Economic Calendar: Tracking Asia's Key Economic Indicators (June 2, 2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Calendar: Tracking Asia's Key Economic Indicators (June 2, 2025)

Asia's economic landscape is a dynamic and complex one, making it crucial for investors and businesses to stay informed about key economic indicators. June 2nd, 2025, marks a significant date for understanding the region's economic pulse, with several crucial data releases painting a picture of growth, stability, and potential challenges. This article will guide you through the key economic indicators to watch and their potential impact.

Understanding the Importance of Asia's Economic Indicators

Asia's economic performance significantly influences the global economy. The region boasts several rapidly growing economies, including China, India, and South Korea, whose performance ripples outwards, affecting global trade, investment, and commodity prices. Monitoring key economic indicators allows stakeholders to:

- Predict market trends: Understanding economic trends helps businesses make informed decisions about investment, production, and expansion.

- Manage risk: Awareness of potential economic downturns allows for proactive risk management strategies.

- Inform investment strategies: Economic data informs investment decisions, helping investors identify opportunities and mitigate risks.

- Gauge government policy effectiveness: Economic indicators offer insights into the effectiveness of government policies aimed at stimulating growth or managing inflation.

Key Economic Indicators to Watch on June 2nd, 2025 (and beyond)

While the specific releases on June 2nd, 2025, are hypothetical for this article, we can highlight the types of indicators that are consistently crucial for understanding Asia's economic health:

1. Manufacturing PMI (Purchasing Managers' Index): This indicator measures the activity level of manufacturing companies. A PMI above 50 generally suggests expansion, while a reading below indicates contraction. Keep an eye out for releases from major economies like China, Japan, and South Korea. [Link to a reputable source on PMI, e.g., IHS Markit]

2. Inflation Data (CPI & PPI): Consumer Price Index (CPI) and Producer Price Index (PPI) track the changes in the price of goods and services. High inflation can signal economic instability and may lead to policy changes by central banks. Monitoring inflation in countries like India and Indonesia is particularly important. [Link to a reputable source on inflation data, e.g., Trading Economics]

3. Trade Balance: The difference between a country's exports and imports reveals its trade performance. A positive trade balance indicates a surplus, while a negative balance suggests a deficit. China's trade balance, for instance, is a major global economic driver. [Link to a reputable source on trade balance data, e.g., World Bank]

4. GDP Growth: Gross Domestic Product (GDP) is the most comprehensive measure of a country's economic output. Regular GDP releases offer a broad perspective on economic health. Tracking GDP growth in countries like India and Vietnam is crucial for understanding regional trends. [Link to a reputable source on GDP data, e.g., IMF]

5. Interest Rate Decisions: Central banks in Asia regularly adjust interest rates to manage inflation and stimulate economic growth. Announcements from the People's Bank of China or the Reserve Bank of India are particularly impactful. [Link to a reputable source on interest rates, e.g., central bank websites]

Analyzing the Data and Making Informed Decisions

Interpreting economic data requires careful consideration of various factors, including geopolitical events, seasonal variations, and the specific economic context of each country. It's advisable to consult reputable sources and seek professional advice for making significant investment or business decisions based on economic indicators.

Conclusion: Staying Ahead of the Curve

The Asian economic calendar is packed with vital information. By closely monitoring these key economic indicators and understanding their implications, investors, businesses, and policymakers can make more informed decisions and navigate the complexities of Asia's dynamic economic landscape. Stay informed and stay ahead. Remember to consult multiple credible sources for the most accurate and up-to-date information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Calendar: Tracking Asia's Key Economic Indicators (June 2, 2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roots Masterclass England Edges West Indies In Cardiff Thriller

Jun 03, 2025

Roots Masterclass England Edges West Indies In Cardiff Thriller

Jun 03, 2025 -

Public Reaction To Sydney Sweeneys Bath Water Soap Hype Or Health Hazard

Jun 03, 2025

Public Reaction To Sydney Sweeneys Bath Water Soap Hype Or Health Hazard

Jun 03, 2025 -

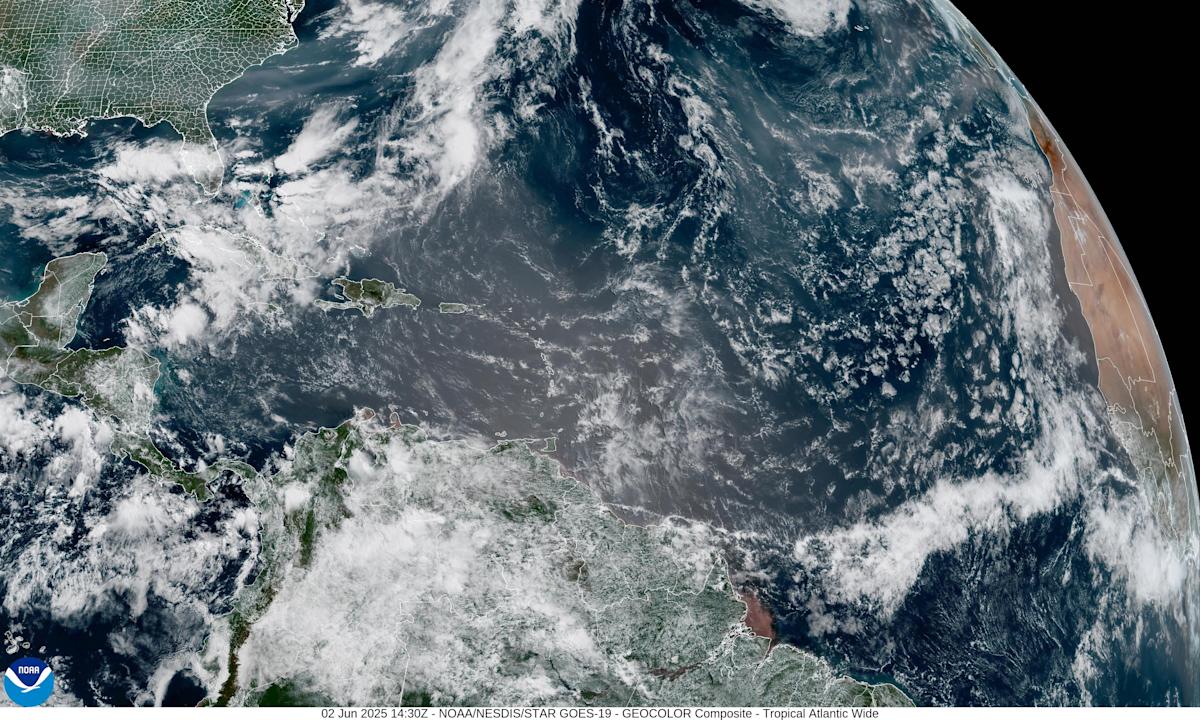

Saharan Dust And Canadian Wildfires A Florida Air Quality Crisis

Jun 03, 2025

Saharan Dust And Canadian Wildfires A Florida Air Quality Crisis

Jun 03, 2025 -

Hims And Hers Hims Stock Performance 3 02 Uptick On May 30

Jun 03, 2025

Hims And Hers Hims Stock Performance 3 02 Uptick On May 30

Jun 03, 2025 -

Patti Lu Pone Faces Backlash Hundreds Of Broadway Artists Denounce Actions

Jun 03, 2025

Patti Lu Pone Faces Backlash Hundreds Of Broadway Artists Denounce Actions

Jun 03, 2025