Six-Day Win Streak For S&P 500: Market Defies Moody's, Stocks Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Six-Day Win Streak for S&P 500: Market Defies Moody's Downgrade, Stocks Surge

The S&P 500 just achieved something remarkable: a six-day winning streak, defying expectations and sending a clear signal of market resilience. This impressive rally comes on the heels of Moody's downgrade of several small and mid-sized US banks, a move that many analysts predicted would trigger a significant market correction. Instead, the market has shown surprising strength, leaving investors wondering what's driving this unexpected surge.

Moody's Downgrade and Market Reaction: A Tale of Two Narratives

Moody's recent downgrade of 10 US regional banks, citing concerns about credit quality and the potential impact of rising interest rates, sent ripples through the financial world. The action fueled anxieties about the banking sector's stability and its potential spillover effects on the broader economy. However, the market's response has been far from the anticipated panic. This divergence highlights the complex interplay of factors influencing investor sentiment.

Factors Fueling the S&P 500's Six-Day Rally:

Several factors are contributing to the S&P 500's unexpected six-day winning streak:

-

Strong Corporate Earnings: A string of better-than-expected corporate earnings reports has boosted investor confidence. Companies across various sectors have shown resilience, defying concerns about a looming recession. Strong earnings often translate into higher stock prices, contributing significantly to market gains. This positive trend suggests that many businesses are navigating the current economic climate more effectively than initially anticipated.

-

Resilient Consumer Spending: Despite rising interest rates and persistent inflation, consumer spending remains relatively robust. This resilience indicates that the economy is not as weak as some forecasts suggested, providing a counter-narrative to recessionary fears. Continued consumer spending fuels economic growth and, subsequently, strengthens the stock market.

-

Easing Inflation Concerns: While inflation remains above the Federal Reserve's target, there are signs that price increases are moderating. This easing of inflationary pressures reduces the likelihood of more aggressive interest rate hikes by the Fed, benefiting both businesses and investors. Decreased inflation expectations often contribute to increased market stability and investor confidence.

-

Technical Factors: Technical analysis suggests that the market may have been oversold in the preceding weeks, creating a buying opportunity for investors. This technical rebound, coupled with positive fundamental news, has amplified the market's upward momentum. Understanding technical indicators can be invaluable for short-term trading strategies, but it's essential to also consider the bigger economic picture.

What Does the Future Hold for the S&P 500?

While the six-day winning streak is undeniably impressive, it's crucial to avoid premature celebrations. The market remains susceptible to various economic headwinds, including potential further interest rate increases and lingering geopolitical uncertainties. The resilience shown so far is encouraging, but sustained growth will depend on the continued strength of corporate earnings, consumer spending, and the overall economic outlook. Careful analysis of upcoming economic indicators and corporate reports remains crucial for informed investment decisions.

Further Reading:

- [Link to article on recent corporate earnings reports]

- [Link to article on the latest inflation data]

- [Link to article on Federal Reserve policy]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Six-Day Win Streak For S&P 500: Market Defies Moody's, Stocks Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

One Rate Cut Predicted For 2025 Impact On U S Treasury Yields

May 20, 2025

One Rate Cut Predicted For 2025 Impact On U S Treasury Yields

May 20, 2025 -

Putins Actions Highlight Trumps Reduced Global Impact

May 20, 2025

Putins Actions Highlight Trumps Reduced Global Impact

May 20, 2025 -

My 600 Lb Life Cast Member Latonya Pottain Passes Away At Age 40

May 20, 2025

My 600 Lb Life Cast Member Latonya Pottain Passes Away At Age 40

May 20, 2025 -

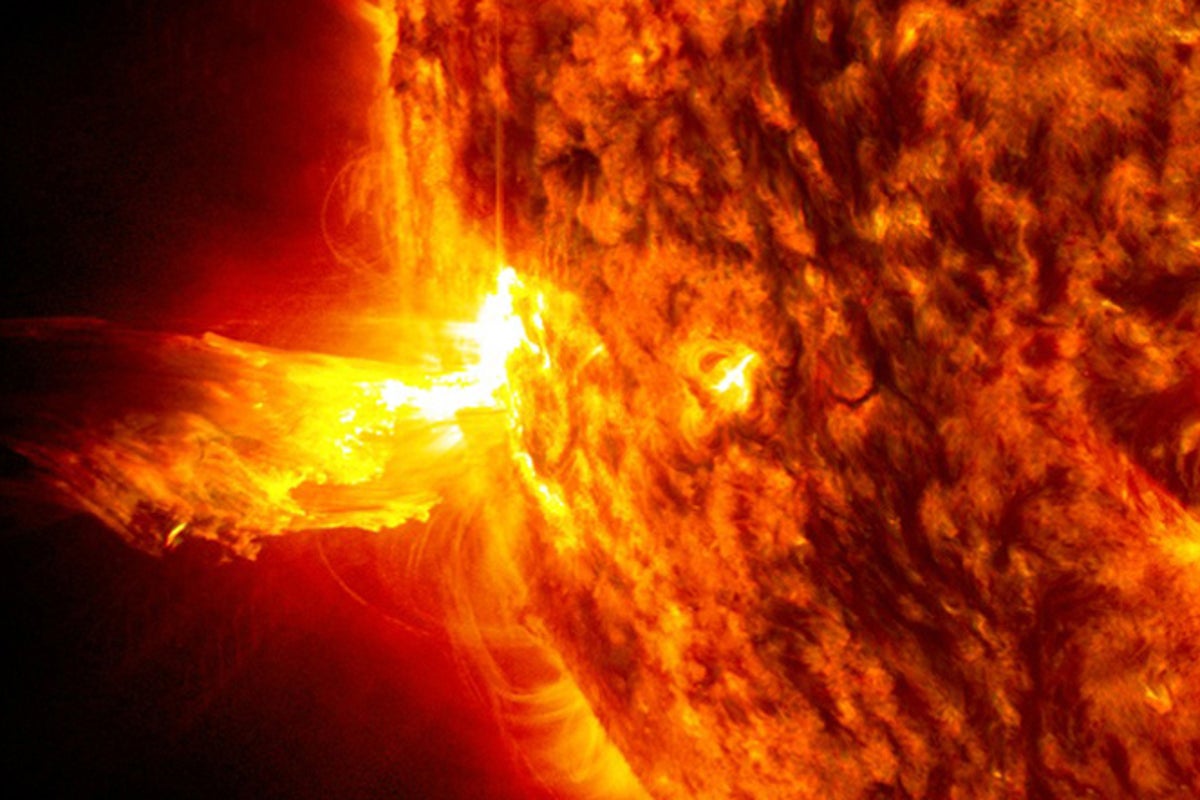

Solar Storm Warning Nasa Forecasts Widespread Blackouts

May 20, 2025

Solar Storm Warning Nasa Forecasts Widespread Blackouts

May 20, 2025 -

Moodys Downgrade Fails To Dampen Market Strong Gains For S And P 500 Dow And Nasdaq

May 20, 2025

Moodys Downgrade Fails To Dampen Market Strong Gains For S And P 500 Dow And Nasdaq

May 20, 2025