JPMorgan Chase CEO Jamie Dimon's Stark Warning: China Tariffs And US Economic Fallout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan Chase CEO Jamie Dimon's Stark Warning: China Tariffs and US Economic Fallout

JPMorgan Chase CEO Jamie Dimon issued a stark warning about the potential economic fallout from escalating tariffs between the United States and China. His comments, delivered during a recent earnings call, sent shockwaves through the financial markets, highlighting the precarious balance of the global economy. Dimon's concerns underscore the interconnectedness of the US and Chinese economies and the potential for widespread negative consequences if trade tensions continue to escalate.

The escalating trade war between the US and China has been a simmering concern for months, but Dimon's direct and forceful warning brought the issue into sharp focus. He painted a picture of potential economic hardship for American consumers and businesses, highlighting the significant impact these tariffs could have on the already complex global economic landscape.

Dimon's Key Concerns: A Deeper Dive

Dimon's warning wasn't based on speculation; he cited specific concerns, including:

-

Inflationary Pressures: Increased tariffs directly translate to higher prices for consumers. This can lead to reduced consumer spending, a key driver of the US economy. Dimon emphasized the potential for a significant slowdown in consumer spending as a direct result of these increased costs.

-

Supply Chain Disruptions: The intricate web of global supply chains linking the US and China is highly vulnerable to disruptions caused by tariffs. Companies relying on Chinese goods face increased costs and potential delays, impacting their profitability and potentially leading to job losses. This disruption could ripple through various sectors, affecting everything from manufacturing to retail.

-

Retaliatory Measures: China's potential retaliatory measures against US tariffs could further exacerbate the situation. These measures could target key US exports, leading to further economic hardship in specific sectors. The risk of a protracted trade war, with both sides imposing tariffs and counter-tariffs, is a significant concern.

The Broader Economic Context

Dimon's warning comes at a time when the global economy is facing multiple challenges. Rising inflation, interest rate hikes by the Federal Reserve, and geopolitical instability are all contributing factors to the current economic uncertainty. The potential impact of US-China trade tensions adds another layer of complexity to this already challenging environment. Understanding the interconnectedness of these issues is crucial to grasping the full scope of the potential economic fallout.

What Happens Next?

The future trajectory of the US-China trade relationship remains uncertain. While some analysts remain optimistic about a potential resolution, Dimon’s warning serves as a potent reminder of the significant risks involved. The impact of these tariffs will likely be felt across various sectors, requiring businesses and consumers to adapt to a potentially more challenging economic climate.

The situation calls for careful monitoring and proactive strategies from both governments and businesses. Dimon's statement should serve as a call to action, urging policymakers to find solutions that minimize the negative economic consequences of the escalating trade war. The global economy, already facing significant headwinds, can ill afford a protracted trade conflict between the world's two largest economies.

Keywords: Jamie Dimon, JPMorgan Chase, China tariffs, US economy, trade war, inflation, supply chain, economic fallout, global economy, recession, economic uncertainty, consumer spending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan Chase CEO Jamie Dimon's Stark Warning: China Tariffs And US Economic Fallout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Underwater Attack On Crimean Bridge Ukraines Latest Strike Claims

Jun 03, 2025

Underwater Attack On Crimean Bridge Ukraines Latest Strike Claims

Jun 03, 2025 -

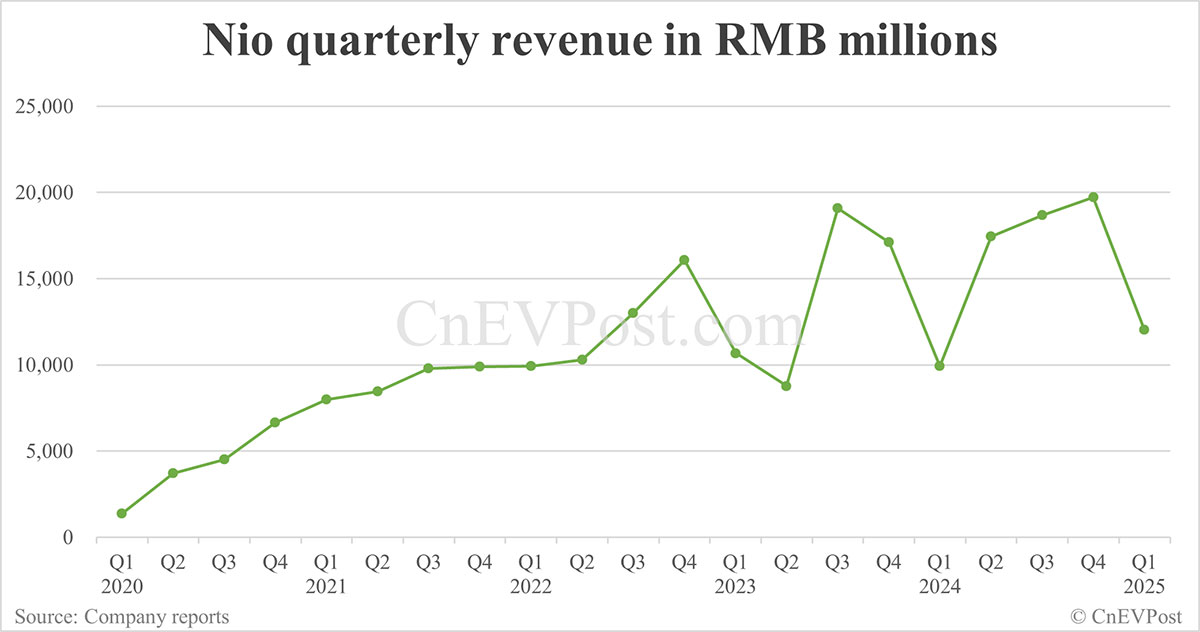

Chinese Ev Maker Nio Sees 21 Revenue Surge In First Quarter

Jun 03, 2025

Chinese Ev Maker Nio Sees 21 Revenue Surge In First Quarter

Jun 03, 2025 -

Rising Dte Rates A Looming Financial Crisis For Michigan Families

Jun 03, 2025

Rising Dte Rates A Looming Financial Crisis For Michigan Families

Jun 03, 2025 -

Economic Fallout Predicted After Trump Doubles Steel And Aluminum Tariffs

Jun 03, 2025

Economic Fallout Predicted After Trump Doubles Steel And Aluminum Tariffs

Jun 03, 2025 -

Jamie Dimons Key Advice To Trump Amid Global Uncertainty

Jun 03, 2025

Jamie Dimons Key Advice To Trump Amid Global Uncertainty

Jun 03, 2025