Dimon's Blunt Assessment: The Impact Of US-China Tariffs On The Global Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Blunt Assessment: The Impact of US-China Tariffs on the Global Economy

Jamie Dimon, CEO of JPMorgan Chase, isn't known for mincing words. His recent pronouncements on the lingering effects of US-China tariffs have sent shockwaves through the global financial community, highlighting the ongoing economic uncertainty stemming from this protracted trade war. Dimon's blunt assessment paints a picture of a complex and interconnected global economy significantly impacted by these trade barriers, with consequences far beyond initial predictions.

The Lingering Shadow of Tariffs:

Dimon's concerns aren't about some theoretical economic model; they're rooted in real-world observations of the impact on JPMorgan Chase's extensive global operations. He points to the continued disruption in supply chains, increased costs for businesses, and a dampening effect on overall global growth. While the initial headlines focused on specific industries, the ripple effect has been felt across the board, impacting everything from consumer goods to manufacturing.

The tariffs, initially implemented under the Trump administration, aimed to address trade imbalances and protect American industries. However, Dimon argues that the long-term consequences have far outweighed any short-term benefits. The resulting uncertainty has made it difficult for businesses to plan for the future, leading to hesitancy in investment and hiring.

Beyond the Headlines: A Deeper Dive into the Economic Fallout

The impact extends beyond simple price increases. Here's a breakdown of the key areas affected by the lingering effects of US-China tariffs:

-

Inflation: Increased costs of imported goods have contributed significantly to global inflation, squeezing household budgets and dampening consumer spending. This inflationary pressure puts central banks in a difficult position, forcing them to make tough choices between controlling inflation and supporting economic growth. [Link to article on global inflation]

-

Supply Chain Disruptions: The tariffs exacerbated existing supply chain vulnerabilities, exposing the fragility of global trade networks. Businesses have struggled to secure essential components and raw materials, leading to production delays and shortages. This disruption has also increased the cost of transportation and logistics. [Link to article on supply chain issues]

-

Geopolitical Instability: The trade war has further strained US-China relations, adding to existing geopolitical tensions. This uncertainty creates a less predictable environment for businesses, making long-term planning even more challenging.

Dimon's Call for Action: A Path Forward?

While Dimon’s assessment is undeniably pessimistic, he also hints at potential solutions. He advocates for a more predictable and stable trade relationship between the US and China, emphasizing the need for clear and consistent policies. This would allow businesses to plan more effectively and invest with greater confidence. Reducing tariffs and easing trade tensions would undoubtedly boost global economic growth and stabilize the global financial system.

Looking Ahead: Navigating the Uncertain Future

The full impact of the US-China trade war is still unfolding. While some sectors have adapted, others continue to struggle. Dimon's frank assessment serves as a stark reminder of the interconnectedness of the global economy and the far-reaching consequences of protectionist trade policies. The future remains uncertain, but a clear path towards de-escalation and a more collaborative approach to international trade is crucial for fostering sustainable global economic growth.

Keywords: US-China tariffs, Jamie Dimon, JPMorgan Chase, global economy, trade war, inflation, supply chain, geopolitical instability, economic impact, trade relations, global trade.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Blunt Assessment: The Impact Of US-China Tariffs On The Global Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

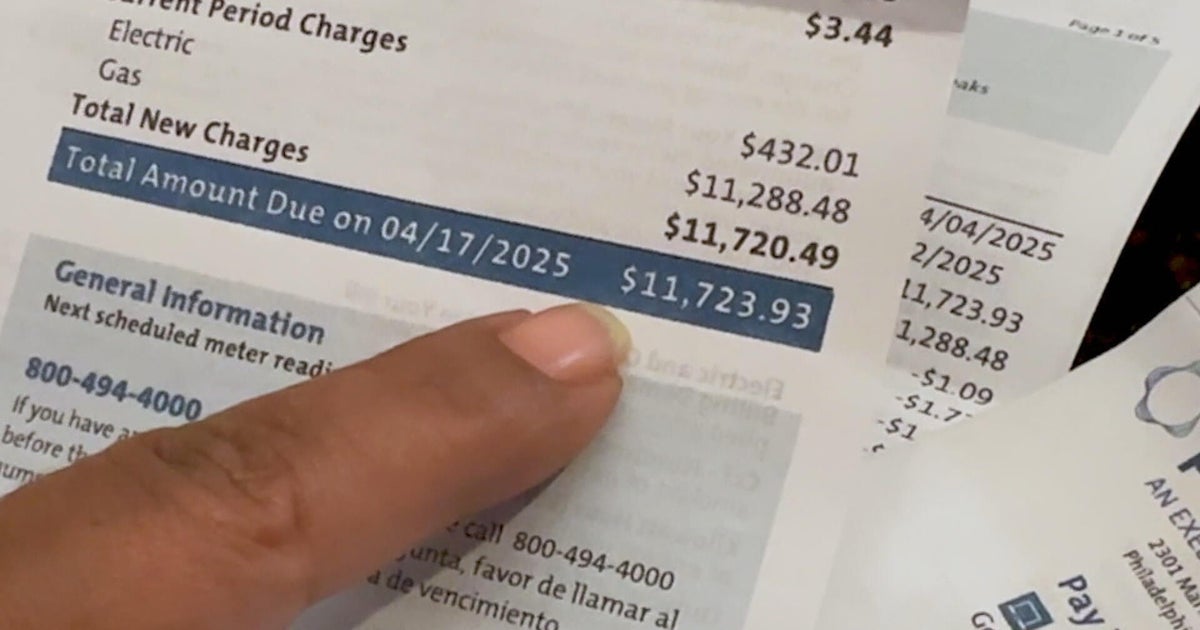

Massive Peco Bill Sparks Outrage Delays And Errors Plague Customers

Jun 03, 2025

Massive Peco Bill Sparks Outrage Delays And Errors Plague Customers

Jun 03, 2025 -

A 2 C World Assessing The Urgency Of Corporate Climate Adaptation Strategies

Jun 03, 2025

A 2 C World Assessing The Urgency Of Corporate Climate Adaptation Strategies

Jun 03, 2025 -

Tornado Throws The Wire Actors Son 300 Feet Familys Harrowing Account

Jun 03, 2025

Tornado Throws The Wire Actors Son 300 Feet Familys Harrowing Account

Jun 03, 2025 -

The Wire Stars Son Seriously Injured In Henry County Tornado

Jun 03, 2025

The Wire Stars Son Seriously Injured In Henry County Tornado

Jun 03, 2025 -

Wtf With Marc Maron A Look Back At 15 Years Of Interviews

Jun 03, 2025

Wtf With Marc Maron A Look Back At 15 Years Of Interviews

Jun 03, 2025