Investing In Clean Energy: The Tax Implications For America's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Clean Energy: The Tax Implications for America's Future

The transition to a clean energy economy is no longer a distant prospect; it's a rapidly unfolding reality. As the United States accelerates its efforts to combat climate change and achieve energy independence, investing in clean energy technologies presents both significant opportunities and complex tax implications. Understanding these implications is crucial for individuals and businesses looking to participate in this burgeoning sector.

The Allure of Clean Energy Investments:

The clean energy sector encompasses a vast array of technologies, including solar, wind, geothermal, hydropower, and advanced biofuels. Government incentives, coupled with growing public and private sector investment, have fueled substantial growth. This creates attractive investment opportunities, but the tax landscape can be intricate.

Key Tax Credits and Incentives:

Several federal and state tax credits and incentives are designed to encourage clean energy investments. These include:

-

Investment Tax Credit (ITC): This credit offers a significant reduction in tax liability for investments in solar, wind, fuel cells, and other qualifying renewable energy technologies. The ITC percentage can vary depending on the technology and project size. .

-

Production Tax Credit (PTC): This credit is available for electricity generated from renewable sources, such as wind and solar. It's calculated based on the amount of electricity produced.

-

Renewable Energy Tax Credits for Businesses: Numerous other incentives exist specifically tailored for businesses investing in clean energy infrastructure, including accelerated depreciation and bonus depreciation.

-

State-Level Incentives: Many states offer their own tax credits, rebates, and other incentives to encourage clean energy development within their borders. These vary significantly, so it's crucial to research your specific state's programs.

Navigating the Tax Complexity:

While these incentives are beneficial, understanding the intricacies of the tax code is paramount. Several factors influence the tax implications of clean energy investments:

-

Project Size and Structure: The size and structure of a clean energy project can significantly impact the applicable tax credits and deductions.

-

Ownership Structure: Whether you're investing as an individual, through a partnership, or a corporation will influence how tax benefits are realized.

-

Compliance Requirements: Strict compliance requirements must be met to claim tax credits and avoid penalties. Accurate record-keeping and timely filing are essential.

Tax Planning Strategies:

Effective tax planning is crucial to maximize the benefits of clean energy investments. This often involves:

-

Consulting with Tax Professionals: Engaging a qualified tax advisor experienced in clean energy tax incentives is highly recommended. They can help navigate the complexities of the tax code and ensure compliance.

-

Careful Project Design: Structuring the project in a tax-efficient manner from the outset can significantly improve returns.

-

Long-Term Financial Planning: Clean energy investments are often long-term endeavors. Understanding the tax implications over the entire project lifespan is vital for making informed decisions.

The Future of Clean Energy and Tax Policy:

The future of clean energy tax policy remains dynamic. As the United States continues its commitment to decarbonization, we can expect ongoing adjustments to tax incentives and regulations. Staying informed about these changes is crucial for anyone involved in the clean energy sector.

Conclusion:

Investing in clean energy offers a compelling opportunity to contribute to a sustainable future while potentially realizing significant financial returns. However, navigating the complex tax landscape is essential to maximize benefits and avoid potential pitfalls. Proactive tax planning and expert guidance are key to success in this rapidly evolving field. By carefully considering the tax implications, investors can position themselves for long-term growth and contribute to a cleaner, more sustainable America.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Clean Energy: The Tax Implications For America's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

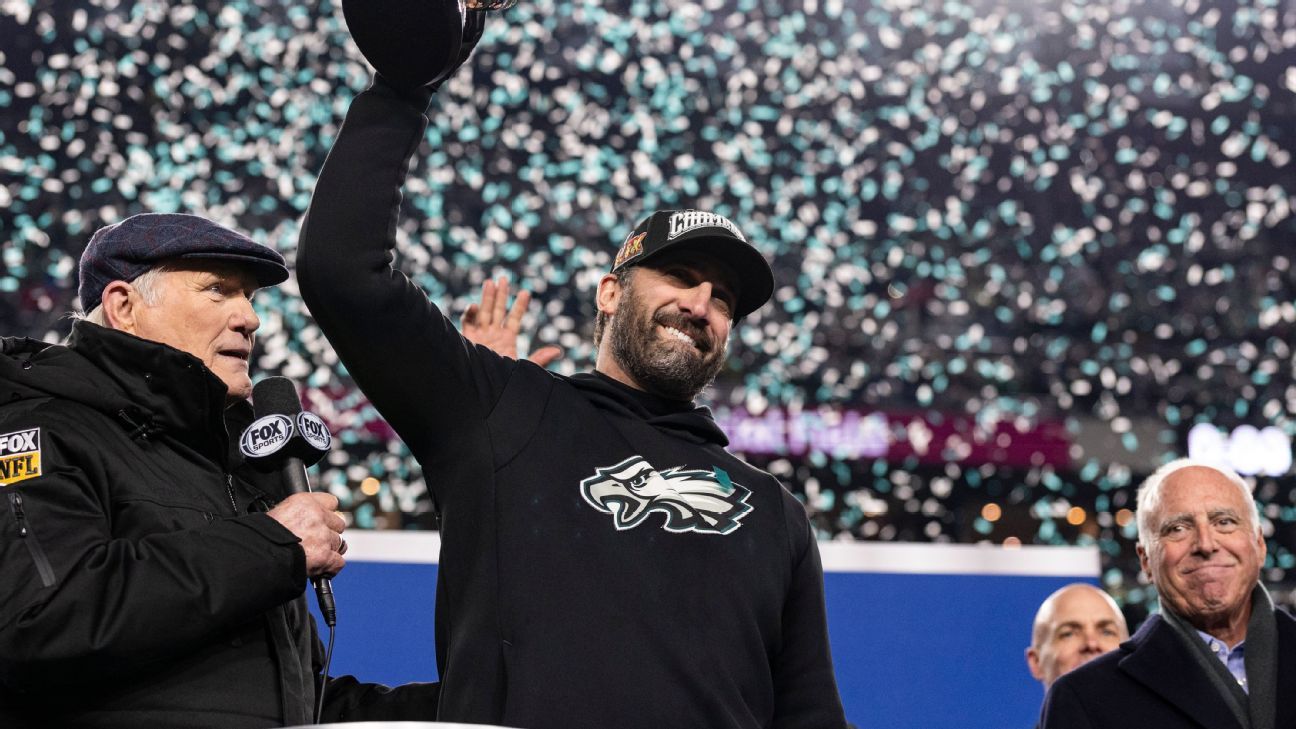

Nick Siriannis Future Secure Eagles Announce Contract Extension

May 20, 2025

Nick Siriannis Future Secure Eagles Announce Contract Extension

May 20, 2025 -

Market Rally Continues S And P 500 Leads Gains As Investors Shake Off Moodys

May 20, 2025

Market Rally Continues S And P 500 Leads Gains As Investors Shake Off Moodys

May 20, 2025 -

U S Treasury Yield Slip Fed Projects Only One Interest Rate Cut By 2025

May 20, 2025

U S Treasury Yield Slip Fed Projects Only One Interest Rate Cut By 2025

May 20, 2025 -

Putin Demonstrates Trumps Unimportance On The World Stage

May 20, 2025

Putin Demonstrates Trumps Unimportance On The World Stage

May 20, 2025 -

Unpacking Taylor Jenkins Reids Publishing Dominance Strategy And Success

May 20, 2025

Unpacking Taylor Jenkins Reids Publishing Dominance Strategy And Success

May 20, 2025