Dimon: A 'Self-Inflicted Wound'? JPMorgan CEO On US Economic Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon: A 'Self-Inflicted Wound'? JPMorgan CEO Sounds Alarm on US Economic Risks

JPMorgan Chase CEO Jamie Dimon's recent warnings about the US economy have sent shockwaves through financial markets, prompting urgent discussions about potential pitfalls and the role of government policy. Dimon, known for his frank assessments, described certain economic challenges as a "self-inflicted wound," highlighting the precarious position of the US amidst rising inflation, geopolitical instability, and the lingering effects of the pandemic.

His stark warning, delivered during JPMorgan's second-quarter earnings call, underscores growing concerns among leading economists and financial experts. The comments weren't merely a pessimistic outlook; they served as a powerful call to action, urging policymakers to address underlying economic vulnerabilities before they escalate into a full-blown crisis.

The "Self-Inflicted Wound": Deciphering Dimon's Concerns

Dimon's use of the phrase "self-inflicted wound" directly points to the role of government policy in contributing to the current economic climate. He specifically highlighted several key areas:

-

Fiscal Policy: The massive government spending programs implemented during the pandemic, while necessary in the short-term, have contributed to inflationary pressures. Dimon's concern lies in the potential for continued unsustainable spending, exacerbating already elevated inflation rates. This resonates with broader discussions around fiscal responsibility and the long-term impact of government debt.

-

Geopolitical Instability: The war in Ukraine, ongoing tensions with China, and other global conflicts create significant uncertainty and impact supply chains. This adds to the inflationary pressures and creates further instability in the global financial system, impacting everything from energy prices to food security. Dimon's comments emphasize the interconnectedness of the global economy and the ripple effect of geopolitical events.

-

The Federal Reserve's Response: While acknowledging the Federal Reserve's efforts to combat inflation through interest rate hikes, Dimon expressed concerns about the potential for unintended consequences, such as triggering a recession. Finding the right balance between controlling inflation and avoiding a significant economic downturn remains a major challenge. This delicate balancing act is a key theme discussed among leading economists worldwide. [Link to article on Federal Reserve policy]

Beyond the Headlines: What Does This Mean for Investors and Consumers?

Dimon's warnings are not just for Wall Street; they carry significant implications for everyday Americans. The potential for a recession, driven by high inflation and tighter monetary policy, could lead to:

- Increased Unemployment: A slowdown in economic activity often translates to job losses across various sectors.

- Higher Interest Rates: The cost of borrowing money will likely remain elevated, impacting everything from mortgages to car loans.

- Reduced Consumer Spending: As prices remain high and job security becomes uncertain, consumers may reduce spending, further dampening economic growth.

These factors paint a challenging economic landscape, underscoring the need for proactive measures from both the government and the Federal Reserve.

Looking Ahead: Navigating Uncertain Times

The economic outlook remains uncertain, with experts offering varied predictions. While Dimon's assessment is undeniably pessimistic, it serves as a critical wake-up call. The potential for a "self-inflicted wound" underscores the importance of responsible fiscal policy, strategic international relations, and a carefully calibrated approach to monetary policy. Staying informed and adapting to evolving economic conditions is crucial for both investors and consumers navigating these turbulent times.

What are your thoughts on Dimon's assessment of the US economy? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon: A 'Self-Inflicted Wound'? JPMorgan CEO On US Economic Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Confirms Underwater Drone Attack On Kerch Bridge To Russia

Jun 03, 2025

Ukraine Confirms Underwater Drone Attack On Kerch Bridge To Russia

Jun 03, 2025 -

North Texas Murder Case Solved Suspect Arrested Following Extensive Search

Jun 03, 2025

North Texas Murder Case Solved Suspect Arrested Following Extensive Search

Jun 03, 2025 -

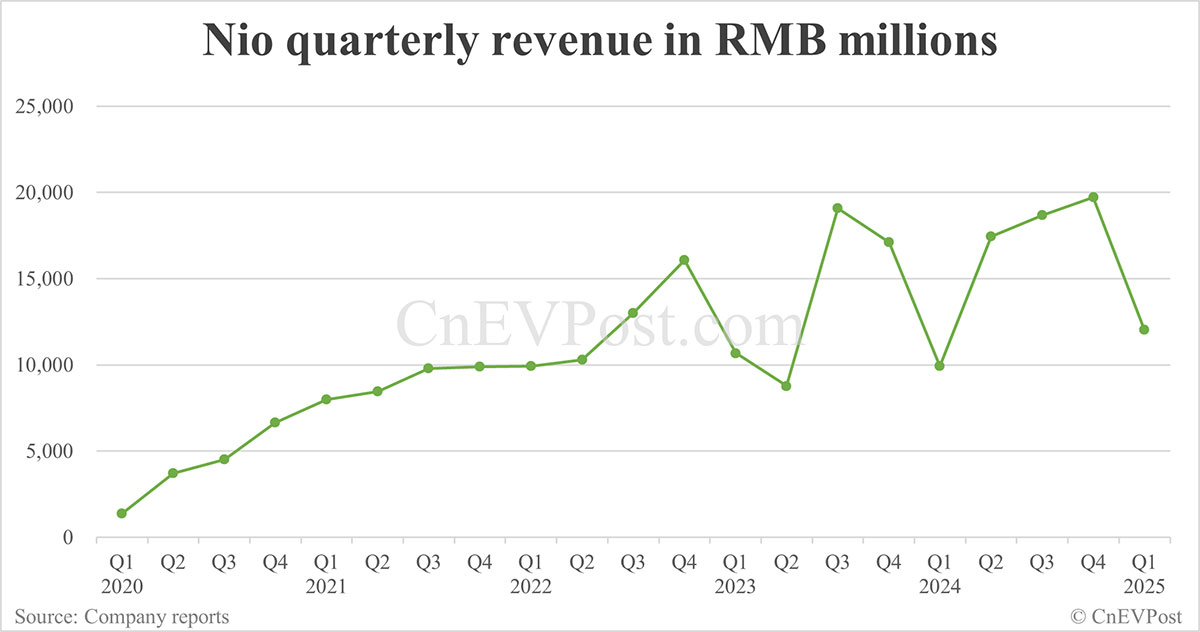

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025 -

Abas Power Reduced Bondis Impact On Trumps Judicial Appointments

Jun 03, 2025

Abas Power Reduced Bondis Impact On Trumps Judicial Appointments

Jun 03, 2025 -

Crimean Bridge Attack Exploring The Motives And Consequences

Jun 03, 2025

Crimean Bridge Attack Exploring The Motives And Consequences

Jun 03, 2025