Is Hims & Hers (HIMS) Stock A Risky Investment? A Deeper Look.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

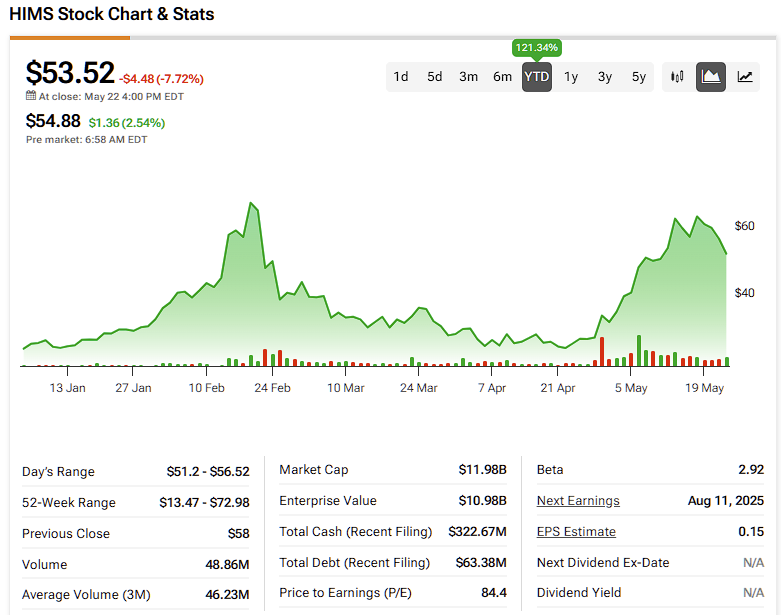

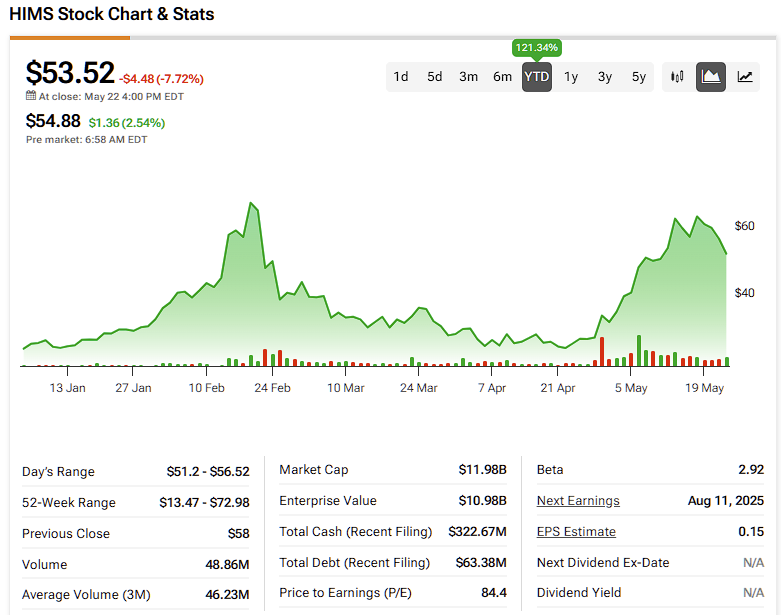

Is Hims & Hers (HIMS) Stock a Risky Investment? A Deeper Look.

The telehealth industry is booming, and Hims & Hers (HIMS) is a major player. But is investing in HIMS stock a smart move, or a risky gamble? This in-depth analysis explores the company's potential, its challenges, and helps you determine if HIMS fits your investment strategy.

Hims & Hers: A Telehealth Giant in the Making?

Hims & Hers has carved a niche in the market by offering convenient, online access to healthcare services, primarily focusing on men's and women's health. Their direct-to-consumer model, utilizing a subscription-based approach, has attracted a significant customer base. They offer a range of products and services, including:

- Hair loss treatments: A significant revenue driver for the company.

- Erectile dysfunction medication: A highly sought-after service, contributing substantially to their revenue stream.

- Skincare products: Catering to a broader market segment.

- Mental health services: Expanding into a rapidly growing area of telehealth.

This diversification across various health areas contributes to the company's resilience, reducing reliance on any single product or service. However, this diversification also presents complexities in management and marketing.

Factors Suggesting Risk:

While the growth potential is undeniable, investing in HIMS stock carries inherent risks. These include:

- Intense Competition: The telehealth market is becoming increasingly crowded, with established players and new entrants vying for market share. Competition could squeeze profit margins and hinder growth.

- Regulatory Scrutiny: The healthcare industry is heavily regulated. Changes in regulations could impact HIMS's operations and profitability. Understanding the regulatory landscape is crucial before investing.

- Dependence on Subscription Model: The company's success hinges on maintaining high subscription rates. Any significant decline in subscriptions could negatively impact the stock price.

- Marketing and Acquisition Costs: Acquiring new customers requires significant marketing investment. The return on these investments is crucial for long-term sustainability.

HIMS Stock: Potential Upsides

Despite the risks, several factors point towards a potentially positive outlook for HIMS stock:

- Growing Market Demand: The demand for convenient, accessible healthcare is steadily increasing, particularly among younger demographics. This trend is a significant tailwind for HIMS.

- Technological Innovation: HIMS is constantly innovating and expanding its product and service offerings, adapting to evolving consumer needs and market trends.

- Brand Recognition: The company has built a recognizable brand, establishing trust and customer loyalty.

- Expansion Opportunities: Further expansion into new markets and the introduction of new healthcare services offer significant growth potential.

Should You Invest?

The decision to invest in HIMS stock is ultimately personal and depends on your risk tolerance and investment goals. It's crucial to conduct thorough due diligence, researching the company's financial performance, competitive landscape, and future outlook. Consider consulting with a financial advisor before making any investment decisions. Remember, past performance is not indicative of future results, and investing in the stock market always carries risk.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in stocks involves risk, and you could lose money.

Further Reading: For more in-depth financial analysis, consider exploring resources like [link to reputable financial news source] and [link to SEC filings for HIMS].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Risky Investment? A Deeper Look.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chinese Ev Maker Nios Q1 Results A Deep Dive Into Deliveries And Tariffs

Jun 03, 2025

Chinese Ev Maker Nios Q1 Results A Deep Dive Into Deliveries And Tariffs

Jun 03, 2025 -

Economic Calendar Tracking Asias Key Economic Indicators June 2 2025

Jun 03, 2025

Economic Calendar Tracking Asias Key Economic Indicators June 2 2025

Jun 03, 2025 -

Chinese Ev Maker Nio Q1 Earnings Preview And Tariff Concerns

Jun 03, 2025

Chinese Ev Maker Nio Q1 Earnings Preview And Tariff Concerns

Jun 03, 2025 -

Support For Sheinelle Jones Today Show Family Gathers Following Husbands Passing

Jun 03, 2025

Support For Sheinelle Jones Today Show Family Gathers Following Husbands Passing

Jun 03, 2025 -

North Texas Police Conclude Manhunt Arresting Capital Murder Fugitive

Jun 03, 2025

North Texas Police Conclude Manhunt Arresting Capital Murder Fugitive

Jun 03, 2025