May 19, 2025: Mortgage Refinance Rates Fall – Your Guide To Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

May 19, 2025: Mortgage Refinance Rates Fall – Your Guide to Savings

Good news for homeowners! Mortgage refinance rates have taken a dip as of May 19th, 2025, presenting a significant opportunity for homeowners to potentially save thousands of dollars over the life of their loan. This could be your chance to lower your monthly payments, shorten your loan term, or even tap into your home equity. But navigating the refinance process can be complex. This guide will break down everything you need to know to determine if refinancing is right for you and how to secure the best possible rate.

Why are Mortgage Refinance Rates Falling?

Several factors contribute to the fluctuation of mortgage refinance rates. Currently, a combination of [insert specific economic factors influencing the drop in rates, e.g., easing inflation, Federal Reserve policy adjustments] is creating a more favorable environment for borrowers. This doesn't guarantee low rates forever, so acting swiftly is crucial. Experts predict [insert expert prediction about the future of rates - source this prediction], making now a potentially opportune time to explore your options.

Is Refinancing Right for You?

Before diving into applications, honestly assess your situation. Refinancing involves costs, including closing costs and potentially appraisal fees. Consider these key questions:

- How much could you save? Use online mortgage refinance calculators (many reputable sources like [link to a reputable mortgage calculator] offer these tools) to compare your current rate with current offers. Consider both the potential monthly savings and the total interest saved over the life of the loan.

- What's your credit score? A higher credit score typically qualifies you for better rates. Check your credit report for accuracy before applying. [Link to a reputable credit report website].

- How long do you plan to stay in your home? Refinancing costs need to be recouped through savings. If you plan to move soon, the costs might outweigh the benefits.

- What type of refinance are you considering? There are several options, including rate-and-term refinancing (lowering your rate and/or shortening your loan term) and cash-out refinancing (borrowing against your home's equity). Each has different implications.

H2: Navigating the Refinancing Process

Once you've determined refinancing is beneficial, follow these steps:

- Shop around: Don't settle for the first offer. Compare rates and fees from multiple lenders, including banks, credit unions, and online lenders.

- Check your credit report: As mentioned, a higher credit score leads to better rates. Address any errors promptly.

- Gather your documents: Lenders will require various documents, including pay stubs, tax returns, and proof of homeownership. Being prepared streamlines the process.

- Understand the closing costs: These fees can vary significantly between lenders. Negotiate where possible.

- Read the fine print: Before signing anything, thoroughly review all documents to understand the terms and conditions of your new mortgage.

H2: Potential Savings and Long-Term Benefits

By refinancing at a lower rate, you can significantly reduce your monthly mortgage payments, freeing up funds for other financial goals. A shorter loan term means you’ll pay off your mortgage faster, saving on overall interest. Cash-out refinancing can provide access to funds for home improvements, debt consolidation, or other expenses – but remember to manage this extra debt responsibly.

H2: Act Now – Don't Miss This Opportunity

The current climate presents a unique window of opportunity for significant mortgage savings. Don't delay – explore your refinancing options today. Use the resources mentioned above to compare rates and determine if refinancing aligns with your financial goals. Remember to consult with a financial advisor for personalized advice tailored to your specific circumstances.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial professional before making any financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on May 19, 2025: Mortgage Refinance Rates Fall – Your Guide To Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Big Changes Ahead New Peaky Blinders Series Officially Confirmed By Creator

May 20, 2025

Big Changes Ahead New Peaky Blinders Series Officially Confirmed By Creator

May 20, 2025 -

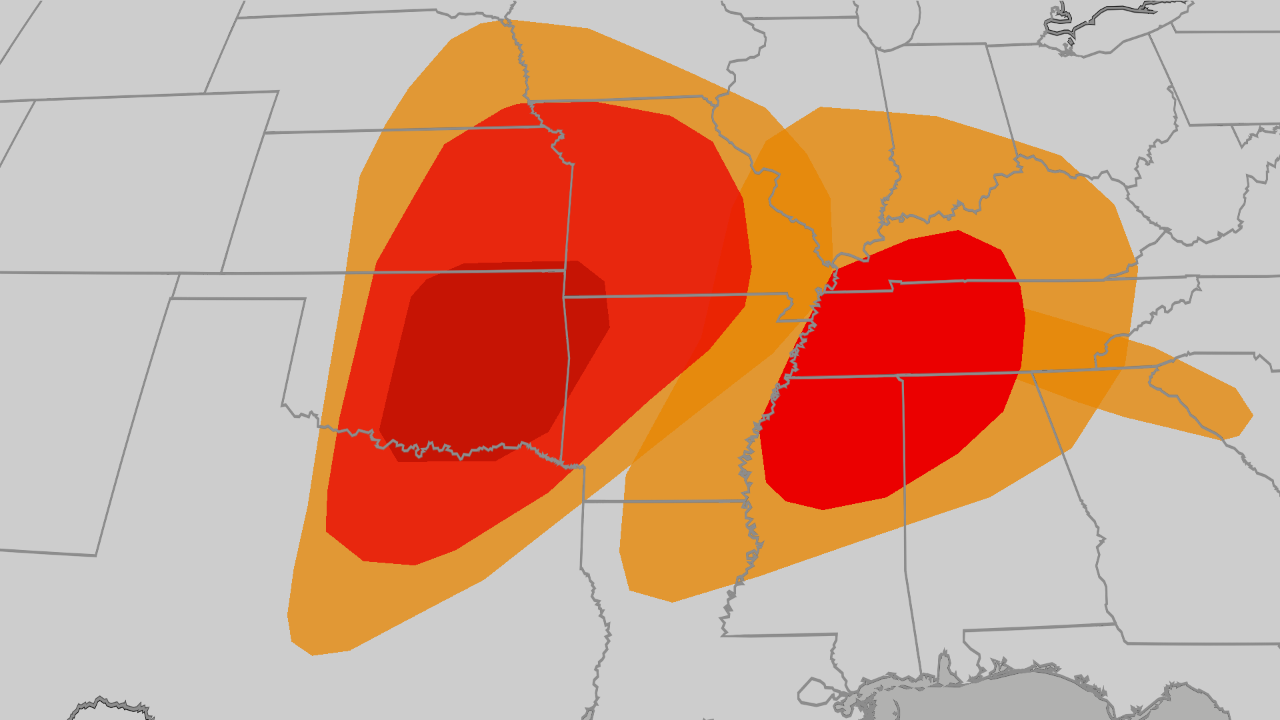

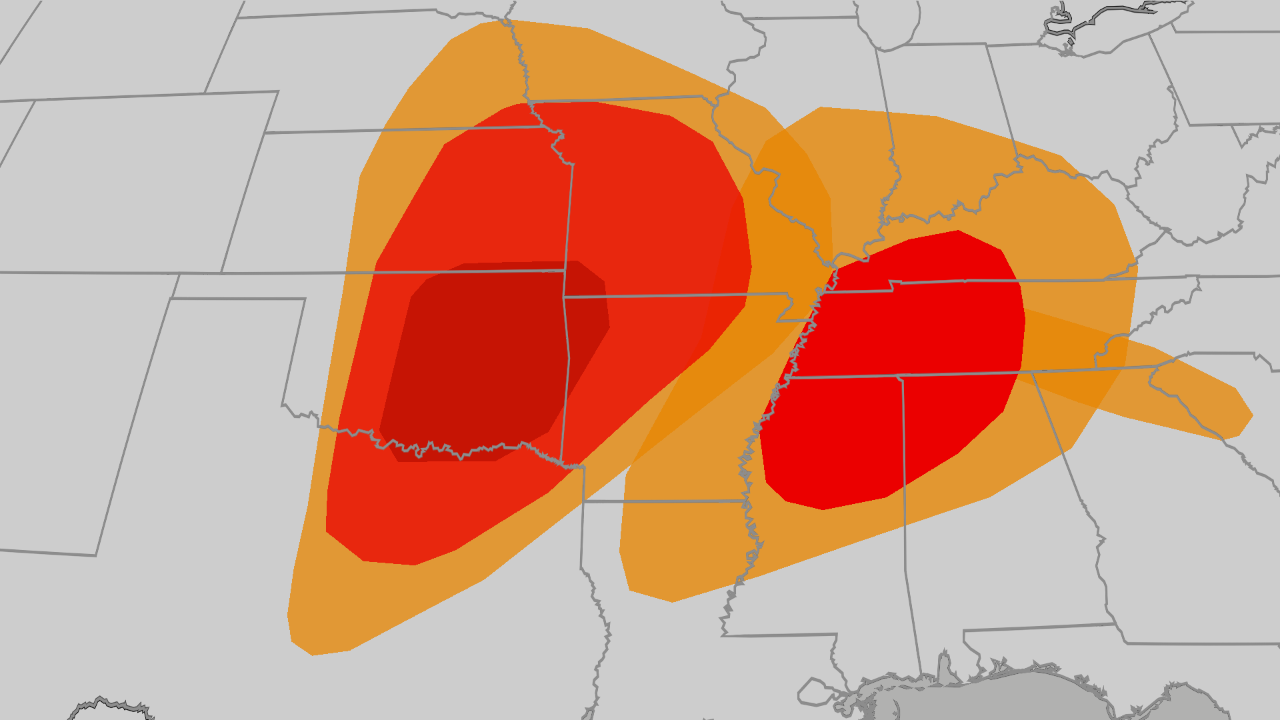

Powerful Storms And Tornado Threat Plains Midwest And South Brace For Severe Weather

May 20, 2025

Powerful Storms And Tornado Threat Plains Midwest And South Brace For Severe Weather

May 20, 2025 -

Tornado Threat Severe Weather Outbreak Sweeping Plains Midwest And South

May 20, 2025

Tornado Threat Severe Weather Outbreak Sweeping Plains Midwest And South

May 20, 2025 -

Fda Grants Novavax Covid 19 Vaccine Approval Under Specific Conditions

May 20, 2025

Fda Grants Novavax Covid 19 Vaccine Approval Under Specific Conditions

May 20, 2025 -

Fda Approval For Novavax Covid 19 Vaccine Understanding The Restrictions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Understanding The Restrictions

May 20, 2025