US Treasury Yields Dip As Federal Reserve Hints At One 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Fed Hints at Potential 2025 Rate Reduction

US Treasury yields experienced a decline following Federal Reserve Chair Jerome Powell's recent comments suggesting a potential interest rate cut in 2025. This shift in market sentiment reflects a growing expectation that the aggressive interest rate hiking cycle implemented to combat inflation may be nearing its end. The implications for investors and the broader economy are significant.

The Federal Reserve has been actively raising interest rates throughout 2022 and 2023 in an effort to curb stubbornly high inflation. This strategy, while effective in slowing price growth, has also raised concerns about potential economic slowdowns and the risk of a recession. Powell's comments, however subtle, offered a glimmer of hope for a more accommodative monetary policy in the future.

What Drove the Yield Dip?

The market reacted positively to the suggestion of a single rate cut in 2025, primarily because it signaled a potential pivot away from the current tightening stance. This implied a belief that inflation is likely to cool sufficiently to allow the Fed to ease its monetary policy without jeopardizing its inflation targets. The specific language used by Powell, while not explicitly promising a rate cut, was interpreted by many analysts as a softening of the Fed's hawkish tone. This interpretation fueled a sell-off in Treasury bonds, driving yields lower.

Understanding the Implications

The dip in US Treasury yields has several important implications:

- Lower borrowing costs: Reduced yields generally translate to lower borrowing costs for businesses and consumers. This could stimulate economic activity, particularly in sectors sensitive to interest rate changes, such as housing and automobiles.

- Increased investor demand for bonds: Lower yields make bonds more attractive to income-seeking investors, potentially increasing demand and supporting bond prices.

- Impact on the dollar: A less hawkish Fed could weaken the US dollar relative to other currencies, potentially impacting international trade and investment flows. . (External link – Investopedia)

- Uncertainty remains: Despite the positive market reaction, significant uncertainty remains. Inflation could prove more persistent than anticipated, forcing the Fed to maintain or even increase interest rates for longer than currently projected. Geopolitical factors and unexpected economic shocks could also significantly alter the outlook.

What to Watch For

Investors and economists will be closely monitoring several key economic indicators in the coming months, including inflation data, employment figures, and consumer spending. These indicators will provide crucial insights into the health of the economy and help determine whether the Fed's projection of a single rate cut in 2025 remains plausible. The Fed's upcoming meetings will also be crucial in gauging the central bank's future course of action.

In conclusion, the recent dip in US Treasury yields reflects a shift in market expectations regarding the future trajectory of interest rates. While the potential for a rate cut in 2025 offers some optimism, considerable uncertainty remains, highlighting the importance of closely monitoring key economic indicators and Fed communications. This situation underscores the complex interplay between monetary policy, inflation, and market sentiment, a dynamic that will continue to shape the global financial landscape in the coming months and years.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Dip As Federal Reserve Hints At One 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Messages Of Solidarity Pour In For President Biden After Cancer Announcement

May 20, 2025

Messages Of Solidarity Pour In For President Biden After Cancer Announcement

May 20, 2025 -

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Where To Watch

May 20, 2025

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Where To Watch

May 20, 2025 -

Philadelphia Eagles Reward Sirianni A Multi Year Contract Extension

May 20, 2025

Philadelphia Eagles Reward Sirianni A Multi Year Contract Extension

May 20, 2025 -

Widespread Communications Failure A Massive Solar Storms Impact

May 20, 2025

Widespread Communications Failure A Massive Solar Storms Impact

May 20, 2025 -

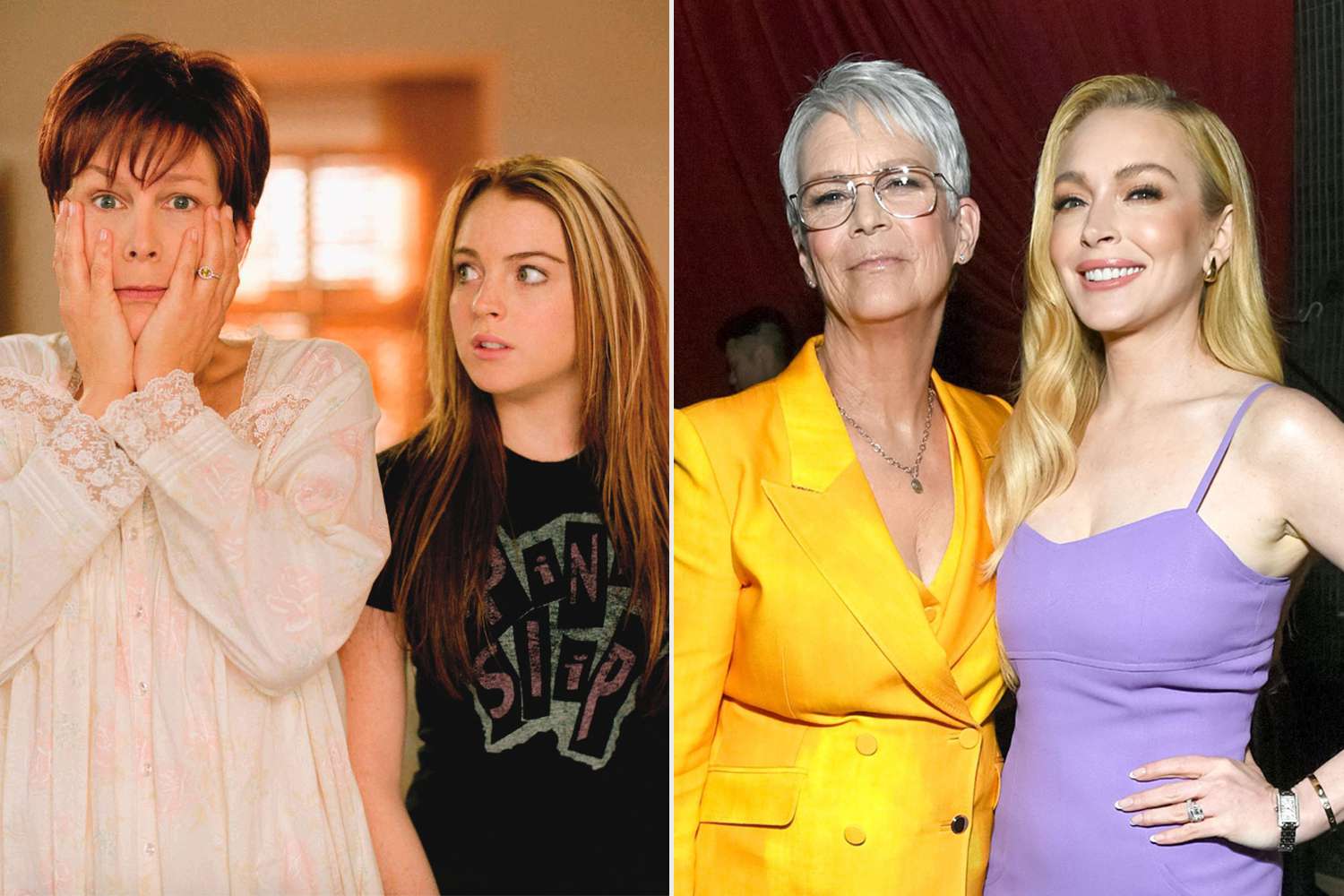

Jamie Lee Curtis Gives Insight Into Her Bond With Lindsay Lohan After Hit Film

May 20, 2025

Jamie Lee Curtis Gives Insight Into Her Bond With Lindsay Lohan After Hit Film

May 20, 2025