Hims & Hers Health (HIMS): Is The Stock Overvalued?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers Health (HIMS): Is the Stock Overvalued? A Deep Dive into the Telehealth Giant

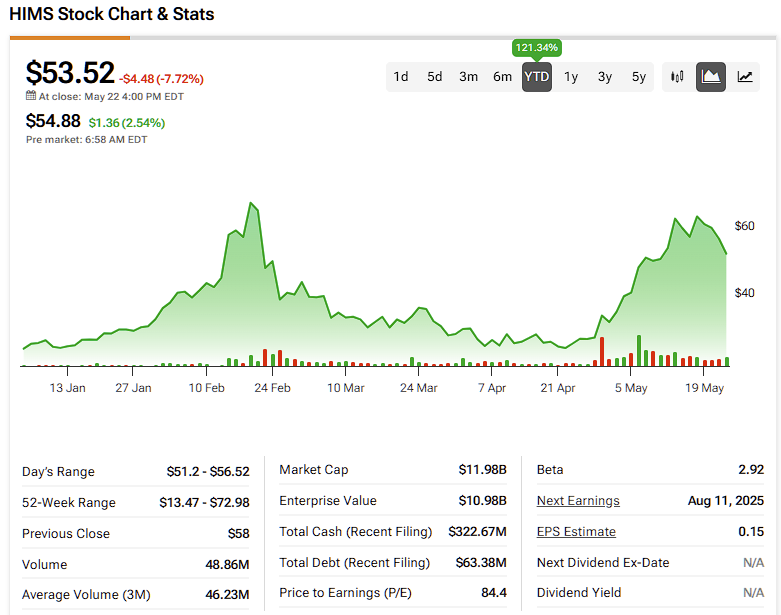

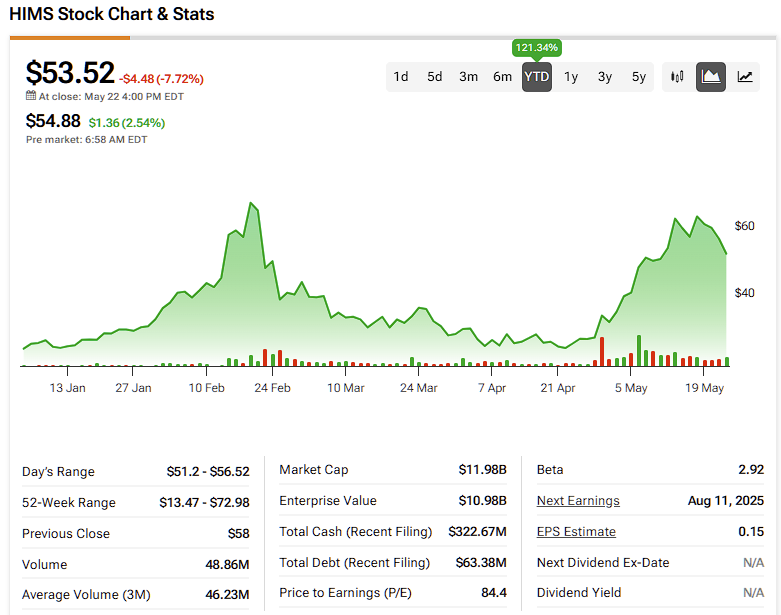

Hims & Hers Health (HIMS) has captured significant attention in the telehealth sector, offering convenient access to healthcare services. But with its stock price fluctuating, many investors are asking: is HIMS stock overvalued? This in-depth analysis explores the company's performance, market position, and future prospects to help answer this critical question.

Hims & Hers: A Quick Overview

Hims & Hers Health is a leading telehealth company providing a range of services, primarily focused on men's and women's health, including dermatology, sexual health, and mental health. Their direct-to-consumer model, utilizing a convenient online platform and mobile app, has attracted a substantial customer base. The company's success hinges on its ability to leverage technology to provide affordable and accessible healthcare options.

The Bull Case: Arguments for Continued Growth

Several factors support the argument that HIMS stock is not overvalued and may even have room for growth:

- Expanding Market: The telehealth market is experiencing explosive growth, fueled by increasing demand for convenient and affordable healthcare solutions. This presents a significant opportunity for HIMS to expand its market share.

- Strong Brand Recognition: Hims & Hers has built a strong brand reputation, particularly among younger demographics. This brand recognition translates to high customer acquisition rates and brand loyalty.

- Diversified Offerings: The company's diverse portfolio of services, ranging from skincare and hair loss treatments to mental health services, minimizes reliance on any single product line and enhances revenue streams.

- Strategic Partnerships: Collaborations with other healthcare providers and insurance companies could significantly boost HIMS' reach and market penetration.

The Bear Case: Concerns About Valuation

Despite the positive aspects, concerns exist regarding HIMS stock valuation:

- High Valuation: HIMS's current market capitalization might be considered high relative to its current revenue and profitability. This raises concerns about potential overvaluation.

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. This intensified competition could pressure HIMS' margins and growth rates.

- Regulatory Landscape: The evolving regulatory environment for telehealth services presents uncertainty and potential challenges for HIMS' operations. Changes in regulations could impact its business model and profitability.

- Profitability Concerns: While HIMS is experiencing significant revenue growth, achieving sustainable profitability remains a key challenge. Investors should carefully examine the company's path to profitability.

Analyzing the Financials: A Crucial Step

Investors should meticulously review HIMS' financial statements, including revenue growth, operating expenses, and net income (or loss). Key metrics to consider include:

- Revenue Growth Rate: Analyze the historical and projected revenue growth to assess the company's trajectory.

- Customer Acquisition Cost (CAC): A high CAC can signal difficulties in acquiring new customers and impacting profitability.

- Customer Lifetime Value (CLTV): A high CLTV indicates strong customer loyalty and repeat business.

- Profit Margins: Examine the company's gross and operating margins to assess its profitability.

Conclusion: A Cautious Approach

Determining whether HIMS stock is overvalued requires a comprehensive analysis of its business model, market position, financial performance, and future prospects. While the company operates in a high-growth market and has a strong brand, concerns regarding its valuation and competition warrant a cautious approach. Investors should conduct thorough due diligence before investing in HIMS stock, carefully weighing the potential risks and rewards. Consult with a financial advisor to make informed investment decisions.

Further Research:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS): Is The Stock Overvalued?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Detroit Residents Rally Against Dte Fight For Affordable Energy Rates

Jun 03, 2025

Detroit Residents Rally Against Dte Fight For Affordable Energy Rates

Jun 03, 2025 -

Jp Morgan Chase Ceo Jamie Dimons Stark Warning China Tariffs And Us Economic Fallout

Jun 03, 2025

Jp Morgan Chase Ceo Jamie Dimons Stark Warning China Tariffs And Us Economic Fallout

Jun 03, 2025 -

Detroit Politician To Grill Dte Energy On Reliability And Rate Increases At Public Forum

Jun 03, 2025

Detroit Politician To Grill Dte Energy On Reliability And Rate Increases At Public Forum

Jun 03, 2025 -

Age Is Just A Number Harry Brook On Joe Roots Enhanced Performance

Jun 03, 2025

Age Is Just A Number Harry Brook On Joe Roots Enhanced Performance

Jun 03, 2025 -

Dimon Sounds Alarm Chinas Response To Us Tariffs

Jun 03, 2025

Dimon Sounds Alarm Chinas Response To Us Tariffs

Jun 03, 2025