$5B+ Bitcoin ETF Investments: A Bold Bet On Crypto's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>$5B+ Bitcoin ETF Investments: A Bold Bet on Crypto's Future</h1>

The cryptocurrency market is buzzing with excitement as investments in Bitcoin exchange-traded funds (ETFs) surpass the $5 billion mark. This monumental surge signifies a significant shift in institutional investors' perception of Bitcoin and its potential as a mainstream asset. But is this a bold, calculated bet on crypto's future, or a risky gamble? Let's delve into the details.

<h2>The Rise of Bitcoin ETFs: A Mainstream Milestone</h2>

The approval of the first Bitcoin futures ETF in the US marked a pivotal moment for the crypto industry. This paved the way for a wave of similar products, attracting significant investment from both institutional and retail investors. The recent surge past the $5 billion investment threshold underlines growing confidence in Bitcoin's long-term viability as a store of value and a potential hedge against inflation. This isn't just about speculation; it reflects a strategic shift towards integrating crypto assets into diversified portfolios.

<h3>Why the Massive Investment?</h3>

Several factors contribute to this unprecedented level of investment:

- Increased Regulatory Clarity: While regulatory landscapes remain complex, the gradual acceptance and clarification of rules surrounding Bitcoin ETFs have boosted investor confidence. This reduced uncertainty makes it easier for institutional players to allocate funds.

- Institutional Adoption: Major financial institutions are increasingly recognizing Bitcoin's potential. Their participation legitimizes the asset class and encourages further investment. This move away from purely speculative investments towards strategic allocation signals a maturing market.

- Inflation Hedge Potential: With persistent global inflation, investors are seeking alternative assets to preserve their purchasing power. Bitcoin, with its limited supply, is viewed by some as a potential hedge against inflation, making it an attractive investment option.

- Growing Demand: The demand for exposure to Bitcoin without the complexities of direct ownership is driving the surge in ETF investments. ETFs offer a convenient and regulated pathway for investors to gain Bitcoin exposure.

<h2>Risks and Considerations: Navigating the Crypto Landscape</h2>

Despite the optimism, investing in Bitcoin ETFs is not without risks. The cryptocurrency market remains volatile, subject to price swings driven by various factors including regulatory changes, market sentiment, and technological developments.

- Market Volatility: Bitcoin's price history demonstrates significant volatility. While this can lead to substantial gains, it also exposes investors to potential losses. Understanding and managing this risk is crucial.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies continues to evolve. Changes in regulations could significantly impact the value of Bitcoin ETFs.

- Security Concerns: While ETFs mitigate some security risks associated with direct Bitcoin ownership, risks associated with the exchange or custodian remain.

<h2>The Future of Bitcoin ETFs and Crypto Investment</h2>

The $5 billion milestone represents a significant step towards the mainstream adoption of cryptocurrencies. The continued growth of Bitcoin ETFs suggests a growing belief in Bitcoin's long-term potential. However, it's crucial to remember that investing in any asset, especially in volatile markets like cryptocurrencies, involves risk. Conduct thorough research and understand the potential downsides before investing.

<h3>What to do next?</h3>

For those considering Bitcoin ETF investments, consult with a qualified financial advisor to assess your risk tolerance and develop a suitable investment strategy. Remember, diversification is key to mitigating risk within any investment portfolio. Learn more about [link to reputable financial news source on Bitcoin ETFs].

This surge in investment marks a significant turning point. The future of Bitcoin and the broader cryptocurrency market remains uncertain, but the $5 billion+ invested in ETFs strongly suggests a growing belief in crypto's potential to reshape the financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Bitcoin ETF Investments: A Bold Bet On Crypto's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Peaky Blinders Series Confirmed What To Expect From The Next Installment

May 21, 2025

New Peaky Blinders Series Confirmed What To Expect From The Next Installment

May 21, 2025 -

Brett Favres Fallout A J Perez Discusses Threats And The Impact On Untold

May 21, 2025

Brett Favres Fallout A J Perez Discusses Threats And The Impact On Untold

May 21, 2025 -

Decoding A Gleason Score Of 9 Implications And Treatment Options

May 21, 2025

Decoding A Gleason Score Of 9 Implications And Treatment Options

May 21, 2025 -

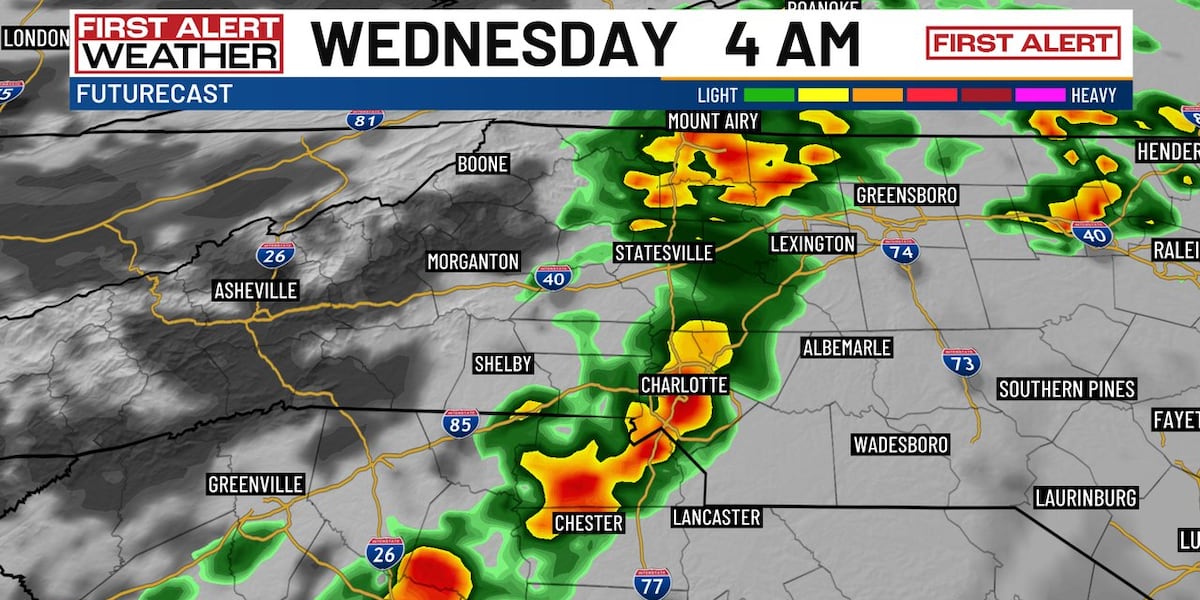

Charlotte Facing Overnight Storms Cooldown To Follow

May 21, 2025

Charlotte Facing Overnight Storms Cooldown To Follow

May 21, 2025 -

Stock Market Update Positive Momentum Continues Despite Moodys Downgrade

May 21, 2025

Stock Market Update Positive Momentum Continues Despite Moodys Downgrade

May 21, 2025