China Tariffs: JPMorgan CEO Jamie Dimon Sounds The Alarm

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Tariffs: JPMorgan CEO Jamie Dimon Sounds the Alarm on Escalating Trade Tensions

JPMorgan Chase CEO Jamie Dimon's recent warning about escalating US-China trade tensions has sent shockwaves through the global financial markets. Dimon, known for his candid assessments of the economic landscape, expressed serious concerns regarding the potential impact of further tariffs and trade restrictions between the world's two largest economies. His comments highlight a growing unease among business leaders about the unpredictable nature of the ongoing trade war and its potential for long-term economic damage.

This isn't just another Wall Street prediction; Dimon's words carry significant weight, given JPMorgan Chase's vast global reach and Dimon's reputation for insightful economic analysis. His statement underscores a critical point: the current climate of uncertainty is harming businesses and investors alike, potentially leading to a global slowdown.

<h3>Dimon's Concerns: Beyond the Headlines</h3>

Dimon's alarm isn't simply about short-term market fluctuations. He's highlighting the broader implications of prolonged trade friction:

- Supply Chain Disruptions: Increased tariffs make importing and exporting goods more expensive, disrupting established supply chains and increasing costs for consumers. This ripple effect can impact everything from the price of everyday goods to the profitability of multinational corporations.

- Reduced Investment: Uncertainty about future trade policies discourages businesses from making long-term investments, hindering economic growth and job creation. Companies are hesitant to commit to expansion plans when faced with unpredictable tariff changes.

- Geopolitical Instability: The escalating trade war fuels geopolitical tensions, adding another layer of complexity to an already volatile global environment. This instability can further deter investment and negatively impact global confidence.

- Inflationary Pressures: Increased tariffs directly contribute to inflation, as businesses pass on higher costs to consumers. This can erode purchasing power and lead to slower economic growth.

<h3>The Broader Context: US-China Trade Relations</h3>

The ongoing trade dispute between the US and China has been a defining feature of the global economic landscape for several years. While there have been periods of détente, the underlying tensions remain. Dimon's warning serves as a stark reminder that the consequences of a prolonged and escalating trade war could be far-reaching and potentially devastating. Understanding the history of these trade relations is crucial to grasping the gravity of Dimon's statement. [Link to a reputable article on the history of US-China trade relations]

<h3>What's Next? The Path Forward</h3>

Dimon's comments are a call to action, urging policymakers to prioritize de-escalation and find mutually beneficial solutions. The need for clear and predictable trade policies is paramount for restoring business confidence and fostering sustainable economic growth. While the immediate future remains uncertain, proactive measures are needed to mitigate the potential damage of further trade restrictions.

The impact of these tariffs extends far beyond the headlines, affecting global markets and everyday consumers. Understanding the complexity of this issue is vital for navigating the current economic landscape. Staying informed about developments in US-China trade relations is crucial for businesses and investors alike.

Keywords: China Tariffs, US-China Trade War, Jamie Dimon, JPMorgan Chase, Global Economy, Trade Tensions, Supply Chain Disruptions, Inflation, Geopolitical Risks, Economic Uncertainty, Investment, Market Volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Tariffs: JPMorgan CEO Jamie Dimon Sounds The Alarm. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hims Stock Rises 3 02 Increase On May 30th For Hims And Hers Health Inc

Jun 03, 2025

Hims Stock Rises 3 02 Increase On May 30th For Hims And Hers Health Inc

Jun 03, 2025 -

Us Economic Outlook Under Threat Jp Morgan Ceo Highlights Internal Challenges

Jun 03, 2025

Us Economic Outlook Under Threat Jp Morgan Ceo Highlights Internal Challenges

Jun 03, 2025 -

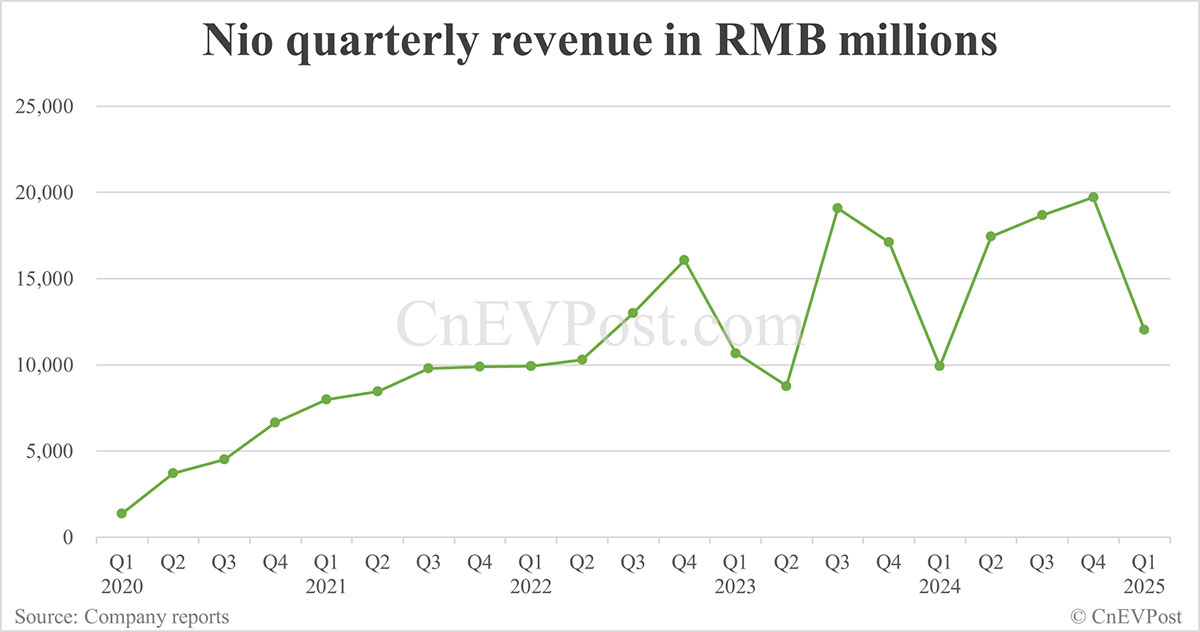

Electric Vehicle Sales Surge Nios Q1 2024 Revenue Jumps 21

Jun 03, 2025

Electric Vehicle Sales Surge Nios Q1 2024 Revenue Jumps 21

Jun 03, 2025 -

From Hollywood To Heartland Roseanne Barrs Post Accident Texas Life

Jun 03, 2025

From Hollywood To Heartland Roseanne Barrs Post Accident Texas Life

Jun 03, 2025 -

The Future Of Federal Unions Protecting Collective Bargaining In A Changing Landscape

Jun 03, 2025

The Future Of Federal Unions Protecting Collective Bargaining In A Changing Landscape

Jun 03, 2025