Dimon's Blunt Assessment: The Impact Of US-China Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Blunt Assessment: The Impact of US-China Tariffs – A Costly Trade War?

Jamie Dimon, CEO of JPMorgan Chase, rarely minces words. His recent assessment of the ongoing impact of US-China tariffs hasn't been an exception. Dimon's blunt pronouncements paint a picture of a costly trade war that continues to ripple through the global economy, impacting everything from consumer prices to corporate profits. This article delves into Dimon's key concerns and analyzes the lingering effects of these tariffs.

The Dimon Doctrine: A Cost Borne by Consumers

Dimon’s criticism of the US-China trade war isn't new, but his recent comments underscore the enduring negative consequences. He hasn't shied away from stating that the tariffs, intended to protect American industries, have ultimately resulted in higher prices for American consumers. This sentiment echoes concerns raised by economists who argue that the costs are disproportionately borne by the consumer. Instead of shielding American businesses, the tariffs have led to increased costs for raw materials and finished goods, squeezing profit margins and fueling inflation.

Beyond the Headlines: Specific Impacts of the Tariffs

The effects of the US-China tariffs extend far beyond headline inflation figures. Specific impacts include:

- Increased Prices for Consumers: The most immediate impact is the increase in prices for everyday goods, impacting household budgets across the board. From electronics to clothing, the tariffs have inflated the cost of numerous products.

- Supply Chain Disruptions: The tariffs have significantly disrupted global supply chains, forcing companies to re-evaluate sourcing strategies and leading to delays and shortages. This disruption has cascading effects throughout the economy.

- Reduced Business Investment: Uncertainty surrounding trade policies has led to a decrease in business investment, as companies hesitate to commit to long-term projects in a volatile economic climate.

- Geopolitical Tensions: The trade war has exacerbated geopolitical tensions between the two global superpowers, adding to existing global uncertainties.

JPMorgan Chase's Perspective: Navigating a Complex Landscape

As one of the world's largest financial institutions, JPMorgan Chase is uniquely positioned to observe the impact of the US-China tariffs across various sectors. Dimon’s comments reflect the challenges faced by businesses navigating this complex economic landscape. The bank itself has likely felt the effects of these tariffs through its various business units, providing a firsthand perspective on the broader economic consequences.

Looking Ahead: The Long-Term Implications

The long-term effects of the US-China tariffs remain uncertain. While some argue that the tariffs have fostered domestic production in certain sectors, the overall economic consensus leans towards the negative consequences outweighing any potential benefits. The question remains: how can future trade policies mitigate the negative impacts while achieving the desired economic outcomes? Experts continue to debate the best path forward, emphasizing the need for a more nuanced and predictable approach to international trade.

Call to Action: Understanding the Broader Context

Understanding the complexities of US-China trade relations is crucial for navigating the current economic climate. Further research into the long-term effects of the tariffs and alternative trade policy approaches is vital for informed decision-making. Staying abreast of expert opinions, like those offered by Dimon, provides valuable insight into the continuing impact of this significant geopolitical and economic event. Learn more about the impact of trade wars by exploring resources from the [link to reputable economic research institution].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Blunt Assessment: The Impact Of US-China Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

China Tariffs Jp Morgan Ceo Jamie Dimon Sounds The Alarm

Jun 03, 2025

China Tariffs Jp Morgan Ceo Jamie Dimon Sounds The Alarm

Jun 03, 2025 -

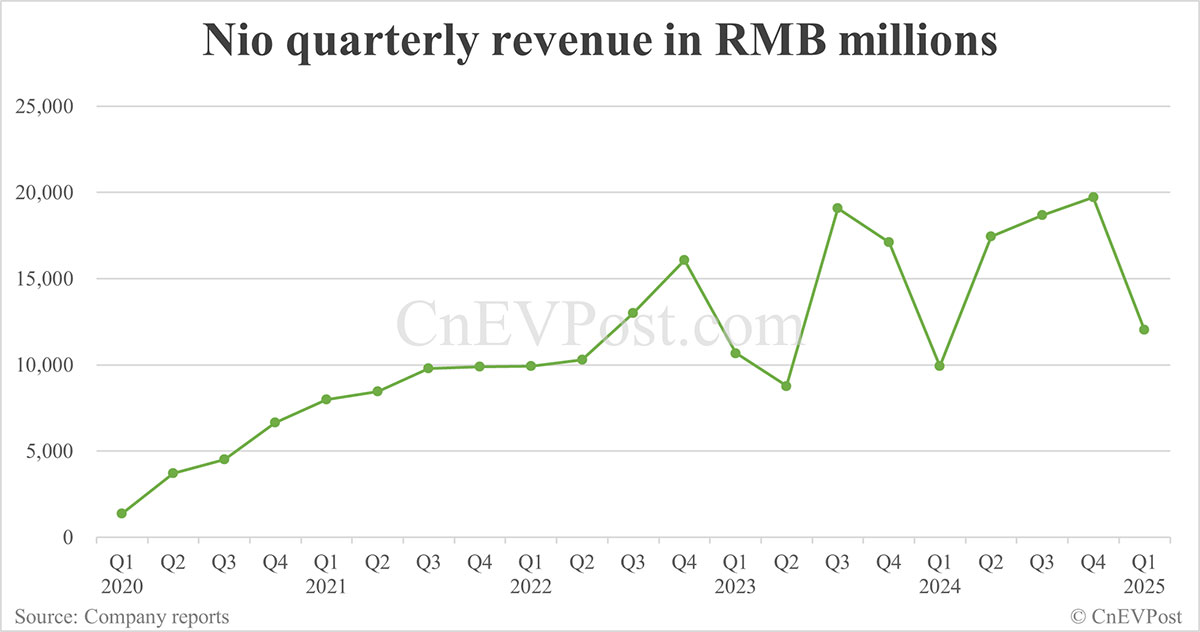

Nios Q1 2024 Financial Results 21 Revenue Growth Outpaces Expectations

Jun 03, 2025

Nios Q1 2024 Financial Results 21 Revenue Growth Outpaces Expectations

Jun 03, 2025 -

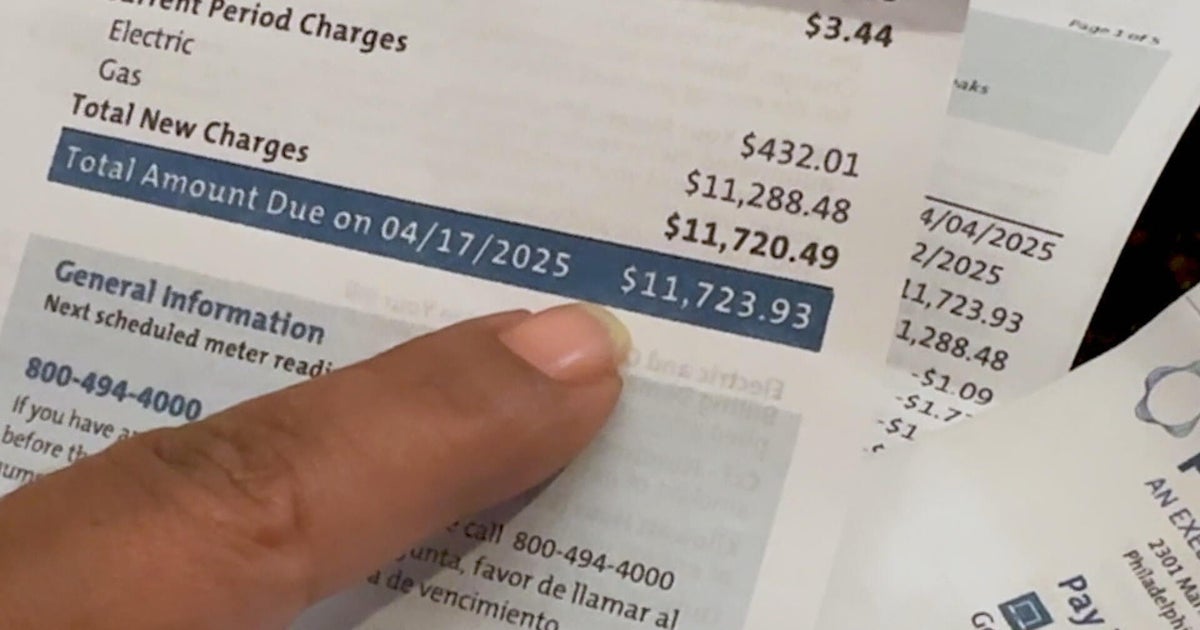

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025 -

Trump Judicial Nominee Vetting Bondi Curbs Aba Influence

Jun 03, 2025

Trump Judicial Nominee Vetting Bondi Curbs Aba Influence

Jun 03, 2025 -

Patti Lu Pone Issues Apology For Disrespectful Remarks

Jun 03, 2025

Patti Lu Pone Issues Apology For Disrespectful Remarks

Jun 03, 2025