Chinese EV Maker NIO: Q1 Earnings Preview And Tariff Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese EV Maker NIO: Q1 Earnings Preview and Tariff Concerns

Chinese electric vehicle (EV) maker NIO is gearing up to release its first-quarter 2024 earnings, and investors are on the edge of their seats. The report, expected [insert expected release date], will offer crucial insights into the company's performance amidst a complex landscape of growing competition, shifting consumer demand, and lingering concerns about potential US tariffs. This article will delve into the key aspects investors should watch for and analyze the impact of potential tariff hikes on NIO's future.

NIO's Q1 2024: What to Expect

Analysts predict [insert range of predicted deliveries and revenue figures], reflecting the ongoing challenges and opportunities within the Chinese EV market. Several factors will significantly influence NIO's Q1 results:

-

Delivery Numbers: The number of vehicles delivered will be a key indicator of NIO's market share and overall growth trajectory. Any significant deviation from analyst expectations could trigger market volatility. Stronger-than-expected deliveries will likely boost investor confidence, while weaker numbers could signal trouble.

-

Gross Margin: Maintaining a healthy gross margin is crucial for NIO's long-term sustainability. Pressure from competition and rising raw material costs could impact profitability. Investors will closely scrutinize the gross margin figures to assess the company's pricing strategy and cost management effectiveness.

-

New Model Launches and Demand: The success of newly launched models, if any, will be a pivotal factor. Strong demand for new vehicles indicates successful product development and market positioning, while weak demand might raise concerns about future growth.

-

Research & Development (R&D) Spending: NIO's continued investment in R&D is vital for its competitiveness. While increased spending might temporarily impact profitability, it signifies a commitment to innovation and future growth.

The Looming Threat of US Tariffs

The potential imposition or increase of US tariffs on Chinese imports, including EVs, poses a significant threat to NIO's ambitions in the North American market. While NIO has a relatively small presence in the US compared to its domestic market, any tariff increase could severely hinder its expansion plans and impact its overall profitability. The ongoing trade tensions between the US and China add an element of uncertainty to NIO's future prospects. Investors are closely watching developments on this front.

NIO's Strategic Response

NIO is likely to employ several strategies to mitigate the potential negative impact of tariffs:

-

Localization Strategies: Increasing local production in target markets could reduce reliance on Chinese manufacturing and associated tariff implications.

-

Pricing Adjustments: Adjusting pricing strategies in the US market to absorb potential tariff increases is a possibility, although this could impact sales volume.

-

Focus on Domestic Market: Strengthening its position in the rapidly expanding Chinese EV market will help offset any losses incurred in international markets.

Conclusion:

NIO's Q1 2024 earnings report will be a crucial event for investors. The results, combined with the ongoing uncertainty surrounding US tariffs, will paint a clearer picture of the company's short-term and long-term prospects. Investors should carefully analyze all aspects of the report, including delivery figures, gross margin, R&D spending, and the company's strategic response to potential tariff challenges. The next few weeks will be critical for NIO, and the market will react strongly to the news. Stay tuned for updates as the earnings release approaches.

Keywords: NIO, NIO stock, Chinese EV maker, Q1 earnings, electric vehicle, EV market, US tariffs, China-US trade, EV sales, gross margin, R&D spending, NIO stock price, NIO forecast, NIO future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO: Q1 Earnings Preview And Tariff Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

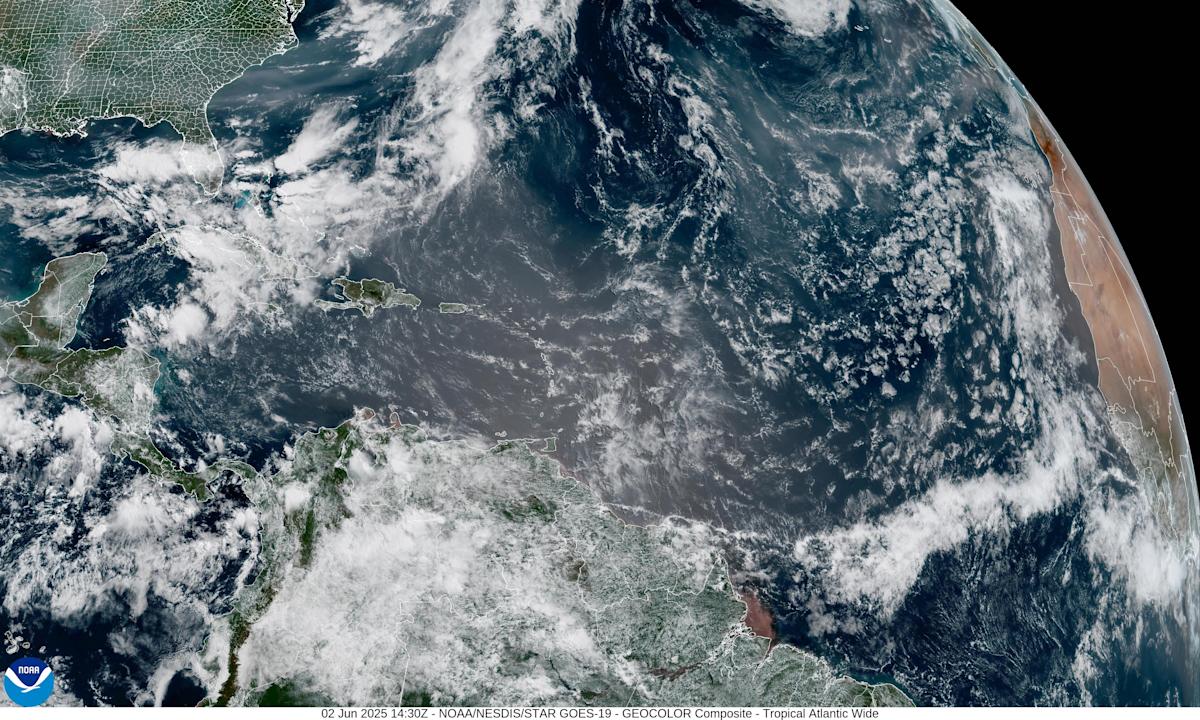

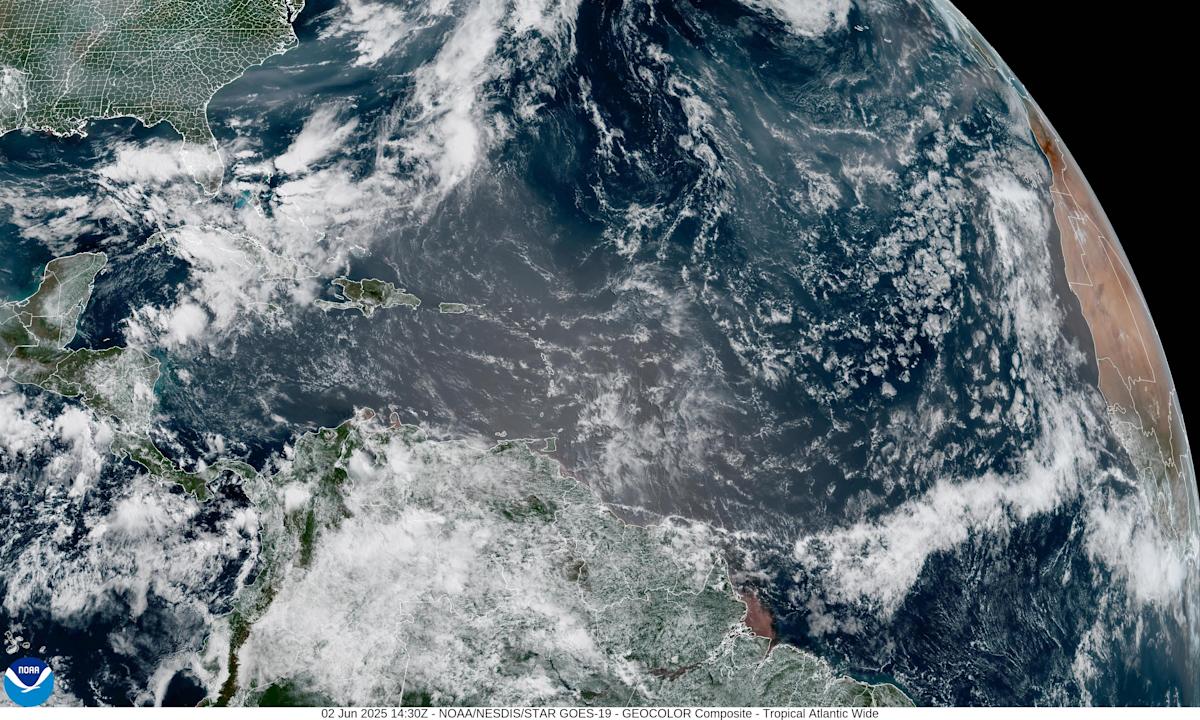

Canadian Wildfires And Saharan Dust A Double Threat To Floridas Air Quality

Jun 03, 2025

Canadian Wildfires And Saharan Dust A Double Threat To Floridas Air Quality

Jun 03, 2025 -

Support For Sheinelle Jones Today Show Family At Uche Ojehs Service

Jun 03, 2025

Support For Sheinelle Jones Today Show Family At Uche Ojehs Service

Jun 03, 2025 -

Saharan Dust And Canadian Wildfires A Perfect Storm Over Florida

Jun 03, 2025

Saharan Dust And Canadian Wildfires A Perfect Storm Over Florida

Jun 03, 2025 -

Ukraine Accuses Russia New Underwater Drone Attack On Crimean Bridge

Jun 03, 2025

Ukraine Accuses Russia New Underwater Drone Attack On Crimean Bridge

Jun 03, 2025 -

Underwater Attack On Crimean Bridge Ukraines Alleged Role And Strategic Implications

Jun 03, 2025

Underwater Attack On Crimean Bridge Ukraines Alleged Role And Strategic Implications

Jun 03, 2025