JPMorgan's Dimon Sounds Alarm: Internal Risks Jeopardize US Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan's Dimon Sounds Alarm: Internal Risks Jeopardize US Economy

JPMorgan Chase CEO Jamie Dimon's stark warning about internal US economic risks has sent shockwaves through Wall Street and beyond. His concerns, expressed during a recent earnings call, go beyond typical economic anxieties, highlighting vulnerabilities within the American financial system itself. This isn't just about inflation or interest rates; Dimon points to a more insidious threat brewing beneath the surface.

Dimon, known for his frank assessments of the economic landscape, painted a picture far from rosy. He didn't shy away from using strong language, emphasizing the potential for significant disruptions and unforeseen consequences. This isn't simply a prediction of a recession; it's a cautionary tale about the fragility of the system and the potential for self-inflicted wounds.

Internal Threats Overshadowing External Factors

While external factors like the war in Ukraine and global inflation undoubtedly pose challenges, Dimon's focus lies squarely on internal risks. These aren't easily quantifiable metrics; they represent systemic weaknesses that could trigger cascading failures. He highlighted several key areas of concern:

-

The Debt Ceiling Crisis: The recent near-miss on a US debt default highlighted the perilous game of brinkmanship surrounding government finances. Dimon stressed the long-term consequences of repeated fiscal showdowns and their potential to erode investor confidence. This uncertainty, he argues, is a significant drag on economic growth and a breeding ground for instability.

-

Geopolitical Instability & Rising Protectionism: While not strictly "internal," these factors significantly impact the US economy and amplify existing vulnerabilities. The increasing fragmentation of global supply chains and a rise in protectionist policies create further uncertainty, making it harder for businesses to plan and invest. This uncertainty directly contributes to the internal risks Dimon highlighted.

-

The Banking Sector's Resilience: The recent banking sector turmoil served as a stark reminder of the interconnectedness of the financial system. While the immediate crisis may have been contained, Dimon's concerns extend to the underlying health of the sector and its capacity to withstand future shocks. He stressed the need for robust regulation and proactive risk management.

-

Political Polarization: The increasingly polarized political climate also plays a role. Dimon suggested that gridlock and political infighting hinder effective policymaking, exacerbating existing economic challenges and creating further uncertainty. This hampers the government's ability to address critical issues and maintain stability.

What Does This Mean for Investors and the Average American?

Dimon's warning is a serious one. It suggests a need for cautious optimism, urging both investors and individuals to be mindful of the potential for significant economic disruption. While a full-blown crisis isn't necessarily imminent, the potential for a series of unforeseen events cascading into a larger problem is a real possibility.

This isn't a call for panic, but a call for vigilance. Investors should diversify their portfolios, carefully consider their risk tolerance, and stay informed about developments in the financial sector. For the average American, it's a reminder to be fiscally responsible, build up emergency savings, and stay informed about economic trends.

Looking Ahead: A Call for Proactive Measures

Dimon's message isn't simply one of doom and gloom. It's a call for proactive measures – a plea for greater fiscal responsibility, more effective regulation, and a renewed focus on strengthening the foundations of the US economy. Addressing these internal weaknesses is crucial to mitigate the risks and ensure long-term stability and prosperity. The question now is whether policymakers will heed this warning before it's too late. The future of the US economy may well depend on it.

Further Reading: [Link to relevant JPMorgan Chase earnings report] [Link to a reputable financial news source discussing the debt ceiling]

Keywords: Jamie Dimon, JPMorgan Chase, US Economy, Economic Risks, Internal Risks, Debt Ceiling, Banking Sector, Geopolitical Instability, Recession, Financial Crisis, Inflation, Investment, Economy News, Financial News.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan's Dimon Sounds Alarm: Internal Risks Jeopardize US Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dimon A Self Inflicted Wound Jp Morgan Ceo On Us Economic Risks

Jun 03, 2025

Dimon A Self Inflicted Wound Jp Morgan Ceo On Us Economic Risks

Jun 03, 2025 -

Miley Cyruss Mature Response To Billy Ray Cyrus Dating Elizabeth Hurley

Jun 03, 2025

Miley Cyruss Mature Response To Billy Ray Cyrus Dating Elizabeth Hurley

Jun 03, 2025 -

Hims Stock Price Increase 3 02 On May 30th

Jun 03, 2025

Hims Stock Price Increase 3 02 On May 30th

Jun 03, 2025 -

Dimons Blunt Assessment The Impact Of Us China Tariffs

Jun 03, 2025

Dimons Blunt Assessment The Impact Of Us China Tariffs

Jun 03, 2025 -

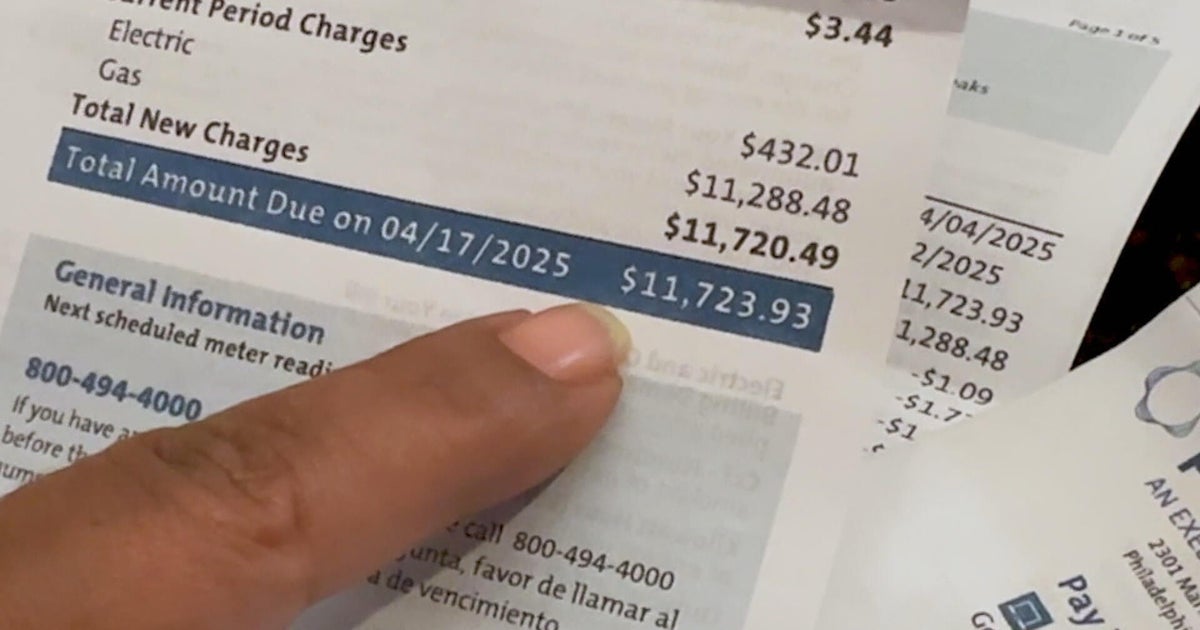

Massive Peco Bill Sparks Outrage Delays And Errors Plague Customers

Jun 03, 2025

Massive Peco Bill Sparks Outrage Delays And Errors Plague Customers

Jun 03, 2025