].

The Broader Context: Beyond the US-China Trade War

The implications of Dimon's warning extend beyond the immediate US-China trade relationship. His concerns highlight the broader challenges facing global trade in an increasingly interconnected world. The need for careful consideration of trade policy and its potential consequences is a critical issue for all nations.

Conclusion: A Wake-Up Call for Policymakers

Jamie Dimon's stark warning serves as a significant wake-up call for policymakers. His comments underscore the need for a more nuanced and strategic approach to trade relations, acknowledging the potential pitfalls of overly aggressive protectionist measures. The future of the global economy, and indeed the American economy, may hinge on a careful reevaluation of these policies. The question remains: will policymakers heed this warning before the economic consequences become irreversible?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jamie Dimon's Stark Warning: China Tariffs And The US's Miscalculation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

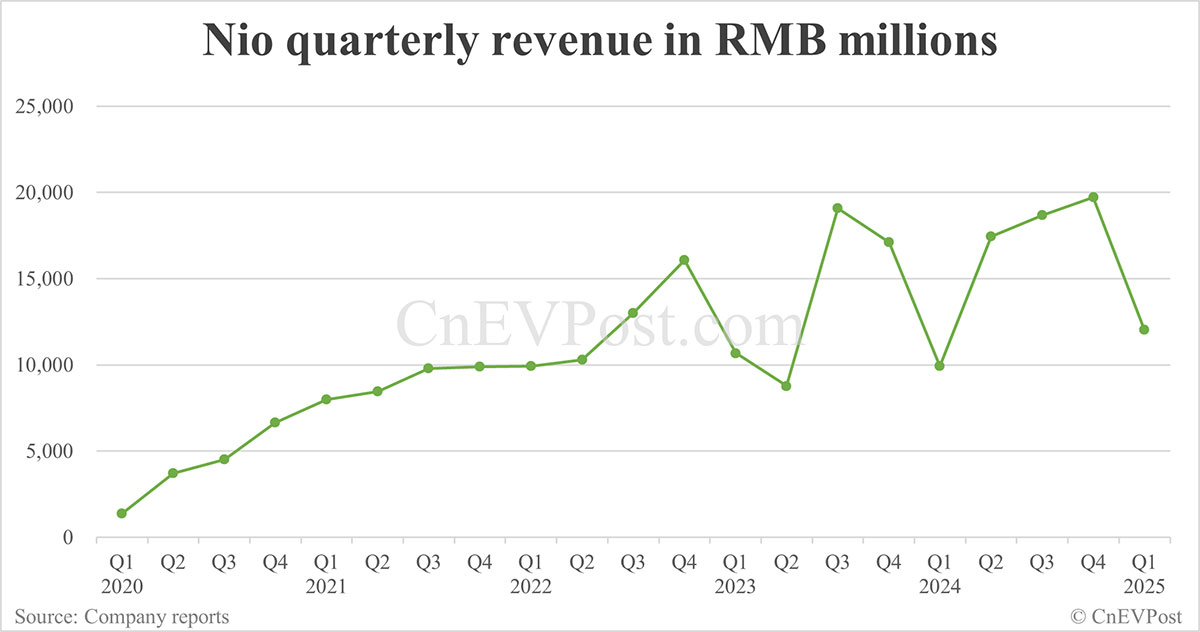

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025 -

Cross State Arrest Suspect In Custody For Homicide

Jun 03, 2025

Cross State Arrest Suspect In Custody For Homicide

Jun 03, 2025 -

The 2 C Threshold Timelines For Corporate Climate Change Adaptation

Jun 03, 2025

The 2 C Threshold Timelines For Corporate Climate Change Adaptation

Jun 03, 2025 -

Patti Lu Pone Issues Apology For Disrespectful Remarks

Jun 03, 2025

Patti Lu Pone Issues Apology For Disrespectful Remarks

Jun 03, 2025 -

Federal Layoff Announcement Met With Opposition From Rep Khanna And Unions

Jun 03, 2025

Federal Layoff Announcement Met With Opposition From Rep Khanna And Unions

Jun 03, 2025