Impact Of Fed's Rate Cut Projection: Lower US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Projection Sends US Treasury Yields Lower: What It Means for Investors

The Federal Reserve's recent projection of potential interest rate cuts has sent ripples through the financial markets, notably causing a significant decline in US Treasury yields. This move, signaling a potential shift towards a more accommodative monetary policy, has investors scrambling to understand the implications. But what does this actually mean for the average investor and the broader economy? Let's delve into the details.

Understanding the Connection: Fed Rate Cuts and Treasury Yields

US Treasury yields move inversely to bond prices. When the Fed hints at or implements rate cuts, it typically suggests a less aggressive stance on inflation. This, in turn, makes bonds – including US Treasuries – relatively more attractive compared to other investments offering higher yields but potentially greater risk. The increased demand for these safer assets pushes their prices up, consequently lowering their yields. The recent projection of rate cuts is a prime example of this dynamic in action.

The Impact of Lower Yields:

The decline in US Treasury yields has several important implications:

- Mortgage Rates: Lower Treasury yields often translate to lower mortgage rates, making homeownership more affordable and potentially stimulating the housing market. This could be a significant boon for the real estate sector.

- Corporate Borrowing Costs: Businesses may find it cheaper to borrow money, potentially boosting investment and economic growth. Lower borrowing costs can fuel expansion and job creation.

- Investment Strategies: Investors are now reevaluating their portfolios. With lower yields on traditionally safe assets like Treasuries, some might seek higher returns in riskier investments like stocks or corporate bonds. This shift in investment behavior can have far-reaching consequences on market performance.

- Dollar's Strength: While initially, a rate cut projection might weaken the US dollar, the long-term effects are complex and depend on various global economic factors. A weaker dollar could boost exports, but also increase import costs.

What Drove the Fed's Projection?

The Fed's projection of rate cuts reflects concerns about potential economic slowdown. Recent economic data, including slower-than-expected job growth and persistent inflation, prompted the shift in their outlook. The aim is to prevent a recession by easing monetary policy, providing a cushion against economic headwinds.

Looking Ahead: Uncertainty Remains

While the lower US Treasury yields are a direct result of the Fed's projection, the future remains uncertain. Several factors could influence the trajectory of yields, including:

- Inflation Data: Future inflation reports will be crucial in shaping the Fed's actual actions. Persistent high inflation might lead to a more cautious approach to rate cuts.

- Global Economic Conditions: Global economic uncertainties, including geopolitical tensions and international trade disputes, could significantly impact the US economy and the Fed's policy decisions.

- Market Sentiment: Investor sentiment and overall market confidence play a major role in determining the direction of Treasury yields.

Conclusion:

The Fed's rate cut projection has undeniably impacted US Treasury yields, lowering them and influencing various sectors of the economy. However, this is a dynamic situation, and investors need to carefully monitor economic indicators and global events to make informed investment decisions. The coming months will be crucial in determining the full impact of this policy shift. It's advisable to consult with a financial advisor before making any significant investment changes based on these market fluctuations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Projection: Lower US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

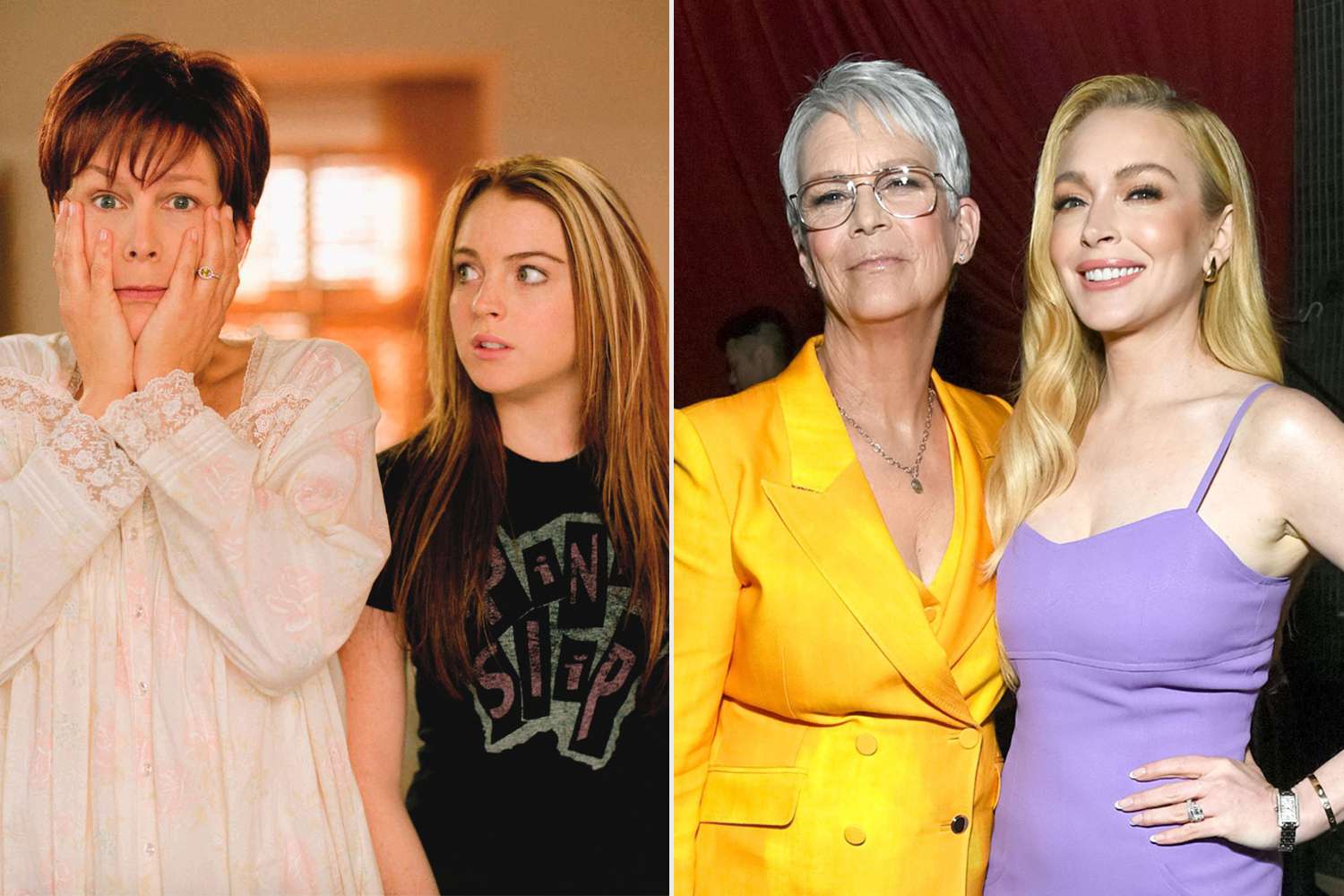

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Today

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Today

May 20, 2025 -

Fed Signals Single Rate Cut In 2025 Sending Us Treasury Yields Lower

May 20, 2025

Fed Signals Single Rate Cut In 2025 Sending Us Treasury Yields Lower

May 20, 2025 -

Climate Changes Devastating Effect On Pregnancy Outcomes A Global Health Concern

May 20, 2025

Climate Changes Devastating Effect On Pregnancy Outcomes A Global Health Concern

May 20, 2025 -

Venezuelan Tps Holders Face Deportation After Supreme Court Ruling

May 20, 2025

Venezuelan Tps Holders Face Deportation After Supreme Court Ruling

May 20, 2025 -

Cathay Pacifics First Aviation Training Program Graduates

May 20, 2025

Cathay Pacifics First Aviation Training Program Graduates

May 20, 2025