Dimon Sounds Alarm: China's Response To US Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon Sounds Alarm: China's Response to US Tariffs Could Trigger Global Recession

JPMorgan Chase CEO Jamie Dimon's stark warning about the potential for a global recession fueled by escalating trade tensions between the US and China has sent shockwaves through financial markets. His comments, delivered during a recent investor call, highlight the growing concerns surrounding China's response to US tariffs and the unpredictable nature of the ongoing trade war. The implications extend far beyond the two economic giants, threatening global stability and impacting everyday consumers worldwide.

Dimon, known for his candid assessments of the economic landscape, didn't mince words. He emphasized the significant risks associated with the current trade climate, painting a picture of a potentially devastating economic downturn if tensions continue to escalate. His alarm signals a growing sense of unease among global economic leaders, who are increasingly worried about the far-reaching consequences of this trade conflict.

<h3>China's Retaliatory Measures: A Delicate Balancing Act</h3>

China's response to US tariffs has been multifaceted, ranging from retaliatory tariffs on American goods to measures aimed at bolstering domestic industries. These actions, while intended to protect Chinese interests, have the potential to significantly disrupt global supply chains and trigger a domino effect across various sectors.

- Increased Tariffs: China's imposition of tariffs on US goods has directly impacted American businesses, leading to increased costs and reduced competitiveness in the Chinese market.

- Curtailed Imports: Reduced imports of American goods have had knock-on effects, impacting American farmers and manufacturers disproportionately.

- Investment Diversification: China's efforts to diversify its trade partnerships and reduce its reliance on the US are a long-term strategy that could reshape global trade dynamics.

The delicate balancing act China faces is attempting to mitigate the negative economic impacts of the trade war while simultaneously maintaining its economic growth trajectory. This strategy carries inherent risks, and missteps could amplify the global economic instability.

<h3>Global Economic Uncertainty: A Looming Threat</h3>

Dimon's warning underscores the increasing uncertainty surrounding the global economy. The US-China trade war has created a climate of fear and instability, impacting investor confidence and hindering economic growth. This uncertainty is not limited to large corporations; small businesses and consumers are also feeling the pinch.

The potential consequences of a full-blown trade war are significant, including:

- Increased Inflation: Higher tariffs translate to increased prices for consumers, impacting purchasing power and potentially leading to decreased consumer spending.

- Supply Chain Disruptions: Global supply chains are intricately linked, and disruptions caused by the trade war can lead to shortages and delays.

- Reduced Global Growth: The overall impact on global economic growth could be substantial, with a real possibility of a global recession.

<h3>Navigating the Uncertain Future: What Lies Ahead?</h3>

The situation remains fluid, and the outcome of the US-China trade conflict remains uncertain. However, Dimon's warning serves as a crucial reminder of the potential severity of the situation. Experts are urging both governments to find common ground and de-escalate the conflict to prevent a major global economic downturn. The need for diplomatic solutions and a concerted effort to stabilize the global economy is paramount. Failure to do so could lead to a protracted period of economic instability with severe consequences for businesses and individuals worldwide. The coming months will be critical in determining the trajectory of the global economy and whether Dimon's alarm proves to be a prophetic warning or a cautionary tale averted.

Keywords: Jamie Dimon, JPMorgan Chase, China, US Tariffs, Trade War, Global Recession, Economic Uncertainty, Global Economy, Supply Chain Disruptions, Inflation, Retaliatory Tariffs

(Note: This article is for informational purposes only and does not constitute financial advice. Consult with a financial professional for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon Sounds Alarm: China's Response To US Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

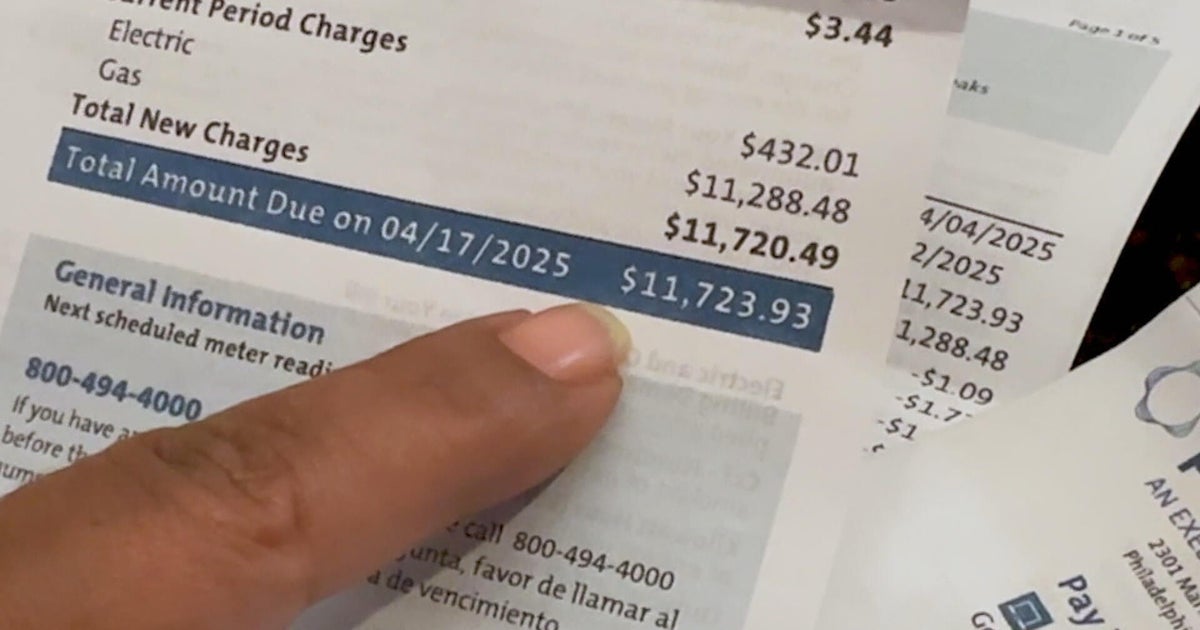

Peco Billing Issues High Bills And Months Long Delays Spark Customer Outrage

Jun 03, 2025

Peco Billing Issues High Bills And Months Long Delays Spark Customer Outrage

Jun 03, 2025 -

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Success

Jun 03, 2025

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Success

Jun 03, 2025 -

Miley Cyruss Honest Take How Adulthood Altered Her Parent Child Dynamic

Jun 03, 2025

Miley Cyruss Honest Take How Adulthood Altered Her Parent Child Dynamic

Jun 03, 2025 -

Racial Disrespect Allegations Against Patti Lu Pone Spark Broadway Controversy

Jun 03, 2025

Racial Disrespect Allegations Against Patti Lu Pone Spark Broadway Controversy

Jun 03, 2025 -

New Discovery Scientists Investigate Unusual Stars Rhythmic Pulses

Jun 03, 2025

New Discovery Scientists Investigate Unusual Stars Rhythmic Pulses

Jun 03, 2025